The Indian market on July 22 gained more than one percent profit from healthy purchases in all sectors. International best practices have supported the sentiment that compels investors to buy funds that were available at cheaper prices after two days of healthy restructuring.

Sensex closed with 639 points, or 1.22 percent, up 52,837.21 while Nifty remained at 15,824.05, up by 192 points or 1.23 percent.

Mid and smallcaps surpassed their larger peers. BSE Midcap and Smallcap indicators closed at 1.49 and 1.52 percent higher, respectively.

“Ahead of technology, Nifty has launched the Open Bullish Marabozu candle, which reflects the strength of the upcoming session. The index has given us a close above 21 and 50-DMA, which adds counter power,” said Sumeet Bagadia, Executive Director, Choice Broking.

“The hourly pressure indicator with the MACD also indicates a positive trend, which also indicates the strength of the next day. Nifty has 15,600 subsidies, while its counterparts are 15,950,” said Bagadia.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,755.33, followed by 15,686.67. If the index moves up, the key resistance levels to watch out for are 15,863.73 and 15,903.47.

Nifty Bank

The Nifty Bank jumped 262 points or 0.76 percent to 34,677.30 on July 22. The important pivot level, which will act as crucial support for the index, is placed at 34,493.77, followed by 34,310.23. On the upside, key resistance levels are placed at 34,924.97 and 35,172.64 levels.

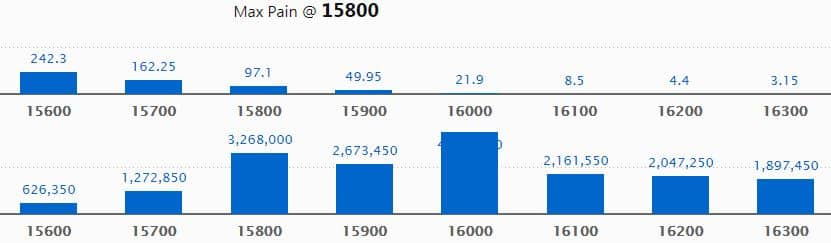

Call Option Data

Maximum Call open interest of 43.60 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the July series.

This is followed by 15,800 strike, which holds 32.68 lakh contracts, and 15,900 strike, which has accumulated 26.73 lakh contracts.

Call writing was seen at 16,000 strike, which added 13.44 lakh contracts, followed by 16,100 strike which added 10.07 lakh contracts and 15,900 strike which added 8.95 lakh contracts.

Call unwinding was seen at 15,700 strike, which shed 11.37 lakh contracts, followed by 15,600 strike which shed 4.41 lakh contracts, and 15,500 strike which shed 2.04 lakh contracts.

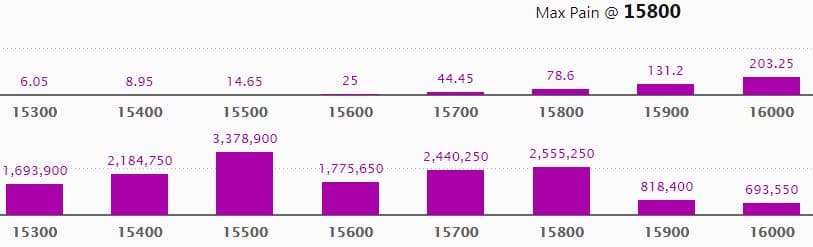

Put Option Data

Maximum Put open interest of 33.79 lakh contracts was seen at 15,500 strike, which will act as a crucial support level in the July series.

This is followed by 15,800 strike, which holds 25.55 lakh contracts, and 15,700 strike, which has accumulated 24.40 lakh contracts.

Put writing was seen at 15,800 strike, which added 12.44 lakh contracts, followed by 15,700 strike which added 11.22 lakh contracts, and 15,500 strike which added 3.93 lakh contracts.

Put unwinding was seen at 15,300 strike, which shed 1.96 lakh contracts, followed by 16,300 strike which shed 7,450 contracts.

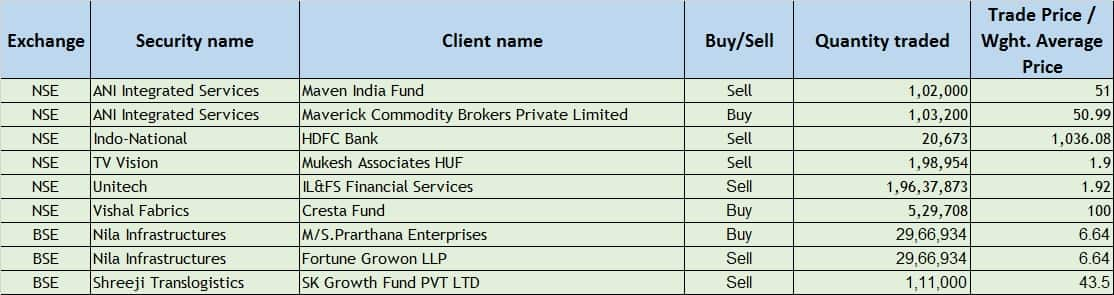

Bulk Deals

Results On July 23

Reliance Industries, Ambuja Cements, JSW Steel, Federal Bank, United Spirits, Yes Bank, Artson Engineering, Atul, Aurionpro Solutions, Cigniti Technologies, Crompton Greaves Consumer Electricals, Dynamatic Technologies, Fineotex Chemical, Majesco, Nectar Lifesciences, Panacea Biotec, ABB Power Products and Systems India, SBI Cards and Payment Services, Seshasayee Paper & Boards, SKF India and Symphony are slated to announce their quarterly results today.

Stocks In The News

Balaji Telefilms: The company has appointed Nachiket Pantvaidya as the Group Chief Executive Officer.

Indiamart Intermesh Q1: The company’s Q1 consolidated net profit rose 18.6 percent to Rs 87.9 crore versus Rs 74.1 crore YoY and revenue was up 18.6 percent at Rs 181.6 crore versus Rs 153.1 crore YoY.

Tanla Platforms Q1: The company posted a 32.9 percent jump in its Q1 consolidated net profit at Rs 104.5 crore versus Rs 78.6 crore and revenue was up 37.5 percent at Rs 626.4 crore against Rs 455.5 crore, YoY.

PSP Projects: The company has secured new work orders worth Rs 82.79 crore till date in the financial year 2021-22 for institutional and industrial projects from various clients.

Tata Power: The company has signed a share purchase agreement (SPA) with Tata Power International Pte., a wholly-owned subsidiary of the company, for sale of 100 percent equity shares held in Trust Energy Resources Pte, another wholly-owned subsidiary of the company for a consideration of USD 285.64 million.

Hero MotoCorp: The company launched an advanced, ‘connected’, and feature-rich new Maestro Edge 125.

Wipro: The company launched FieldX, a cloud-based end-to-end digital service lifecycle automation solution built on ServiceNow’s Now Platform.

Mahindra Lifespace Developers: The company board to consider the proposal for issuance of bonus equity shares, subject to requisite approvals.

South Indian Bank Q1: The company’s Q1 net profit was down 87.4 percent at Rs 10.3 crore versus Rs 81.7 crore and NII was down 7.6 percent at Rs 542 crore versus Rs 586.9 crore, YoY.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 247.59 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 942.55 crore in the Indian equity market on July 22, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Five stocks – Cadila Healthcare, Canara Bank, Indiabulls Housing Finance, NALCO and Sun TV Network – are under the F&O ban for July 23. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.