After a lifetime high in the previous program, the home equity market entered the consolidation phase on August 26, the last day of future contracts and options for the August series, and remained at a low level.

The BSE Sensex increased by 4.89 points to 55,949.10, while the Nifty50 increased by 2.20 points to 16,636.90 and formed a Doji pattern pattern on the daily charts as the closure approached the opening levels.

“A beautiful small candle is being built on a daily chart with a higher shade and a much lower day distance is also silenced. Technically, this pattern reflects a broader market trend with weak bias. -HDFC Securities.

He also said that the emergence of weakness from the upper class failed to turn into a serious setback. “Ongoing consolidation / consolidation work can continue for the next 1-2 sessions, before showing signs of distance movement. The immediate funding of the ten-time EMA is set at 16,520 levels,” he added.

Wide markets for front-runners on the expiration date. Indicators for the Nifty Midcap 100 and Smallcap 100 received 0.2 percent each.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,598.97, followed by 16,561.04. If the index moves up, the key resistance levels to watch out for are 16,679.27 and 16,721.63.

Nifty Bank

The Nifty Bank also closed flat, rising 31.35 points to close at 35,617.60 on August 26. The important pivot level, which will act as crucial support for the index, is placed at 35,424.33, followed by 35,231.07. On the upside, key resistance levels are placed at 35,798.33 and 35,979.07 levels.

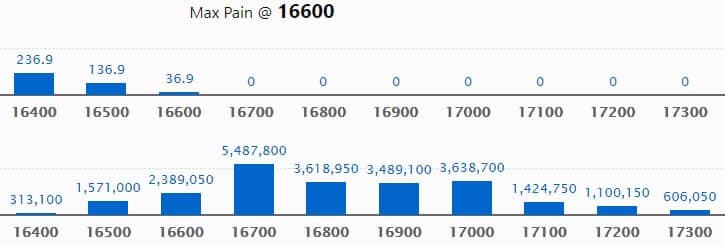

Call Option Data

Maximum Call open interest of 54.87 lakh contracts was seen at 16,700 strike, which will act as a crucial resistance level in the September series.

This is followed by 17,000 strike, which holds 36.38 lakh contracts, and 16,800 strike, which has accumulated 36.18 lakh contracts.

Call writing was seen at 16,800 strike, which added 19.41 lakh contracts, followed by 17,000 strike, which added 14.63 lakh contracts, and 16,700 strike which added 12.68 lakh contracts.

There was hardly any Call unwinding seen on expiry day.

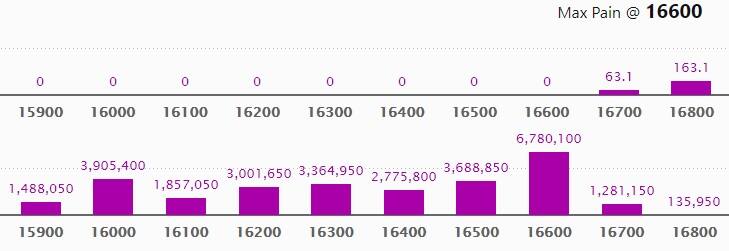

Put Option Data

Maximum Put open interest of 67.8 lakh contracts was seen at 16,600 strike, which will act as a crucial support level in the September series.

This is followed by 16,000 strike, which holds 39.05 lakh contracts, and 16,500 strike, which has accumulated 36.88 lakh contracts.

Put writing was seen at 16,600 strike, which added 17.39 lakh contracts.

Put unwinding was seen at 16,500 strike, which shed 31.91 lakh contracts, followed by 16,400 strike which shed 14.22 lakh contracts, and 16,000 strike which shed 6.7 lakh contracts.

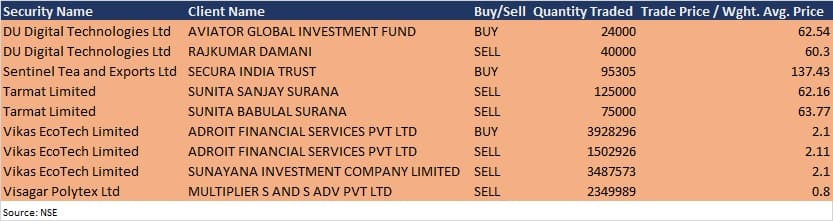

Bulk Deals

DU Digital Technologies: Aviator Global Investment Fund acquired 24,000 equity shares in the company at Rs 62.54 per share, whereas Rajkumar Damani sold 40,000 equity shares at Rs 60.3 per share on the NSE, the bulk deals data showed.

Analysts/Investors Meeting

Sterling and Wilson Solar: The company’s officials will meet investors and analysts on August 27.

Tata Chemicals: The company’s officials will meet Ishana Capital on August 27.

Hindustan Copper: The company’s officials will meet several investors (including Enam, SBI General, Goldman Sachs AM, Alchemy, and Aegon) on August 27.

UltraTech Cement: The company’s officials will meet Neuberger Berman Group LLC on August 27.

Meghmani Finechem: The company’s officials will meet GIC (Government of Singapore Investment Corporation) on August 27.

Narayana Hrudayalaya: The company’s officials will meet UTI Mutual Fund – Institutional Investor on August 30.

Garware Hi-Tech Films: The company’s officials will meet Aditya Birla Money on August 31.

JSW Energy: The company’s officials will meet analysts and institutional investors in Systematix – Virtual Power Sector Conference on August 31.

Stocks In The News

Jindal Poly Films: The company has acquired 100% shares of Jindal India Solar Energy and consequent thereof Jindal India Solar became wholly-owned subsidiary.

GRM Overseas: Promoters acquired 23,802 equity shares in the company via open market transaction, increasing shareholding to 71.70% from 71.51% earlier.

BHEL: A Memorandum of Understanding (MOU) was signed between the company and JSC Rosoboronexport, to cooperate and implement possible joint projects and activities with BHEL for joint production of spare parts and components for Russian-origin equipment installed onboard the Indian Navy Aircraft Carrier “Vikramaditya” and maintenance of systems and equipment of Aircraft Carrier “Vikramaditya and on other issues of mutual interest.

IDFC First Bank: The RBI approved the appointment of Sanjeeb Chaudhuri, Independent Director, as the Part-Time Chairman of the bank, for a period of three years.

Onward Technologies: ICRA assigned long term rating for bank facilities of the company at BBB-/Positive and short term rating at A3.

Wipro: The company signed a strategic partnership with DataRobot to provide Augmented Intelligence at scale, to help customers become AI-driven enterprises, and accelerate their business impact.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,974.48 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,055.21 crore in the Indian equity market on August 26, as per provisional data available on the NSE.