The market after the first turbulent hours gained momentum and traded heavily for the rest of the season to reach a new record with a high intraday on August 27, the first day of the September series. All sector indicators are closed with green IT, Metal and Pharma is the leader.

The measurement indicators ended with a recording at the top. BSE Sensex increased by 175.62 points to 56,124.72, while Nifty50 rose by 68.30 points to 16,705.20 and formed a bullish candle on the daily charts. The index gained 1.55 percent in the week and saw the formation of bullish candles on the weekly scale.

“Technically, sending short-term adjustments to Nifty has kept the composition of the series even higher and after a strong pull-back meeting, the indicator is currently trading near the breakout level. Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities.

According to him, if the index exceeds the level, the uptrend could continue to reach 16,825-16,950 levels. On the one hand, “16,550 dismissals could cause temporary weakness of up to 16,375-16,300 levels,” he said.

Wide markets came out ahead of the front with the Nifty Midcap 100 index rising 1.06 percent and the Smallcap 100 up 0.77 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,606.5, followed by 16,507.8. If the index moves up, the key resistance levels to watch out for are 16,763 and 16,820.8.

Nifty Bank

The Nifty Bank underperformed benchmark indices, rising 10.20 points to 35,627.80 on August 27. The important pivot level, which will act as crucial support for the index, is placed at 35,415.36, followed by 35,202.93. On the upside, key resistance levels are placed at 35,784.06 and 35,940.33 levels.

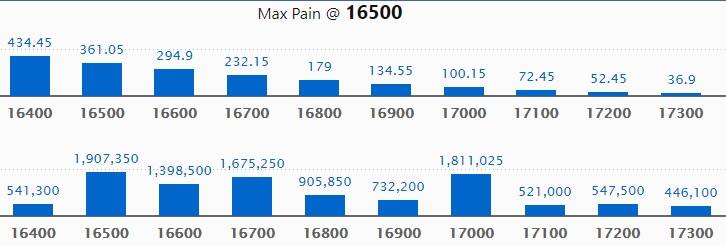

Call Option Data

Maximum Call open interest of 19.07 lakh contracts was seen at 16500 strike. This is followed by 17000 strike, which holds 18.11 lakh contracts, and 16700 strike, which has accumulated 16.75 lakh contracts.

Call writing was seen at 16700 strike, which added 1.36 lakh contracts, followed by 16900 strike, which added 1.28 lakh contracts and 17500 strike which added 1.23 lakh contracts.

Call unwinding was seen at 16600 strike, which shed 1.13 lakh contracts.

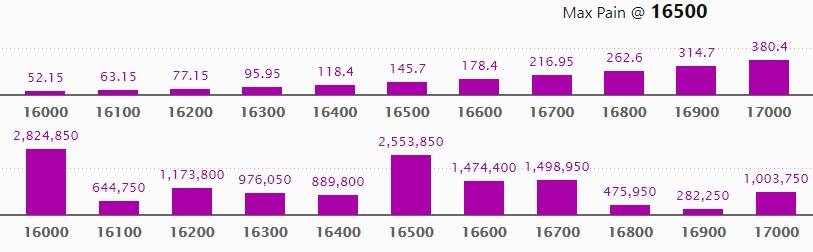

Put Option Data

Maximum Put open interest of 28.24 lakh contracts was seen at 16000 strike, which will act as a crucial support level in the September series.

This is followed by 16500 strike, which holds 25.53 lakh contracts, and 16700 strike, which has accumulated 14.98 lakh contracts.

Put writing was seen at 16500 strike, which added 4.5 lakh contracts, followed by 16700 strike which added 3.81 lakh contracts, and 16600 strike which added 2.63 lakh contracts.

There was hardly any Put unwinding seen on Friday.

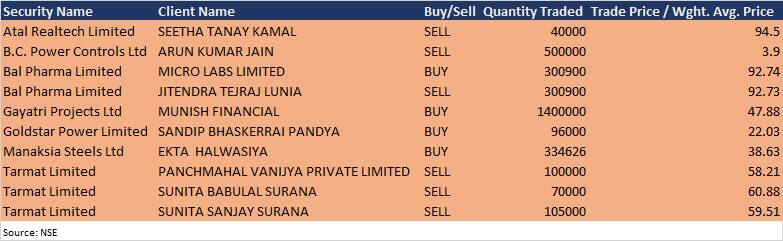

Bulk Deals

Bal Pharma: Promoter Micro Labs acquired entire stake in the company from investor Jitendra Tejraj Lunia. Promoter bought 3,00,900 equity shares at Rs 92.74 per share. Jitendra Tejraj Lunia exited the company by selling entire shareholding at Rs 92.73 per share on the NSE, the bulk deals data showed.

Gayatri Projects: Munish Financial bought 14 lakh equity shares in the company at Rs 47.88 per share on the NSE, the bulk deals data showed.

Manaksia Steels: Investor Ekta Halwasiya added additional 3,34,626 equity shares in the company at Rs 38.63 per share on the NSE, the bulk deals data showed.Tarmat: Investors Sunita Babulal Surana and Sunita Sanjay Surana sold 70,000 equity shares in the company at Rs 60.88 and 1,05,000 equity shares in the company at Rs 59.51 per share respectively on the NSE, the bulk deals data showed.

Analysts/Investors Meeting

Steel Strips Wheels: The company’s officials will meet Edelweiss Securities on August 30.

Hinduja Global Solutions: The company’s officials will meet Fidelity International on August 30.

Finolex Industries: The company’s officials will meet analysts and fund managers on August 30.

The Ramco Cements: The company’s officials will meet Goldman Sachs Asset Management on August 30.

Tube Investments of India: The company’s officials will meet analysts and institutional investors on August 30.

Blue Star: The company’s officials will meet BOB Capital Markets on August 30, and meet investors in Ambit Investor Connect on September 3.

Indian Railway Catering and Tourism Corporation: The company’s officials will meet Motilal Oswal Mutual Fund, Tata AMC, Sundaram MF, Birla MF, Birla Insurance, WhiteOak Capital, and Kotak AMC on August 31.

Adani Transmission: The company’s officials will meet investors and analysts in Systematix Power Utilities Conference on August 31, Elara Conference on September 7, and Jefferies Asia Forum on September 8-9.

Crompton Greaves Consumer Electricals: The company’s officials will meet First Sentier Investors on September 1, and HDFC Life Insurance on September 6.

RACL Geartech: The company’s officials will meet investors on September 3.

Stocks In The News

Tinplate Company of India: The company approved an expansion plan, investing in putting up an additional capacity of 3,00,000 tonne per annum at Jamshedpur. The project is expected to be completed in about 3 years.

Dalmia Bharat: Subsidiary Dalmia Cement (Bharat) signed three Memorandum of Understandings with the Government of Jharkhand to invest Rs 758 crore in the state.

GOCL Corporation: The company has entered into an agreement with Squarespace Infra City for sale of 44.25 acres land at Kukatpally, Hyderabad, for Rs 451.79 crore. The transaction is expected to be completed in 3-6 months. The remaining land of about 32.09 acres will continue under the Joint Development Agreement with Hinduja Estates (HEPL) for development based on approvals.

SRF: Gujarat Pollution Control Board (GPCB) has issued a revocation order under Air (Prevention and Control of Pollution) Act, 1981 for resumption of operations in P2 and the two other allied plants with immediate effect.

Nazara Technologies: The company to make strategic investment for the proposed acquisition of 100% stake in OpenPlay Technologies from its existing shareholders i.e. Sreeram Reddy Vanga and Unnati Management Consultants LLP, for Rs 186.41 crore, in one or more tranches.

Mahindra & Mahindra: The Ministry of Defence (MoD) has awarded a major contract to Mahindra Defence Systems worth Rs 1,349.95 crore for the manufacturing of Integrated Anti-Submarine Warfare Defence Suite (IADS) for modern warships of Indian Navy.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 778.75 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,646.19 crore in the Indian equity market on August 27, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Not a single stock is under the F&O ban for August 30. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.