Equity benchmarks Sensex and the Nifty hit their fresh record highs of 53,126.73 and 15,915.65, respectively, in intraday trade on June 28 but failed to hold altitude and ended lower amid subdued global cues.

Sensex lost 189 points, or 0.36 percent, to end at 52,735.59 while the Nifty settled 46 points, or 0.29 percent, lower at 15,814.70.

“The Nifty50 has witnessed strong resistance at 15,900 which means going forward also 15,900 will act as a strong hurdle. As long as we don’t see a decisive close above 15,900 we may not see an aggressive northward move. Support is coming near 15,775-15,675 zone,” said Rohit Singre, Senior Technical Analyst at LKP Securities.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,766.03, followed by 15,717.37. If the index moves up, the key resistance levels to watch out for are 15,889.53 and 15,964.37.

Nifty Bank

The Nifty Bank closed flat at 35,359.4 on June 28. The important pivot level, which will act as crucial support for the index, is placed at 35,204.9, followed by 35,050.4. On the upside, key resistance levels are placed at 35,545.4 and 35,731.4 levels.

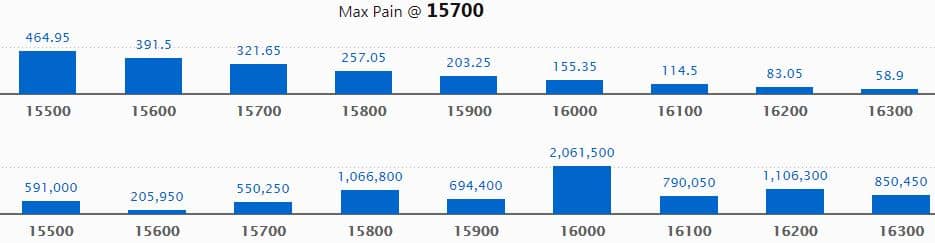

Call Option Data

Maximum Call open interest of 20.62 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the July series.

This is followed by 16,200 strike, which holds 11.06 lakh contracts, and 15,800 strike, which has accumulated 10.67 lakh contracts.

Call writing was seen at 16,000 strike, which added 3.89 lakh contracts, followed by 16,200 strike which added 3.87 lakh contracts, and 16,100 strike which added 3.66 lakh contracts.

Call unwinding was seen at 15,500 strike, which shed 21,900 contracts, followed by 15,700 strike which shed 7,600 contracts.

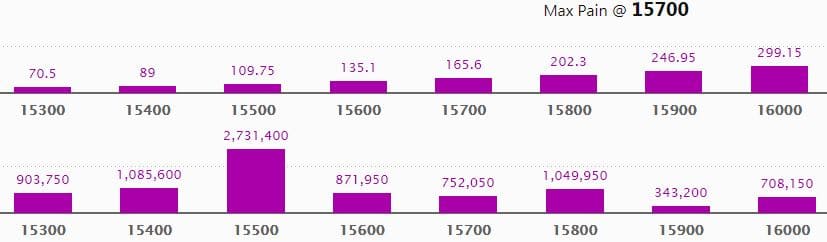

Put Option Data

Maximum Put open interest of 27.31 lakh contracts was seen at 15,500 strike, which will act as a crucial support level in the July series.

This is followed by 15,400 strike, which holds 10.86 lakh contracts, and 15,800 strike, which has accumulated 10.5 lakh contracts.

Put writing was seen at 15,600 strike, which added 3.12 lakh contracts, followed by 15,400 strike which added 1.66 lakh contracts, and 15,800 strike which added 1.34 lakh contracts.

A minor Put unwinding was seen at 16,300 strike, which shed 4,350 contracts.

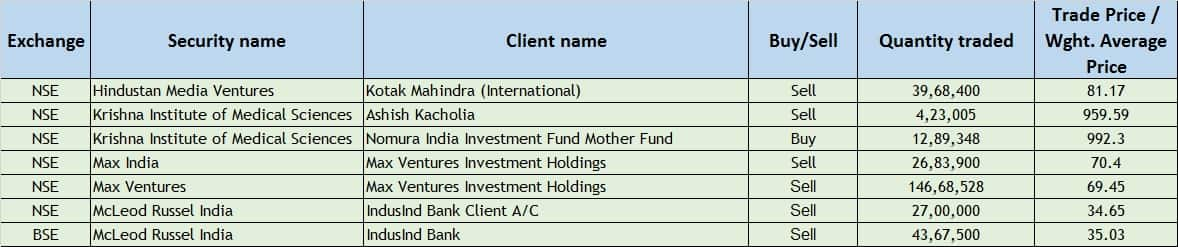

Bulk Deals

Results On June 29

Acme Resources, Cochin Minerals & Rutile, DCM, IRCTC, Omaxe, Ruchi Soya, Sintex Industries, Suzlon Energy and Tatia Global Vennture are among the companies that will announce their March quarter earnings on June 29.

Stocks In The News

RITES: Metro Express Limited, Mauritius has awarded additional work of consultancy services (PMC) for extension of the mainline from Rose Hill to Reduit through Ebene for an additional fee of MUR 250 millions (Rs 45 crore approximately).

Godrej Consumer Products: ICRA upgraded its long-term rating to [ICRA] AAA (Stable) from [ICRA] AA+ (Stable) while reaffirming its short-term rating of [ICRA] A1+.

Ramco Systems: The company will provide its next-gen Enterprise Resource Planning (ERP) software to Aden Ports Development Company (APDC) at their Aden Container Terminal (ACT).

HDFC Life Insurance Company: Standard Life to sell 3.46 percent stake in HDFC Life; price band at Rs 658- Rs 678 per share.

Thomas Cook: The company’s subsidiary DEI (Digiphoto Entertainment Imaging) has signed a multi-year memorandum with Shanghai Disney Resort.

NALCO: The company posted a standalone profit of Rs 935.64 crore against Rs 102.76 crore and revenue was up at Rs 2,821.48 crore against Rs 1,935.86 crore, YoY.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,658.72 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,277.08 crore in the Indian equity market on June 28, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

National Aluminium Company is under the F&O ban for June 29. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.