After about two months of extensive trading, Nifty saw a more than 16,000 decision-making exit on August 3 in support of the entire board acquisition.

Fifty-four reached 16,000 for the first time after a long merger phase. Sensex hit its new peak of 53,887.98, while Nifty made a peak of 16,146.90 in internal trades.

The Sensex 30 stock exchange closed with a profit of 873 points, or 1.65 percent of 53,823.36 while Nifty finished with 16,130.75, up 246 points, or 1.55 percent.

The BSE Midcap index closed at 23,374, up 0.19 percent while the smallcap index resolved a 0.23% gain of 27,134.

“With the market moving into an unfamiliar area, it’s best to take one step at a time and focus on energy-intensive packages. In terms of indicator levels, the next 16,200-16,400 levels should be viewed from the top, while the support base now rises to 16,000-15,900,” Ruchit said. Jain, Senior Analyst – Technical and Derivatives, Angel Broking.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support level for the Nifty is placed at 15,981.1, followed by 15,831.4. If the index moves up, the key resistance levels to watch out for are 16,213.7 and 16,296.6.

Nifty Bank

The Nifty Bank climbed 1.43 percent to 35,207.45. The important pivot level, which will act as crucial support for the index, is placed at 34,824.93, followed by 34,442.46. On the upside, key resistance levels are placed at 35,414.13 and 35,620.86 levels.

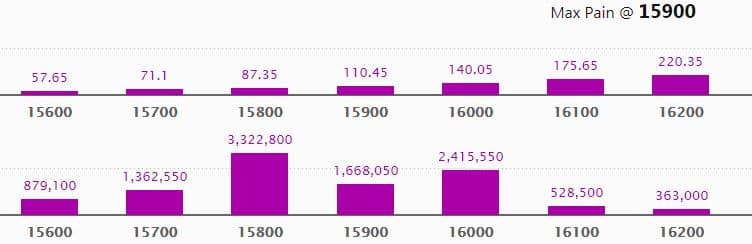

Call Option Data

Maximum Call open interest of 22.17 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the August series.

This is followed by 15,800 strike, which holds 19.35 lakh contracts, and 16,500 strike, which has accumulated 18.06 lakh contracts.

Call writing was seen at 16,400 strike, which added 2.52 lakh contracts, followed by 16,500 strike, which added 2.09 lakh contracts and 16,600 strike which added 2.05 lakh contracts.

Call unwinding was seen at 15,800 strike, which shed 2.87 lakh contracts, followed by 15,900 strike which shed 87,600 contracts, and 15,700 strike which shed 42,650 contracts.

Put Option Data

Maximum Put open interest of 33.23 lakh contracts was seen at 15,800 strike, which will act as a crucial support level in the August series.

This is followed by 16,000 strike, which holds 24.16 lakh contracts, and 15,900 strike, which has accumulated 16.68 lakh contracts.

Put writing was seen at 16,000 strike, which added 11.43 lakh contracts, followed by 15,800 strike which added 5.16 lakh contracts, and 15,900 strike which added 5.15 lakh contracts.

Put unwinding was seen at 15,600 strike, which shed 12,650 contracts.

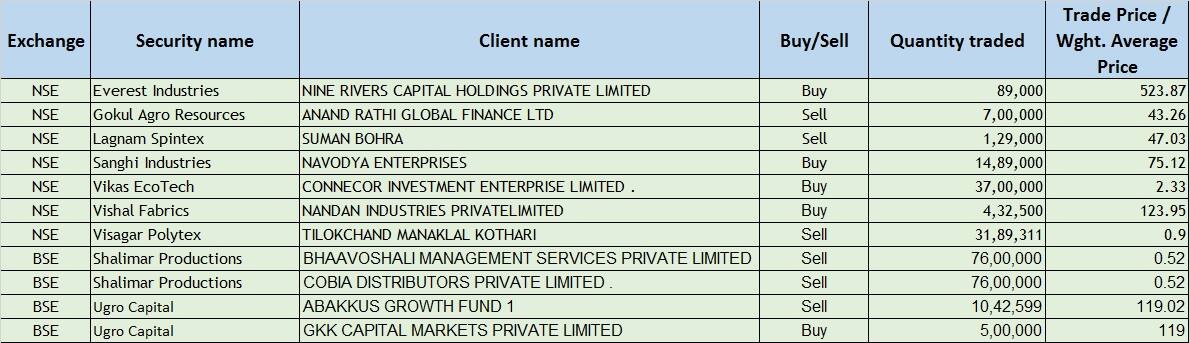

Bulk Deals

Results On August 04

State Bank of India, Hindustan Petroleum Corporation, Titan Company, Adani Green Energy, Godrej Consumer Products, Apollo Tyres, Adani Total Gas, Bharat Bijlee, Blue Star, Bosch, Butterfly Gandhimathi Appliances, Chambal Fertilisers & Chemicals, Cholamandalam Financial Holdings, Cosmo Films, Gabriel India, Greenply Industries, H.G. Infra Engineering, HT Media, Mayur Uniquoters, Nava Bharat Ventures, PNB Housing Finance, Solara Active Pharma Sciences, Sonata Software, Subros, Tasty Bite Eatables, Tata Communications and Thomas Cook (India) are among the companies that will announce their June quarter results on August 4.

Stocks In The News

Shipping Corporation of India Q1: The company’s consolidated net profit slipped 53 percent to Rs 158.5 crore versus Rs 336.9 crore and revenue was down 10.1 percent at Rs 1,028 crore versus Rs 1,143.5 crore, YoY.

Linde India: The company signed a business transfer agreement with HPS Gases, Vadodara to acquire its entire packaged gases business along with certain distribution assets for an aggregate cash consideration of Rs 27.5 crore.

Kalpataru Power Transmission Q1: The company posted a consolidated net profit of Rs 78 crore versus Rs 28 crore and revenue was up at Rs 3,204 crore versus Rs 2,330 crore, YoY.

Dhampur Sugar Mills Q1: The company posted a consolidated net profit of Rs 45.42 crore versus Rs 54.71 crore and revenue was at Rs 880.28 crore versus Rs 1086.67 crore, YoY.

Bharti Airtel Q1: The company has posted a net profit at Rs 283.5 crore versus Rs 759.2 crore and revenue was at Rs 26,853 crore versus Rs 25,747.3 crore, QoQ.

Adani Enterprises Q1: The company posted a net profit at Rs 265.60 crore against a loss of Rs 65.67 crore and revenue was at Rs 12,578.77 crore against Rs 5,265.19 crore, YoY.

IIFL Wealth Management: The company has reported a 42 percent jump in its net profit of Rs 119 crore versus Rs 83 crore and revenue was up 43 percent of Rs 283 crore versus Rs 199 crore.

G R Infraprojects: The company has received Letter of Acceptance (LoA) for the construction of elevated structures (Viaduct & stations) from Gottigere to Swagath Road Cross of Bangalore Metro Rail Project, Phase- 2 worth Rs 364.87 crore.

FII And DII Data

Foreign institutional investors (FIIs) net bought shares worth Rs 2,116.6 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 298.54 crore in the Indian equity market on August 3, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

One stock – Sun TV Network – is under the F&O ban for August 4. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.