The market started the week on a negative note and dropped sharply to close the lower percentage on July 19, attracted by banks and finance, automotive, metals, and stock options IT.

BSE Sensex scored 586.66 points or 1.10 percent to 52,553.40, while Nifty50 dropped 171 points or 1.07 percent to 15,752.40 and formed a Doji type pattern on daily charts.

“A Doji (not old-fashioned) candle pattern was created with a gap in the daily chart, indicating that another round of adjustment is coming from higher altitudes,” said Nagaraj Shetti, Research Technology Specialist, HDFC Securities

He said, “Monday’s weakness has proven to be an attempt at false positives at 15,900 levels. This is a bad sign in the market, as high false positive cracks reach the bottom of the consolidation / wide movement or move below that. Therefore, one would expect the Nifty to decline down to 15,635 levels or down in a short period of time. “

But, “there is a good chance that Nifty will go under this grant at some point. Any increase from here could get sales pressure at about 15,825 levels,” he added.

Wide markets are over mixed. The Nifty Midcap 100 index fell 0.81 percent and the Nifty Smallcap 100 index decreased by 0.03 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,694.3, followed by 15,636.2. If the index moves up, the key resistance levels to watch out for are 15,823.7 and 15,895.

Nifty Bank

The Nifty Bank declined 672.60 points or 1.88 percent to 35,079.20 on July 19. The important pivot level, which will act as crucial support for the index, is placed at 34,869.9, followed by 34,660.6. On the upside, key resistance levels are placed at 35,317.8 and 35,556.4 levels.

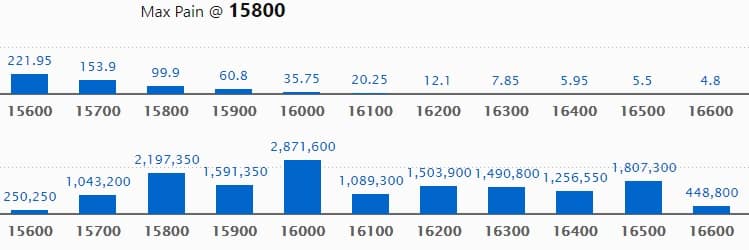

Call Option Data

Maximum Call open interest of 28.71 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the July series.

This is followed by 15800 strike, which holds 21.97 lakh contracts, and 16500 strike, which has accumulated 18.07 lakh contracts.

Call writing was seen at 15800 strike, which added 10.38 lakh contracts, followed by 15700 strike which added 4.01 lakh contracts and 15900 strike which added 2.31 lakh contracts.

Call unwinding was seen at 16300 strike, which shed 2.9 lakh contracts, followed by 16200 strike which shed 2.07 lakh contracts, and 16400 strike which shed 1.44 lakh contracts.

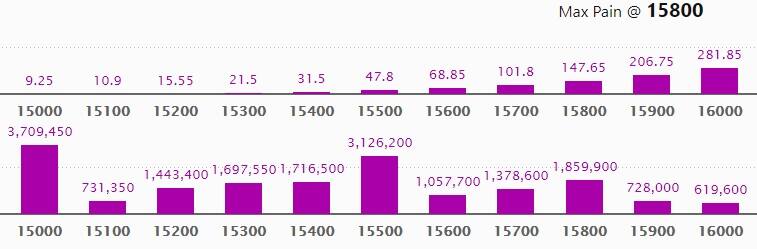

Put Option Data

Maximum Put open interest of 37.09 lakh contracts was seen at 15000 strike, which will act as a crucial support level in the July series.

This is followed by 15500 strike, which holds 31.26 lakh contracts, and 15800 strike, which has accumulated 18.59 lakh contracts.

Put writing was seen at 15400 strike, which added 2.23 lakh contracts, followed by 15500 strike which added 2.05 lakh contracts, and 15300 strike which added 1.9 lakh contracts.

Put unwinding was seen at 15900 strike, which shed 7.18 lakh contracts, followed by 16000 strike which shed 4.3 lakh contracts, and 15800 strike which shed 1.88 lakh contracts.

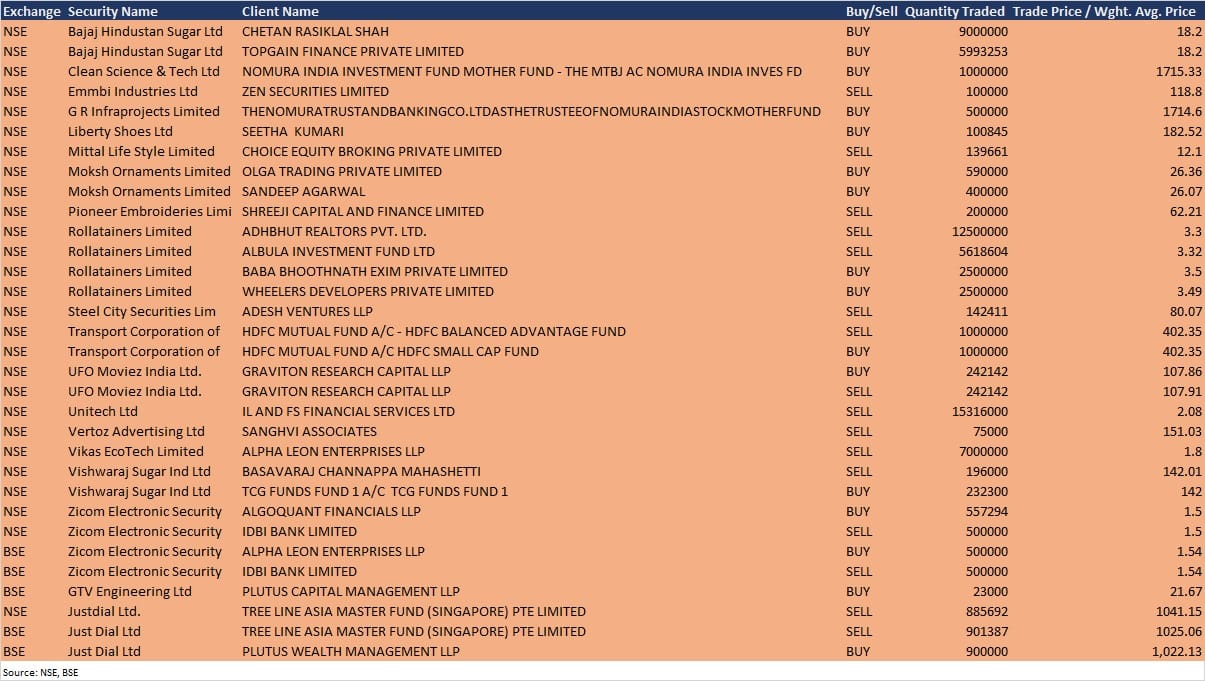

Bulk Deals

Clean Science & Technology: Nomura India Investment Fund Mother Fund — The MTBJ AC Nomura India Investment Fund — acquired 10 lakh equity shares in the company at Rs 1,715.33 per share on the NSE, the bulk deals data showed.

GR Infraprojects: The Nomura Trust and Banking Co Ltd as the Trustee of Nomura India stock Mother Fund bought 5 lakh equity shares in the company at Rs 1,714.6 per share on the NSE, the bulk deals data showed.

Mittal Life Style: Choice Equity Broking sold 1,39,661 equity shares in the company at Rs 12.1 per share on the NSE, the bulk deals data showed.

Vishwaraj Sugar Industries: Basavaraj Channappa Mahashetti sold 1.96 lakh equity shares in the company at Rs 142.01 per share, whereas TCG Funds Fund 1 acquired 2,32,300 equity shares in the company at Rs 142 per share on the NSE, the bulk deals data showed.

Just Dial: Tree Line Asia Master Fund (Singapore) Ptd Limited sold 8,85,692 equity shares in the company at Rs 1,041.15 per share on the NSE, and 9,01,387 equity shares at Rs 1,025.06 per share on the BSE, the bulk deals data showed. However, Plutus Wealth Management LLP bought 9 lakh equity shares in the company at Rs 1,022.13 per share on the BSE.

Results on July 20

Bajaj Finance, Asian Paints, Arihant Superstructures, CRISIL, DCM Shriram, ICICI Prudential Life Insurance Company, ICICI Securities, India Tourism Development Corporation, JSW Ispat Special Products, Jubilant Ingrevia, Kohinoor Foods, Mangalam Organics, Moschip Technologies, Newgen Software Technologies, Reliance Industrial Infrastructure, Rane (Madras), Shyam Metalics and Energy, and Syngene International will release quarterly earnings on July 20.

Analysts/Investors Meeting

Allcargo Logistics: The company’s officials will meet Abakkus Asset Managers on July 20.

Wardwizard Innovations & Mobility: The company’s officials will attend an investor conference with Maitreya Capital Advisors on July 20.

Dishman Carbogen Amcis: The company’s officials will meet several analysts on July 20.

Time Technoplast: The company’s officials will meet institutional investors, organised by Motilal Oswal Financial Services on July 20.

IOL Chemicals & Pharmaceuticals: The company’s officials will meet Franklin Templeton Asset Management (India) on July 20.

Tips Industries: The company’s officials will meet investors on July 21.

Havells India: The company’s officials will meet analysts/investors on July 22, to discuss financial results.

CSB Bank: The company’s officials will meet institutional investors and analysts on July 22, to discuss unaudited financial results.

IndiaMART InterMESH: The company’s officials will meet investors and analysts on July 23 to discuss financial performance.

Aegis Logistics: The company’s officials will meet analysts and investors on July 23.

Greenpanel Industries: The company’s officials will meet investors and analysts on July 28 to discuss unaudited financial results.

Stocks In The News

HCL Technologies: The company reported higher consolidated profit at Rs 3,214 crore in Q1FY22 against Rs 2,962 crore in Q4FY21, and revenue rose to Rs 20,068 crore from Rs 19,642 crore QoQ. The company maintained FY22 constant currency revenue growth guidance of double digits and EBIT margin guidance of 19-21 percent.

ACC: The company reported sharply higher profit at Rs 533.8 crore in Q2CY21 against Rs 268 crore in Q2CY20. Revenue jumped to Rs 3,884.8 crore from Rs 2,600.8 crore YoY.

Zen Technologies: The company secured an export order of Rs 120 crore.

Laurus Labs: Amansa Holdings Pvt Ltd & Amansa Investments Ltd sold 0.63 percent stake in the company via an open market transaction on July 15, reducing shareholding to 3.84 percent from 4.46 percent.

Jindal Stainless: Tata Steel Mining and Jindal Stainless signed MoU for a unique partnership for mining of common boundary in Sukinda, Odisha.

Nippon Life India Asset Management: The company reported higher consolidated profit at Rs 181.54 crore in Q1FY22 against Rs 156.30 crore in Q1FY21, and revenue jumped to Rs 302.27 crore from Rs 233.12 crore YoY.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,198.71 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,047.66 crore in the Indian equity market on July 19, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Seven stocks – Cadila Healthcare, Indiabulls Housing Finance, NALCO, NMDC, Punjab National Bank, SAIL, and Sun TV Network – are under the F&O ban for July 20. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.