The BSE Sensex was down 18.82 points at 52,861.18, while the Nifty50 fell 16.10 points to 15,818.30 and formed Gravestone Doji kind of pattern on the daily charts.

“A small body candle was formed with long upper shadow on the daily timeframe chart. Technically, this pattern indicate a formation of ‘Gavestone Doji’. Normally, formation of such doji pattern at the hurdle/after the reasonable upmove could signal downward reversal in the underlying, post confirmation,” said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Hence, bulls need to be cautious about long positions at the highs and subsequent weakness from here is likely to bring bear’s into action, he added.

He feels the short term uptrend of Nifty seems to have encountered profit booking around 15,900 levels again. “Further weakness on Wednesday could confirm negative reversal and that could open another round of downward correction in the market from highs. A move above doji at 15,915 could only negate this bearish pattern. Immediate support is placed at 15,730,” he said.

The broader markets also closed in red. The Nifty Midcap 100 index fell 0.05 percent and Smallcap 100 index declined 0.66 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,774.73, followed by 15,731.27. If the index moves up, the key resistance levels to watch out for are 15,887.93 and 15,957.67.

Nifty Bank

The Nifty Bank climbed 367.15 points or 1.04 percent to 35,579.15 on July 6. The important pivot level, which will act as crucial support for the index, is placed at 35,227.34, followed by 34,875.57. On the upside, key resistance levels are placed at 35,869.13 and 36,159.16 levels.

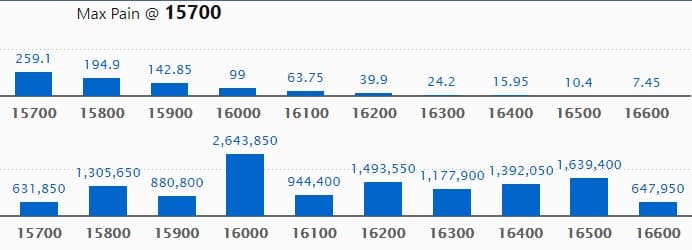

Call Option Data

Maximum Call open interest of 26.43 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the July series.

This is followed by 16500 strike, which holds 16.39 lakh contracts, and 16200 strike, which has accumulated 14.93 lakh contracts.

Call writing was seen at 16200 strike, which added 58,850 contracts, followed by 15900 strike which added 39,850 contracts, and 16100 strike which added 29,100 contracts.

Call unwinding was seen at 15700 strike, which shed 1.18 lakh contracts, followed by 15800 strike which shed 76,550 contracts.

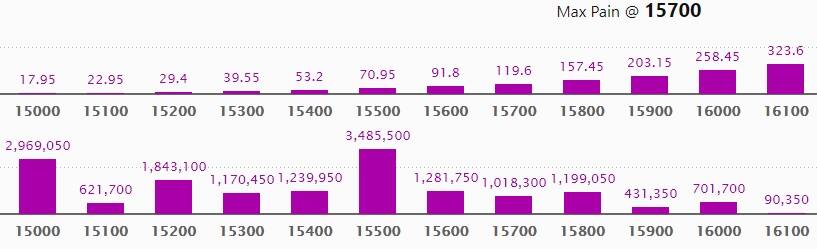

Put Option Data

Maximum Put open interest of 34.85 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the July series.

This is followed by 15000 strike, which holds 29.69 lakh contracts, and 15200 strike, which has accumulated 18.43 lakh contracts.

Put writing was seen at 15500 strike, which added 1.84 lakh contracts, followed by 16200 strike which added 1.7 lakh contracts, and 15600 strike which added 1.41 lakh contracts.

Put unwinding was seen at 15100 strike, which shed 80,600 contracts, followed by 15400 strike which shed 72,700 contracts and 15000 strike which shed 30,700 contracts.

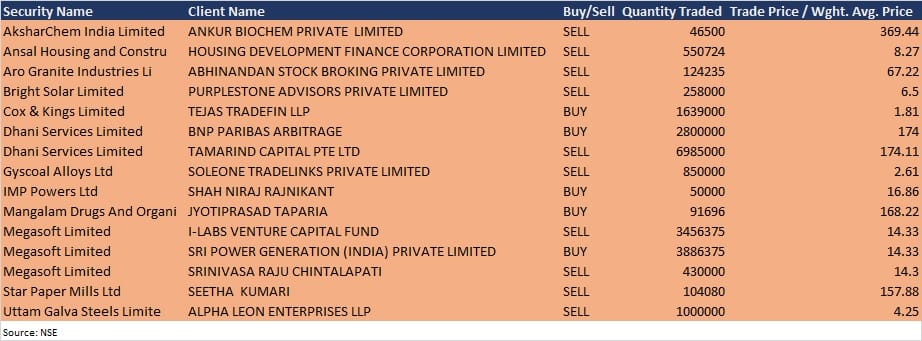

Bulk Deals

Dhani Services: BNP Paribas Arbitrage acquired 28 lakh equity shares in the company at Rs 174 per share on the NSE. However, Tamarind Capital Pte Ltd sold 69.85 lakh shares in the company at Rs 174.11 per share, the bulk deals data showed.

Analysts/Investors Meeting

Mahindra Logistics: To meet ICICI Prudential Mutual Fund and Spark Securities on July 7.

Globus Spirits: To meet analysts/investors on July 7.

Stocks In The News

3i Infotech: Srei Multiple Asset Investment Trust sold 2.31% stake in the company via open market transaction, reducing total shareholding to 11.32% from 13.63%.

Mastek: Hiral Chandrana has been appointed as the Global Chief Executive Officer of Mastek Group. Chandrana will be operating out of USA.

Titan Company: The company recorded revenue growth of around 117% (excluding bullion sales) in Q1FY22, with revenue contribution of approximately 50%, 10% and 40% coming from April, May and June months respectively. Jewellery division in Q1FY22 grew by around 107% (excluding bullion sales), compared to last year, primarily due to zero sales in April of last year. Watches and wearables division grew by around 280% over Q1FY21. Eye Wear division grew by around 117% over Q1FY21.

Gillette India: The company appointed Gautam Kamath as Chief Financial Officer and Additional (Executive) Director effective August 1.

Sobha: The company achieved total sales volume of 8,95,539 square feet of super built-up area valued at Rs 682.9 crore in Q1FY22 against 6,50,400 square feet of super built-up area valued at Rs 487.7 crore sold in Q1FY21.

RBL Bank: The bank’s total deposits grew by 21% YoY to 74,480 crore and gross advances increased by 2 percent to Rs 58,755 crore in June 2021 quarter.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 543.30 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 521.30 crore in the Indian equity market on July 6, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Four stocks – Indiabulls Housing Finance, NALCO, NMDC and Punjab National Bank – are under the F&O ban for July 7. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.