After a day of adjustment, the market crossed another historic milestone of 17,200 marks for Nifty and ended with a new closure on September 2. All sector indicators, blocking Auto and PSU Bank, participated in the process.

BSE Sensex increased by 514.33 points to 57,852.54, while Nifty50 increased by 157.90 points to 17,234.20 and formed a bullish candlestick on the daily charts as the closing was higher than the opening levels.

“A tall bull candle is being built on the daily chart, past Wednesday’s bad candle closed above it. This method has eliminated the small tightening pattern in the daily chart and this shows market strength. This is a good indicator and one can expect to be looked up soon,” said Nagaraj Shetti. who is the Technical Research Analyst for HDFC Securities.

He believes Nifty’s short-term trend is in a strong state and broader market indicators were also in the driver’s seat. “One can expect further ups and downs in the next 1-2 times, before showing any other way to add or book a small profit from the new highs.

Wide markets also joined the group with Nifty Midcap and Smallcap 100 indicators rising by 1 percent each.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,114.1, followed by 16,994. If the index moves up, the key resistance levels to watch out for are 17,299.9 and 17,365.6.

Nifty Bank

The Nifty Bank jumped 257 points to 36,831.30 on September 1. The important pivot level, which will act as crucial support for the index, is placed at 36,568.34, followed by 36,305.37. On the upside, key resistance levels are placed at 36,994.94 and 37,158.57 levels.

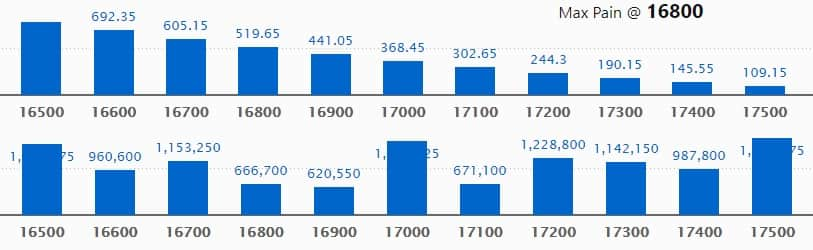

Call Option Data

Maximum Call open interest of 16.41 lakh contracts was seen at 17500 strike, which will act as a crucial resistance level in the September series.

This is followed by 17000 strike, which holds 15.81 lakh contracts, and 16500 strike, which has accumulated 15.19 lakh contracts.

Call writing was seen at 17200 strike, which added 2.25 lakh contracts, followed by 17400 strike, which added 93,450 contracts and 17600 strike which added 79,450 contracts.

Call unwinding was seen at 17100 strike, which shed 85,600 contracts, followed by 17000 strike, which shed 76,900 contracts, and 16700 strike which shed 41,800 contracts.

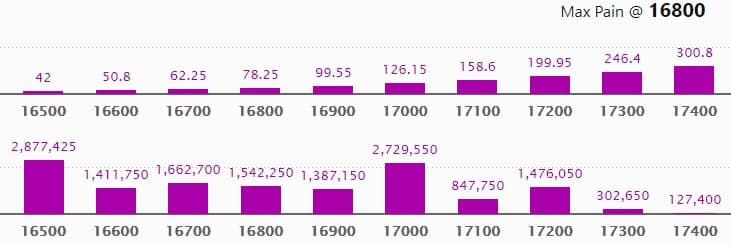

Put Option Data

Maximum Put open interest of 28.77 lakh contracts was seen at 16500 strike, which will act as a crucial support level in the September series.

This is followed by 17000 strike, which holds 27.29 lakh contracts, and 16700 strike, which has accumulated 16.62 lakh contracts.

Put writing was seen at 17200 strike, which added 6.06 lakh contracts, followed by 17100 strike which added 2.6 lakh contracts, and 17000 strike which added 2.19 lakh contracts.

Put unwinding was seen at 16600 strike, which shed 13,850 contracts.

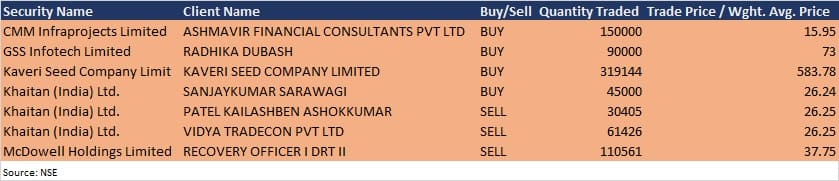

Bulk Deals

Kaveri Seed Company: The company acquired 3,19,144 equity shares of itself at Rs 583.78 per share on the NSE, the bulk deals data showed.

McDowell Holdings: Recovery Officer I DRT (Debt Recovery Tribunal) II sold 1,10,561 equity shares in the company at Rs 37.75 per share on the NSE, the bulk deals data showed.

Analysts/Investors Meeting

Syngene International: The company’s officials will meet PGIM MF on September 3.

UltraTech Cement: The company’s officials will meet Avendus Capital on September 3.

Adani Ports: The company’s officials will meet HSBC Asset Management Company on general business update, on September 3.

Kalyan Jewellers India: The company’s officials will meet Infusive Asset Management, & Quantum Advisors on September 3; Ashmore Group Plc, & Wellington Asset Management on September 6, and Dimensional Securities on September 8.

Sanghi Industries: The company’s officials will meet Ventura Securities on September 6.

KEI Industries: The company’s officials will meet institutional investors on September 8.

Stocks In The News

Jammu & Kashmir Bank: The bank approved raising of equity share capital upto Rs 1,000 crore in one or more tranches, and Rs 1,000 crore by way of non-convertible debentures on a private placement basis.

Rossari Biotech: The company has completed the acquisition of the first tranche of 76% of Tristar Intermediaries.

GOCL Corporation: The company completed acquisition of APDLE Estates from Hinduja Realty Ventures.

IRB Infrastructure Developers: The company has emerged as a preferred bidder for Chittoor – Thachur Six Laning Highway Hybrid Annuity Project in Tamil Nadu.

Salzer Electronics: The company has incorporated a joint venture Salzer Emarch Electromobilidy to make electric conversion kits for auto-rickshaws, cars and buses and also manufacture novel electric driven utility vehicles and other allied activities.

Wockhardt: Promoter entity Themisto Trustee Company created a pledge on 12.4 lakh equity shares and with that, the percent of pledged shares now increased to 28.40 percent.

FII And DII Data

Foreign institutional investors (FIIs) net bought shares worth Rs 348.52 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 381.70 crore in the Indian equity market on September 2, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

One stock – Indiabulls Housing Finance – is under the F&O ban for September 3. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.