The market failed to meet the morning and afternoon gains and was finally resolved on July 12, expanding the existing consolidation phase.

BSE Sensex went down 13.50 points to 52,372.69, while Nifty50 went up 2.80 points to 15,692.60 and formed a bearish candlestick on daily charts as the closing was lower than opening levels.

“A positive candlestick was built on the daily chart after the opening on Monday. Technically this action indicates a bull’s instability to keep rising. The market could not exceed the 15,800 critical resistance (resistance to change in polarity) and showed weakness at the top,” Nagaraj Shetti, Technical Researcher In the HDFC study.

You feel that the choppy trend continues in the market and there is no breathing in the bulls, after showing a high return from the lower support (15,635) in the previous system.

“As long as the support is still in place, the chances of a recurring market are alive for the next 1-2 sessions. Deciding on a base basis is likely to increase the vulnerability to 15,500 levels. .

Wide markets surpassed its predecessors with the Nifty Midcap 100 and Smallcap 100 indices rising 0.44 percent and 0.6 percent, respectively.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,628.53, followed by 15,564.47. If the index moves up, the key resistance levels to watch out for are 15,772.93 and 15,853.27.

Nifty Bank

The Nifty Bank gained 126.95 points at 35,198.90 on July 12. The important pivot level, which will act as crucial support for the index, is placed at 35,041.43, followed by 34,883.96. On the upside, key resistance levels are placed at 35,375.34 and 35,551.77 levels.

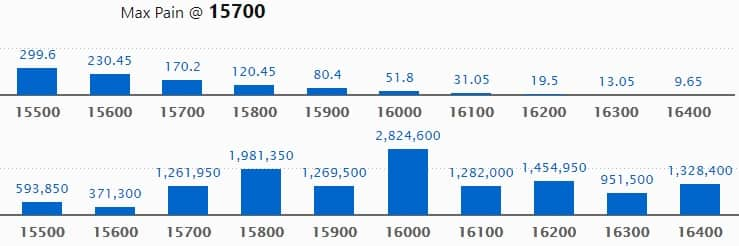

Call Option Data

Maximum Call open interest of 28.24 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the July series.

This is followed by 15800 strike, which holds 19.81 lakh contracts, and 16200 strike, which has accumulated 14.54 lakh contracts.

Call writing was seen at 15800 strike, which added 1.08 lakh contracts, followed by 15700 strike which added 80,300 contracts, and 16100 strike which added 63,900 contracts.

Call unwinding was seen at 16300 strike, which shed 70,150 contracts, followed by 16200 strike which shed 47,150 contracts.

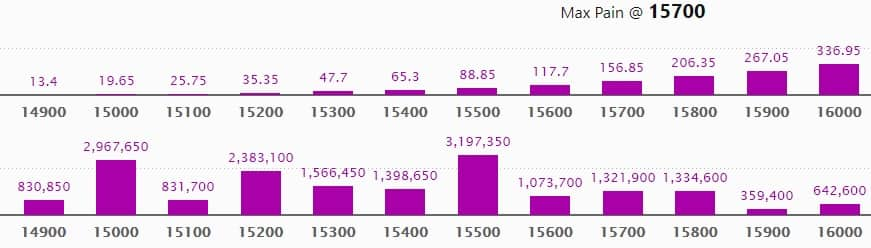

Put Option Data

Maximum Put open interest of 31.97 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the July series.

This is followed by 15000 strike, which holds 29.67 lakh contracts, and 15200 strike, which has accumulated 23.83 lakh contracts.

Put writing was seen at 15000 strike, which added 2.87 lakh contracts, followed by 15700 strike which added 1.56 lakh contracts, and 15400 strike which added 97,300 contracts.

Put unwinding was seen at 16000 strike, which shed 17,800 contracts, followed by 15900 strike which shed 15,450 contracts.

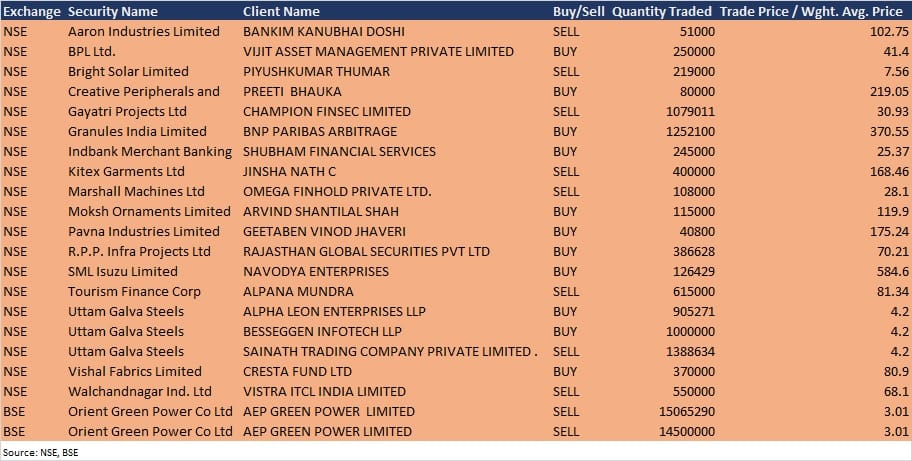

Bulk Deals

Granules India: BNP Paribas Arbitrage acquired 12,52,100 equity shares in the company at Rs 370.55 per share on the NSE, the bulk deals data showed.

SML Isuzu: Navodya Enterprises bought 1,26,429 equity shares in the company at Rs 584.6 per share on the NSE, the bulk deals data showed.

Vishal Fabrics: Cresta Fund bought 3.7 lakh equity shares in the company at Rs 80.9 per share on the NSE, the bulk deals data showed.

Results On July 13

Results on July 13: Mindtree, Tata Metaliks, Deccan Health Care, Gagan Gases, Shree Ganesh Remedies, TPI India, and WS Industries will release quarterly earnings on July 13.

Analysts/Investors Meeting

Housing & Urban Development Corporation: The company’s officials will meet institutional investors on July 13.

Triveni Engineering & Industries: The company’s officials will meet investors in a Conference meeting organised by Systematix Shares and Stocks on Sugar Industry on July 13.

Mrs Bectors Food Specialities: The company’s officials will meet analysts and investors on July 13.

Jubilant FoodWorks: The company’s officials will meet analysts and investors on July 21.

Tanla Platforms: The company’s officials will meet analysts and investors on July 22.

Agro Tech Foods: The company’s officials will meet analysts and investors on July 23.

Stocks In The News

Reliance Industries: The company has invested Rs 1,00,000 in cash in 10,000 equity shares of Rs 10 each of ‘Reliance New Energy Solar’ (RNESL), a newly incorporated wholly owned subsidiary. RNESL is incorporated to undertake activities relating to solar energy. RNESL is yet to commence its business operations.

ISMT: The company reported consolidated loss of Rs 112.2 crore in Q4FY21 against loss of Rs 79.11 crore in Q4FY20, revenue rose to Rs 459 crore from Rs 276.24 crore YoY.

LIC Housing Finance: ICICI Prudential Asset Management Company Ltd sold 1,94,291 equity shares (0.04% stake) in LIC Housing Finance, reducing shareholding to 3.01% from 3.05%.

Shilpa Medicare: The company approved the transfer of API business consisting of Unit-1 and Unit-2 situated at Raichur, Karnataka by way of slump sale to a wholly owned subsidiary of the company.

FDC: The company launched India’s first oral suspension of Favipiravir – Favenza oral suspension, used to treat mild to moderate cases of Covid-19.

Sunteck Realty: The company’s pre-sales grew by 74% YoY in Q1FY22 to Rs 176 crore, and collections grew by 165% YoY in Q1FY22 to Rs 172 crore.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 745.97 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 447.42 crore in the Indian equity market on July 12, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Seven stocks – Granules India, Indiabulls Housing Finance, Vodafone Idea, NALCO, NMDC, Punjab National Bank, and SAIL – are under the F&O ban for July 13. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.