The market gained momentum after the first hour fluctuations and gained profits to close average on July 14, driven by technical shares.

BSE Sensex increased by 134.32 points to 52,904.05, while Nifty50 rose by 41.60 points to 15,854 forming a small bullish candlestick on daily charts.

“Everyday price action creates a bullish candle, which makes the High-Low higher than the previous session that continues to favor positive bias. , “said Rajesh Palviya, VP – technical and Derivative Research at Axis Securities.

He added, “The next high levels to be considered are 15,880 levels. Any sustainable movement above 15,880 levels could create momentum at 15,950-16,000 levels.”

On the negative side, any violation of the support area within 15,800 levels could result in a profit booking of 15,700-15,600 levels, he added.

Wide markets also closed green. The Nifty Midcap 100 and Smallcap 100 indicators gained 0.23 percent and 0.45 percent, respectively.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,786.37, followed by 15,718.73. If the index moves up, the key resistance levels to watch out for are 15,899.47 and 15,944.93.

Nifty Bank

The Nifty Bank fell 5.10 points to 35,668.30 on July 14. The important pivot level, which will act as crucial support for the index, is placed at 35,467.3, followed by 35,266.4. On the upside, key resistance levels are placed at 35,836.61 and 36,005 levels.

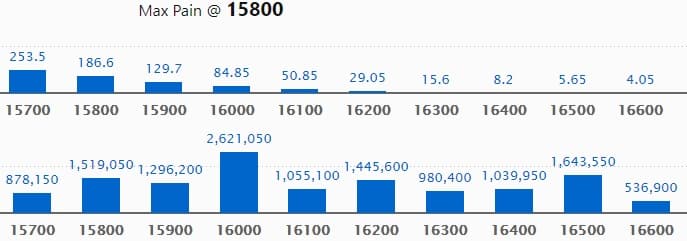

Call Option Data

Maximum Call open interest of 26.21 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the July series.

This is followed by 16500 strike, which holds 16.43 lakh contracts, and 15800 strike, which has accumulated 15.19 lakh contracts.

Call writing was seen at 15900 strike, which added 91,650 contracts, followed by 16500 strike which added 75,700 strike and 16300 strike which added 31,050 contracts.

Call unwinding was seen at 16400 strike, which shed 2.61 lakh contracts, followed by 15800 strike which shed 2.56 lakh contracts, and 16100 strike which shed 2.12 lakh contracts.

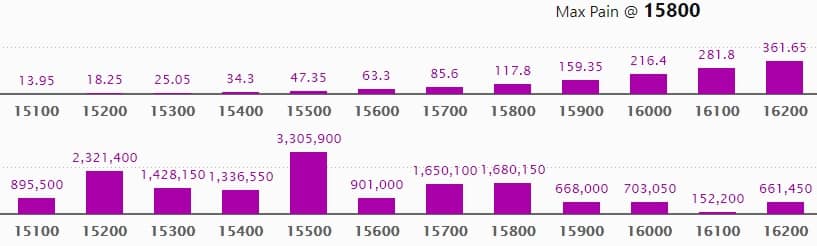

Put Option Data

Maximum Put open interest of 33.05 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the July series.

This is followed by 15200 strike, which holds 23.21 lakh contracts, and 15800 strike, which has accumulated 16.80 lakh contracts.

Put writing was seen at 15700 strike, which added 2.95 lakh contracts, followed by 15900 strike which added 2.44 lakh contracts, and 15800 strike which added 1.32 lakh contracts.

Put unwinding was seen at 15600 strike, which shed 90,250 contracts, followed by 15400 strike which shed 77,500 contracts.

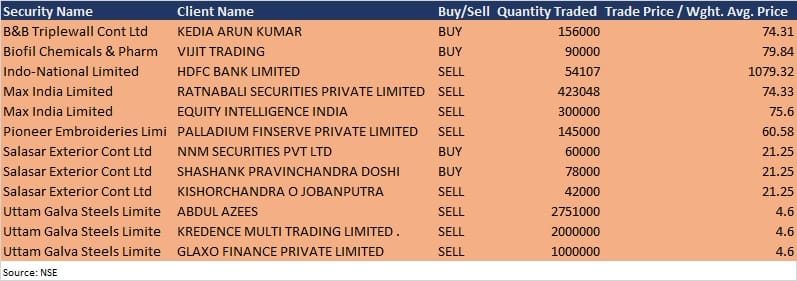

Bulk Deals

Max India: Equity Intelligence India sold 3 lakh equity shares in the company at Rs 75.6 per equity shares on the NSE, and Ratnabali Securities offloaded 4,23,048 equity shares in the company at Rs 74.33 per share, the bulk deals data showed.

Results On July 15

Wipro, Angel Broking, Avantel, Aditya Birla Money, Cyient, Ganesh Housing Corporation, Larsen & Toubro Infotech, Onward Technologies, Rama Paper Mills, Rollatainers, Tata Elxsi, and Tata Steel Long Products will release quarterly earnings on July 15.

Analysts/Investors Meeting

Somany Home Innovation: The company’s officials will meet MK Ventures in a call organised by Motilal Oswal Financial Services on July 15.

Globus Spirits: The company’s officials will meet Svan Investments on July 15.

HDFC Life Insurance Company: The company’s officials will meet analysts and investors on July 19 to discuss the financial results.

Polycab India: The company’s officials will meet investors and analysts on July 22 to discuss the un-audited financial results.

Stocks In The News

Infosys: The company reported higher profit at Rs 5,195 crore in Q1FY22 against Rs 5,076 crore in Q4FY21. Revenue rose to Rs 27,896 crore from Rs 26,311 crore QoQ.

L&T Technology Services: The company reported higher profit at Rs 216.2 crore in Q1FY22 against Rs 194.5 crore in Q4FY21; revenue rose to Rs 1,518.4 crore from Rs 1,440.5 crore QoQ.

Vikas Lifecare: The company acquired a 22.04 percent stake in Advik Laboratories.

5paisa Capital: The company reported higher consolidated profit at Rs 7.19 crore in Q1FY22 against Rs 2.8 crore in Q1FY21. Revenue rose to Rs 60.08 crore from Rs 42.33 crore YoY.

Marico: The company entered into Share Subscription Agreement and Shareholders Agreement with Apcos Naturals, to make a strategic investment by acquiring 60 percent of equity shares and compulsorily convertible preference shares (CCPS) of Apcos Naturals. Marico will acquire 52.4 percent stake in the company by July 31.

Tinplate Company of India: The company reported profit at Rs 68.62 crore in Q1FY22 against loss of Rs 6.9 crore in Q1FY21. Revenue jumped to Rs 866.3 crore from Rs 379.76 crore YoY.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,303.95 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,335.91 crore in the Indian equity market on July 14, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Eight stocks – Granules India, Indiabulls Housing Finance, Vodafone Idea, NALCO, NMDC, Punjab National Bank, SAIL, and Sun TV Network – are under the F&O ban for July 15. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.