The market continued to fluctuate during the session and ended with a record high on August 16, backed by steel, Bajaj Finance, HDFC Group and Reliance Industries.

BSE Sensex increased by 145.29 points to 55,582.58, while Nifty50 rose by 33.90 points to 16,563 and formed a bullish candle on the daily charts.

“Despite this positive trend, the pre-downtrend / downtrend is still out of the market with two south-facing stocks with one stock closed in good areas which explains the wider markets in profit-booking mode through this rally. , Chief Strategist – Technical Research & Trading Advisory at Chartviewindia.in

So more caution is needed on the bulls side, although there are no visible signs on the short-term charts, you feel.

Next time if the Nifty drops below the 16,480 levels where the trend on the negative side can win the day, according to him.

Therefore, given the nature of excessive purchases and small market reductions, Mazhar Mohammad advised traders to book profits if the index fell below the 16,480 level.

Wide markets remained under pressure when the Nifty Midcap 100 index fell 0.34 percent and the Nifty Smallcap 100 index fell 0.78 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,499.47, followed by 16,435.84. If the index moves up, the key resistance levels to watch out for are 16,608.07 and 16,653.04.

Nifty Bank

The Nifty Bank declined 74.85 points to 36,094.50 on August 16. The important pivot level, which will act as crucial support for the index, is placed at 35,997.4, followed by 35,900.3. On the upside, key resistance levels are placed at 36,226.6 and 36,358.7 levels.

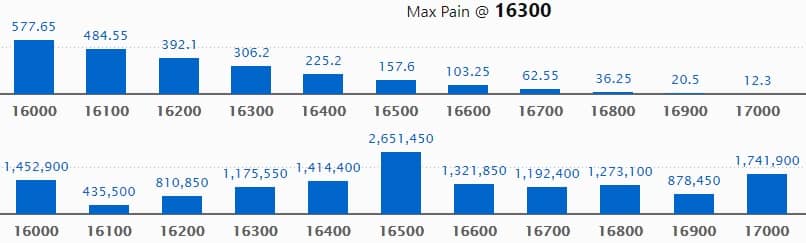

Call Option Data

Maximum Call open interest of 26.51 lakh contracts was seen at 16500 strike, which will act as a crucial resistance level in the August series.

This is followed by 17000 strike, which holds 17.41 lakh contracts, and 16000 strike, which has accumulated 14.52 lakh contracts.

Call writing was seen at 17200 strike, which added 3.44 lakh contracts, followed by 16800 strike, which added 2.18 lakh contracts and 16900 strike which added 2.01 lakh contracts.

Call unwinding was seen at 16400 strike, which shed 1.31 lakh contracts, followed by 16300 strike which shed 1.3 lakh contracts, and 16200 strike which shed 66,550 contracts.

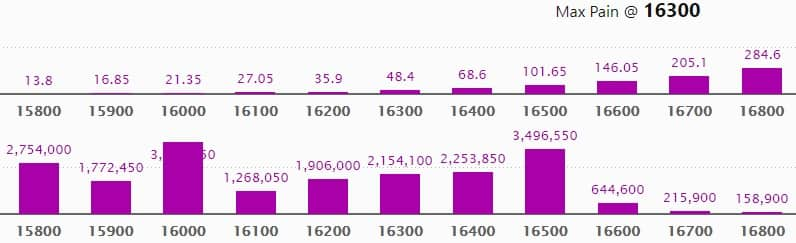

Put Option Data

Maximum Put open interest of 38.2 lakh contracts was seen at 16000 strike, which will act as a crucial support level in the August series.

This is followed by 16500 strike, which holds 34.96 lakh contracts, and 15800 strike, which has accumulated 27.54 lakh contracts.

Put writing was seen at 16500 strike, which added 6.4 lakh contracts, followed by 16400 strike which added 5.02 lakh contracts, and 16000 strike which added 2.63 lakh contracts.

Put unwinding was seen at 17000 strike, which shed 83,400 contracts.

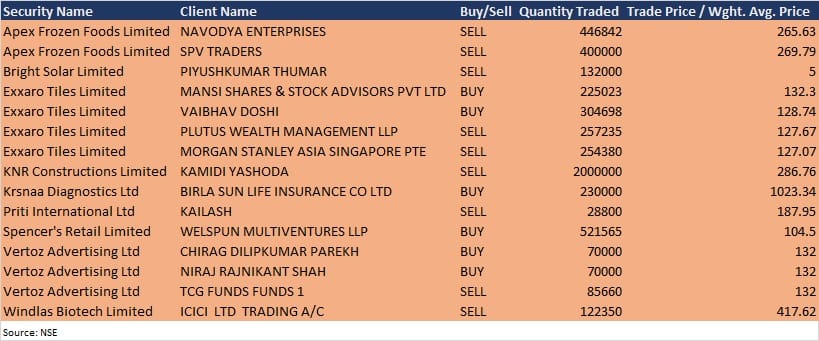

Bulk Deals

Exxaro Tiles: Plutus Wealth Management LLP sold 2,57,235 equity shares in the company at Rs 127.67 per share, and Morgan Stanley Asia Singapore Pte sold 2,54,380 equity shares at Rs 127.07 per share on the NSE, the bulk deals data showed.

Krsnaa Diagnostics: Birla Sun Life Insurance Company acquired 2.3 lakh equity shares in the company at Rs 1,023.34 per share on the NSE, the bulk deals data showed.

Spencer’s Retail: Welspun Multiventures LLP bought 5,21,565 equity shares in the company at Rs 104.5 per share on the NSE, the bulk deals data showed.

Windlas Biotech: ICICI Ltd Trading Account sold 1,22,350 equity shares in the company at Rs 417.62 per share on the NSE, the bulk deals data showed.

KNR Constructions: Promoter Kamidi Yashoda sold 20 lakh equity shares in the company at Rs 286.76 per share on the NSE, the bulk deals data showed.

Apex Frozen Foods: Navodya Enterprises sold 4,46,842 equity shares in the company at Rs 265.63 per share and SPV Traders offloaded 4 lakh equity shares in the company at Rs 269.79 per share on the NSE, the bulk deals data showed.

Analysts/Investors Meeting

Nazara Technologies: The company’s officials will meet Motilal Oswal Securities on August 17.

Kirloskar Oil Engines: The company’s officials will meet MK Ventures, Bellwether Capital, Sundaram MF, Enam Holdings, Lucky Capital, Siddhesh Capital, and ICICI Prudential MF on August 17.

Prataap Snacks: The company’s officials will meet investors in a ‘Consumer Corporate Day’ organised by Centrum Broking on August 17.

Indo Count Industries: The company’s officials will meet analysts on August 17.

Supreme Industries: The company’s officials will meet Nippon Life Asset Management on August 17.

Greaves Cotton: The company’s officials will meet Union MF on August 17.

Gland Pharma: The company’s officials will meet Franklin Templeton Investments on August 17, and William Blair Investment Management on August 18.

PDS Multinational Fashions: The company’s officials will meet Motilal Oswal Group, ASK RJ, DHFL Pramerica Life, MetLife India, Ace Lansdowne, Ambika Fincap, and Roha Group on August 17.

NMDC: The company’s officials will meet analysts and investors on August 17 post Q1FY22 results.

Shoppers Stop: The company’s officials will meet analysts in Centrum Consumer Conference arranged by Centrum Broking on August 17.

Sharda Motor Industries: The company’s officials will meet analysts and investors on August 18, to discuss financial performance.

Stocks In The News

Indian Terrain Fashions: SBI Mutual Fund sold 1.77 lakh equity shares in the company through open market transaction on August 13, reducing shareholding to 5.31% from 5.74%.

HLE Glascoat: ICRA has upgraded rating to A (for long term facilities) and A2+ (for short term facilities) with a stable outlook.

Lupin: The company received tentative approval from USFDA for Brivaracetam tablets, which are indicated for the treatment of partial-onset seizures in patients four years of age and older.

Star Paper Mills: The company announced resignation of Sandeep Rastogi as CFO with a notice period of 3 months.

Suven Life Sciences: Suven Life Sciences announced Phase 3 clinical trial of SUVN-502 (Masupirdine), a 5-HT6 antagonist for treatment of agitation and aggression in Alzheimer’s type dementias’.

Pradeep Metals: CRISIL reaffirmed its long term rating at BBB- and revised outlook to Positive from Stable.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,088.32 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 506.21 crore in the Indian equity market on August 16, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Seven stocks – Cadila Healthcare, Indiabulls Housing Finance, NALCO, Punjab National Bank, RBL Bank, SAIL and Sun TV Network – are under the F&O ban for August 17. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.