The market continued to close sharply on August 4, as the bulls kept their money on Dalal Street, assisted by banks and funds. Encouraging global indicators also support the market.

BSE Sensex collected 546.41 points or 1.02 percent to close at 54,369.77, while Nifty50 increased by 128 points to 16,258.80 and formed a bullish candlestick on daily charts.

“Daily price performance has made a big bullish candle and registered new highs at 16,290 levels. The next high levels to be viewed are 16,300 levels. Any sustainable movement above 16,300 levels could create momentum at 16,400-16,450 levels,” he said. Rajesh Palviya, VP – Axis Security Research and Removal Security.

Worse, “any violation of the support area within 16,200 levels could result in a profit booking of 16,100-16,000 levels,” he added.

However, there has been a sell-off in the broader market, which experts feel is a negative sign of ongoing trends. The Nifty Midcap 100 index fell 1.19 percent and the Smallcap 100 index fell 1.01 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,193.27, followed by 16,127.73. If the index moves up, the key resistance levels to watch out for are 16,307.27 and 16,355.73.

Nifty Bank

The Nifty Bank rallied 820.65 points or 2.33 percent to 36,028.10 on August 4. The important pivot level, which will act as crucial support for the index, is placed at 35,487.46, followed by 34,946.83. On the upside, key resistance levels are placed at 36,394.27 and 36,760.43 levels.

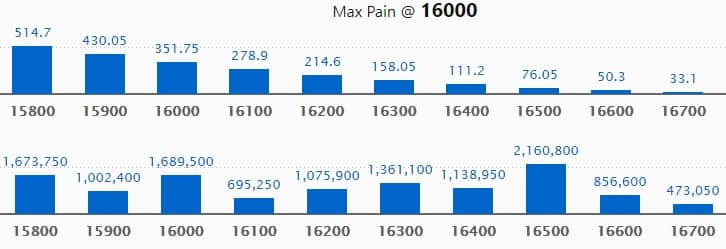

Call Option Data

Maximum Call open interest of 21.60 lakh contracts was seen at 16,500 strike, which will act as a crucial resistance level in the August series.

This is followed by 16,000 strike, which holds 16.89 lakh contracts, and 15,800 strike, which has accumulated 16.73 lakh contracts.

Call writing was seen at 16,500 strike, which added 3.54 lakh contracts, followed by 16,600 strike, which added 2.4 lakh contracts and 16,800 strike which added 1.63 lakh contracts.

Call unwinding was seen at 16,000 strike, which shed 5.27 lakh contracts, followed by 15,800 strike which shed 2.6 lakh contracts, and 16,300 strike which shed 1.55 lakh contracts.

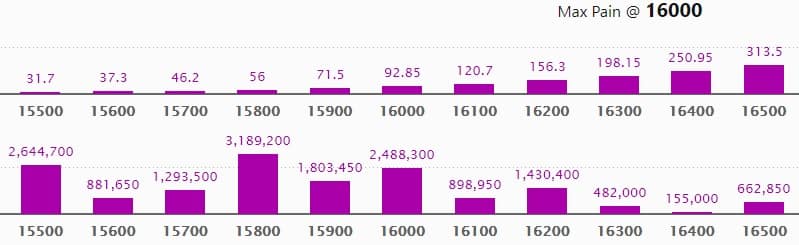

Put Option Data

Maximum Put open interest of 31.89 lakh contracts was seen at 15,800 strike, which will act as a crucial support level in the August series.

This is followed by 15,500 strike, which holds 26.44 lakh contracts, and 16,000 strike, which has accumulated 24.88 lakh contracts.

Put writing was seen at 16,200 strike, which added 10.67 lakh contracts, followed by 16,300 strike which added 3.72 lakh contracts, and 16,100 strike which added 3.7 lakh contracts.

Put unwinding was seen at 15,800 strike, which shed 1.33 lakh contracts, followed by 15,700 strike which shed 69,050 contracts.

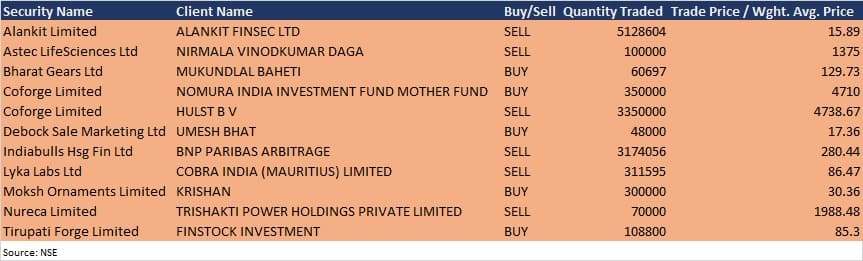

Bulk Deals

Coforge: Nomura India Investment Fund Mother Fund acquired 3.5 lakh equity shares in the company at Rs 4,710 per share. However, promoter Hulst B V sold 33.5 lakh equity shares in the company at Rs 4,738.67 per share on the NSE, the bulk deals data showed.

Indiabulls Housing Finance: BNP Paribas Arbitrage sold 31,74,056 equity shares in the company at Rs 280.44 per share on the NSE, the bulk deal data showed.

Lyka Labs: Cobra India (Mauritius) sold 3,11,595 equity shares in the company at Rs 86.47 per share on the NSE, the bulk deal data showed.

Results on August 5

GAIL India, Cipla, Adani Power, Aditya Birla Capital, Indiabulls Housing Finance, Accelya Solutions India, Ador Welding, Andhra Petrochemicals, Arvind, Bajaj Consumer Care, Birla Corporation, Brigade Enterprises, Cera Sanitaryware, Edelweiss Financial Services, Escorts, Gujarat Gas, Hikal, Honeywell Automation India, Ipca Laboratories, Jubilant Industries, NCC, Narayana Hrudayalaya, PTC India Financial Services, Prince Pipes and Fittings, Quess Corp, REC, Thermax, and TTK Healthcare will release their quarterly earnings on August 5.

Analysts/Investors Meeting

ABB Power Products and Systems India: The company’s officials will meet analysts and institutional investors on August 5.

Tasty Bite Eatables: The company’s officials will meet investors post AGM, on August 5.

Hindustan Petroleum Corporation: The company’s officials will meet analysts and investors on August 5, to discuss financial results.

Cholamandalam Financial Holdings: The company’s officials will meet analysts and investors on August 6, to discuss financial results.

Thermax: The company’s officials will meet analysts and investors on August 9, to discuss financial results.

Stocks In The News

Vodafone Idea: Kumar Mangalam Birla will step down as non-executive director and non-executive chairman of the board with effect from August 4. Himanshu Kapania is appointed as non-executive chairman of board, and Sushil Agarwal, a nominee of Aditya Birla Group, is appointed as additional director.

Reliance Industries: The company is doubling its PET recycling capacity by setting up a recycled polyester staple fiber (PSF) manufacturing facility in Andhra Pradesh. The move is part of RIL’s commitment to lead the industry on circular economy, enhance its sustainability quotient and bolster the entire polyester and polymer value chain.

HPCL: The company reported lower profit at Rs 1,795 crore in Q1FY22 against Rs 3,018 crore in Q4FY21, revenue fell to Rs 72,443.4 crore from Rs 74,843.4 crore QoQ.

Apollo Tyres: The company reported profit at Rs 127.7 crore in Q1FY22 against loss of Rs 134.5 crore in Q1FY21, revenue jumped to Rs 4,584.4 crore from Rs 2,881.7 crore YoY.

Titan Company: The company reported profit at Rs 61 crore in Q1FY22 against loss of Rs 270 crore in Q1FY21, revenue surged to Rs 3,249 crore from Rs 1,862 crore YoY.

Shipping Corporation of India: The company approved scheme of arrangement for demerger of ‘non-core assets’.

FII And DII Data

Foreign institutional investors (FIIs) net bought shares worth Rs 2,828.57 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 411.36 crore in the Indian equity market on August 4, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Three stocks – Canara Bank, Indiabulls Housing Finance, and Sun TV Network – are under the F&O ban for August 5. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.