The market gained a new record during the session, but continued to see a moderate measure of misconduct for the fourth consecutive day and closed modestly on August 10. Wide markets saw major adjustments today with the Nifty Midcap 100 index falling 1.09% and the Smallcap 100 index declining 2.3 percent , experts feel it could be a cause for concern.

BSE Sensex scored 151.81 points to close at 54,554.66, while Nifty50 increased by 21.80 points to 16,280.10 and formed a Doji type pattern on the daily charts as the close approached the opening levels.

“A beautiful small candle with a top and bottom shade is built. Technically, this action reflects the formation of a candle pattern of the highest quality. Generally, such a high wave pattern after a reasonable movement or descent often acts as a retreat. is being released, “said Nagaraj Shetti, Research Specialist for research at HDFC Securities.

He went on to say, “Nifty continues to trade in the narrow range for misconduct and this market action may continue in the next session.

“Decision-making above 16,360 is expected to open up to 16,500 levels in the near future. Immediate support has been set at 16,200-16,150 levels,” he added.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,201.8, followed by 16,123.5. If the index moves up, the key resistance levels to watch out for are 16,358.8 and 16,437.5.

Nifty Bank

The Nifty Bank rose 5.15 points to close at 36,034.10 on August 10. The important pivot level, which will act as crucial support for the index, is placed at 35,844.07, followed by 35,654.04. On the upside, key resistance levels are placed at 36,270.57 and 36,507.04 levels.

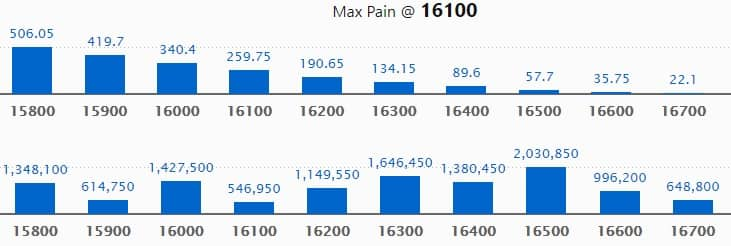

Call Option Data

Maximum Call open interest of 20.30 lakh contracts was seen at 16,500 strike, which will act as a crucial resistance level in the August series.

This is followed by 16,300 strike, which holds 16.46 lakh contracts, and 16,000 strike, which has accumulated 14.27 lakh contracts.

Call writing was seen at 16,500 strike, which added 2.34 lakh contracts, followed by 17,000 strike, which added 1.15 lakh contracts and 16,300 strike which added 1.03 lakh contracts.

Call unwinding was seen at 16,100 strike, which shed 88,250 contracts, followed by 15800 strike which shed 51,550 contracts, and 16,000 strike which shed 49,050 contracts.

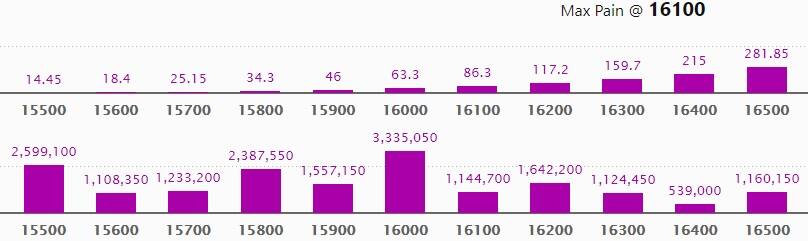

Put Option Data

Maximum Put open interest of 33.35 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the August series.

This is followed by 15,500 strike, which holds 25.99 lakh contracts, and 15,800 strike, which has accumulated 23.87 lakh contracts.

Put writing was seen at 16,500 strike, which added 2.52 lakh contracts, followed by 16,200 strike which added 1.57 lakh contracts, and 15,600 strike which added 1.04 lakh contracts.

Put unwinding was seen at 15,500 strike, which shed 1.76 lakh contracts, followed by 15,900 strike which shed 57,500 contracts, and 15,800 strike which shed 40,100 contracts.

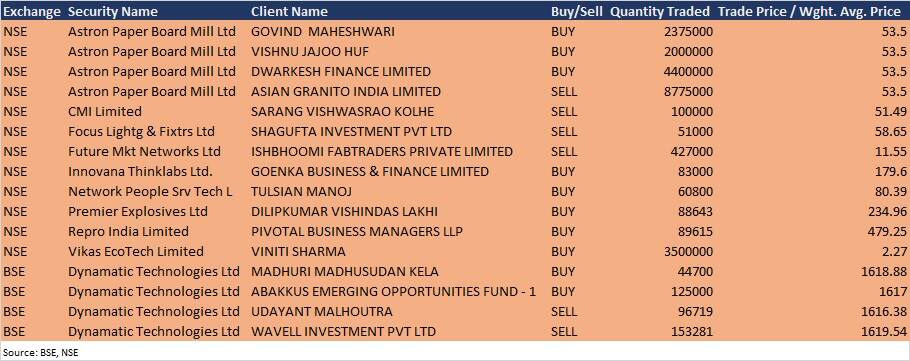

Bulk Deals

Dynamatic Technologies: Madhuri Madhusudan Kela acquired 44,700 equity shares in the company at Rs 1,618.88 per share and Abakkus Emerging Opportunities Fund – 1 bought 1.25 lakh shares in the company at Rs 1,617 per share. However, promoters – Udayant Malhoutra sold 96,719 equity shares in the company at Rs 1,616.38 per share and Wavell Investment sold 1,53,281 equity shares in the company at Rs 1,619.54 per share on the BSE, the bulk deal data showed.

Results On August 11

Cadila Healthcare, Aptech, Aries Agro, Ashiana Housing, Aster DM Healthcare, Antony Waste Handling Cell, Bajaj Electricals, Bata India, BF Utilities, Birla Cable, Bharat Road Network, CESC, CreditAccess Grameen, Cummins India, Endurance Technologies, Equitas Holdings, Force Motors, Greaves Cotton, HEG, IDFC, India Cement, Kolte-Patil Developers, Lemon Tree Hotels, Novartis India, Pidilite Industries, PNC Infratech, Rupa & Company, Take Solutions, VIP Industries, and VA Tech Wabag will release their quarterly earnings on August 11.

Analysts/Investors Meeting

Angel Broking: The company’s officials will meet investors on August 11 in a conference call hosted by Citigroup Global Markets India.

VIP Industries: The company’s officials will meet analysts and institutional investors on August 11, for discussing company’s performance for June quarter.

India Cements: The company’s officials will meet investors and analysts on August 11 post financial results.

Motherson Sumi Systems: The company’s officials will meet investors in Investment delegation Conference organised by Spark Capital on August 11, and Annual Corporate Conference by Emkay on August 12.

Max Healthcare Institute: The company’s officials will meet Fidelity Management & Research (Hong Kong) on August 11, Briarwood and TR Capital on August 12.

Welspun Corp: The company’s officials will meet Authum Investment & Infrastructure on August 11.

Globus Spirits: The company’s officials will meet investors and analysts on August 11, in Emkay Confluence Conference.

Mrs. Bectors Food Specialities: The company’s officials will meet analysts aqnd investors on August 12 post announcement of financial results.

Can Fin Homes: The company’s officials will meet My Lead Fintech on August 12, and Quantum Securities on August 16.

AIA Engineering: The company’s officials will meet investors on August 13, to discuss the financial performance.

Stocks In The News

Aarey Drugs & Pharmaceuticals: The company reported higher profit at Rs 2.5 crore in Q1FY22 against Rs 1.35 crore in Q1FY21, revenue increased to Rs 97.51 crore from Rs 25.21 crore YoY.

Fortis Malar Hospitals: The company reported consolidated loss at Rs 1.34 crore in Q1FY22 against loss of Rs 2.91 crore in Q1FY21, revenue rose to Rs 23.18 crore from Rs 9.43 crore YoY.

Nath Bio-Genes (India): The company reported higher profit at Rs 44.91 crore in Q1FY22 against Rs 41.25 crore in Q1FY21, revenue increased to Rs 215.1 crore from Rs 193.64 crore YoY.

Pricol: The company reported consolidated profit at Rs 5.94 crore in Q1FY22 against loss of Rs 30.85 crore in Q1FY21, revenue rose to Rs 319.91 crore from Rs 120 crore YoY.

Gujarat Alkalies and Chemicals: The company reported higher consolidated profit at Rs 63.12 crore in Q1FY22 against Rs 31.81 crore in Q1FY21, revenue increased to Rs 716.44 crore from Rs 469.61 crore YoY.

Ahluwalia Contracts (India): The company reported higher consolidated profit at Rs 34.78 crore in Q1FY22 against Rs 7.47 crore in Q1FY21, revenue jumped to Rs 580.09 crore from Rs 249.84 crore YoY.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 178.51 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 689 crore in the Indian equity market on August 10, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Seven stocks – Canara Bank, Indiabulls Housing Finance, NALCO, Punjab National Bank, RBL Bank, SAIL and Sun TV Network – are under the F&O ban for August 11. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.