The market started off the week on a solid note and continued its uptrend for the second consecutive session of the September series, ending at another record-closing high on August 30. All sectoral indices, barring IT, participated in the run with Bank, Metal, Pharma, and Auto being the leader with a 1.7-2.5 percent rally.

The BSE Sensex surged 765.04 points or 1.36 percent to 56,889.76, while the Nifty50 jumped 225.80 points or 1.35 percent to 16,931 and formed a bullish candle on the daily charts.

“The daily price action has formed a sizable bullish candle registering a new high at 16,951 levels. The next higher levels to be watched are around 17,000 levels. Any sustainable move above 17,000 levels may cause momentum towards 17,100-17,200 levels,” said Rajesh Palviya, VP – Technical and Derivative Research at Axis Securities.

On the downside, “any violation of an intraday support zone of 16,900 levels may cause profit booking towards 16,850-16,800 levels, he added.

The broader markets also joined the party with the Nifty Midcap 100 index rising 1.94 percent and Smallcap climbing 1.53 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,813.43, followed by 16,695.77. If the index moves up, the key resistance levels to watch out for are 17,000.13 and 17,069.17.

Nifty Bank

The Nifty Bank outpaced the frontline indices, climbing 719.90 points or 2.02 percent to 36,347.70 on August 30. The important pivot level, which will act as crucial support for the index, is placed at 35,913.53, followed by 35,479.46. On the upside, key resistance levels are placed at 36,590.03 and 36,832.46 levels.

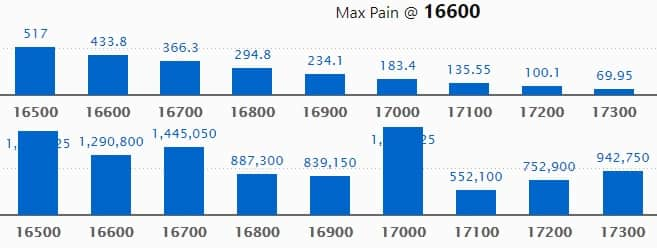

Call Option Data

Maximum Call open interest of 18.73 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the September series.

This is followed by 16,500 strike, which holds 17.96 lakh contracts, and 16,700 strike, which has accumulated 14.45 lakh contracts.

Call writing was seen at 17,400 strike, which added 5.63 lakh contracts, followed by 17,300 strike, which added 4.96 lakh contracts, and 17,500 strike which added 3.73 lakh contracts.

Call unwinding was seen at 16700 strike, which shed 2.3 lakh contracts, followed by 16500 strike, which shed 1.10 lakh contracts, and 16600 strike which shed 1.07 lakh contracts.

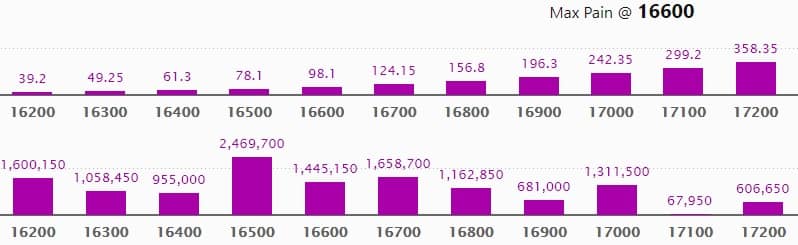

Put Option Data

Maximum Put open interest of 24.69 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the September series.

This is followed by 16,700 strike, which holds 16.58 lakh contracts, and 16,200 strike, which has accumulated 16 lakh contracts.

Put writing was seen at 16,800 strike, which added 6.86 lakh contracts, followed by 16,200 strike which added 4.26 lakh contracts, and 16,900 strike which added 3.98 lakh contracts.

Put unwinding was seen at 16,500 strike, which shed 84,150 contracts, followed by 16,600 strike which shed 29,250 contracts.

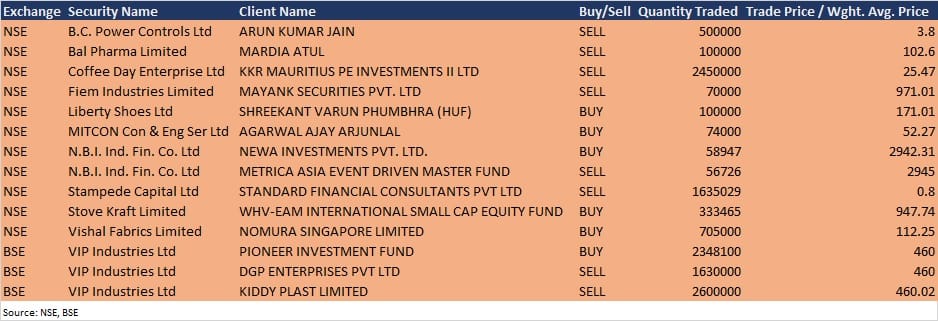

Bulk Deals

Coffee Day Enterprises: KKR Mauritius PE Investments II sold 24.50 lakh equity shares in the company at Rs 25.47 per share on the NSE, the bulk deal data showed.

Stove Kraft: WHV-EAM International Small Cap Equity Fund acquired 3,33,465 equity shares in the company at Rs 947.74 per share on the NSE, the bulk deals data showed.

Vishal Fabrics: Nomura Singapore bought 7.05 lakh equity shares in the company at Rs 112.25 per share on the NSE, the bulk deals data showed.

VIP Industries: Pioneer Investment Fund bought 23,48,100 equity shares in the company at Rs 460 per share on the BSE. However, promoter entities DGP Enterprises sold 16.30 lakh equity shares at Rs 460 per share, and Kiddy Plast offloaded 26 lakh shares at Rs 460.02 per share, the bulk deals data showed.

Analysts/Investors Meeting

Ambuja Cements: The company’s officials will meet Franklin Templeton on August 31.

UGRO Capital: The company’s officials will interact with a group of investors on August 31.

Mahindra & Mahindra: The company’s officials will interact with several funds and investors in Elara Virtual Investor Conference on August 31.

Deep Industries: The company’s officials will meet analysts on August 31 to discuss financial results and road-ahead for the company.

KEC International: The company’s officials will meet Elara Securities (India) on September 1, and Reliance Securities on September 3.

Easy Trip Planners: The company’s officials will meet investors and analysts during August 30 to September 4.

Stocks In The News

Shriram EPC: IDBI sold more than 1.96 crore equity shares of the company via open market transaction, reducing shareholding to 0.07% from 2.1% earlier.

Acrysil: The company announced further expansion of production capacity by an additional 1,60,000 Quartz Sinks per annum through greenfield project at Bhavnagar in Gujarat, taking the overall capacity to 10,00,000 sinks (1 million sinks) per annum.

Larsen & Toubro: The company has completed the sale of its entire stake in L&T Uttaranchal Hydropower to ReNew Power Services.

Ipca Laboratories: CRISIL reaffirmed its credit rating for the company’s commercial paper programme at A1+.

Aayush Food and Herbs: Classic Mercantile LLP picked up a 5.77% stake in the company via an open market transaction on August 30.

Axis Bank: Moody’s has assigned B1(hyb) rating to the bank, GIFT City Branch’s proposed USD-denominated, undated, non-cumulative and subordinated Additional Tier 1 (AT1) capital securities being issued out of its Global Medium Term Note (GMTN) programme.

FII And DII Data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,202.81 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 688.85 crore in the Indian equity market on August 30, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Not a single stock is under the F&O ban for August 31. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.