After declining profits in the afternoon, the market traded down for the remainder of the year and closed at half a percentage on July 27, pulled by pharma, and opted for banks and funds, shares of FMCG, automotive, and IT.

The BSE Sensex declined 273.51 points to close at 52,578.76, while the Nifty50 dropped 78 points to 15,746.50 and formed a bearish candlestick on the daily charts.

“The daily price action creates a small bearish candlestick that makes the High-Low low compared to the previous session and closed below the previous session, indicating further weakness. , remain at a critical level to consider, “Rajesh Palviya, VP – Research and Derivative Research at Axis Securities.

However, the next level to be watched is almost 15,800, and any sustainable movement above 15,800 levels could create momentum at 15,900-15,950 levels, he said.

Wide markets also ended in red, with the Nifty Midcap 100 index falling 0.43 percent and the Smallcap 100 index falling 0.02 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,671.17, followed by 15,595.83. If the index moves up, the key resistance levels to watch out for are 15,851.67 and 15,956.83.

Nifty Bank

The Nifty Bank was down 152.25 points at 34,797.45 on July 27. The important pivot level, which will act as crucial support for the index, is placed at 34,611.97, followed by 34,426.54. On the upside, key resistance levels are placed at 35,084.47 and 35,371.54 levels.

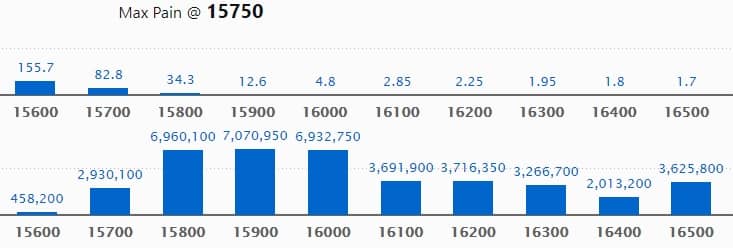

Call Option Data

Maximum Call open interest of 70.70 lakh contracts was seen at 15900 strike, which will act as a crucial resistance level in the July series.

This is followed by 15800 strike, which holds 69.60 lakh contracts, and 16000 strike, which has accumulated 69.32 lakh contracts.

Call writing was seen at 15700 strike, which added 20.60 lakh contracts, followed by 15800 strike which added 20.45 lakh contracts and 15900 strike which added 13.87 lakh contracts.

Call unwinding was seen at 16400 strike, which shed 1.96 lakh contracts, followed by 16000 strike which shed 1 lakh contracts, and 15500 strike which shed 33,750 contracts.

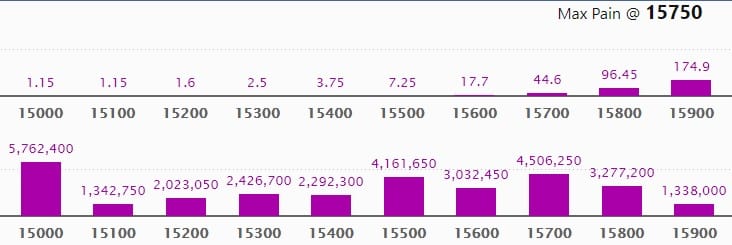

Put Option Data

Maximum Put open interest of 57.62 lakh contracts was seen at 15000 strike, which will act as a crucial support level in the July series.

This is followed by 15700 strike, which holds 45.06 lakh contracts, and 15500 strike, which has accumulated 41.61 lakh contracts.

Put writing was seen at 15000 strike, which added 7.5 lakh contracts, followed by 15700 strike which added 5.49 lakh contracts, and 15600 strike which added 4.26 lakh contracts.

Put unwinding was seen at 15800 strike, which shed 24.05 lakh contracts, followed by 15900 strike which shed 2.62 lakh contracts, and 15300 strike which shed 2.47 lakh contracts.

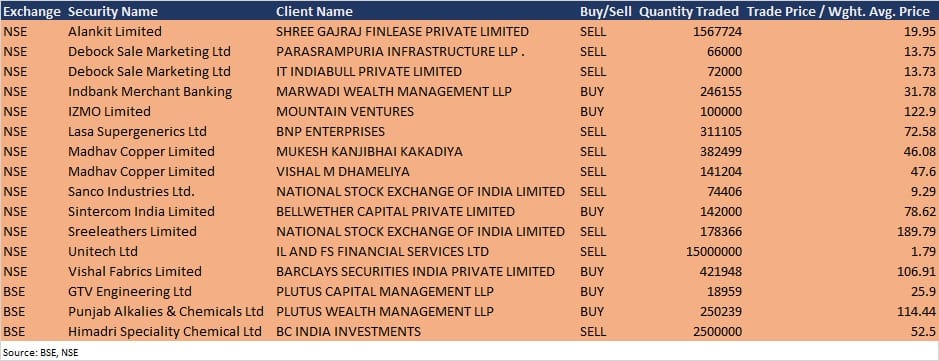

Bulk Deals

Indbank Merchant Banking: Marwadi Wealth Management LLP acquired 2,46,155 equity shares in the company at Rs 31.78 per share on the NSE, the bulk deals data showed.

Lasa Supergenerics: BNP Enterprises sold 3,11,105 equity shares in the company at Rs 72.58 per share on the NSE, the bulk deals data showed.

Vishal Fabrics: Barclays Securities India acquired 4,21,948 equity shares in the company at Rs 106.91 per share on the NSE, the bulk deals data showed.

Punjab Alkalies & Chemicals: Plutus Wealth Management LLP bought 2,50,239 equity shares in the company at Rs 114.44 per share on the BSE, the bulk deals data showed.

Himadri Speciality Chemical: BC India Investments sold 25 lakh equity shares in the company at Rs 52.5 per share on the BSE, the bulk deals data showed.

Results On July 28

Maruti Suzuki India, Nestle India, ABB India, Astec Lifesciences, Birlasoft, Central Bank of India, Century Textiles & Industries, Coforge, Dhanlaxmi Bank, Embassy Office Parks REIT, Gateway Distriparks, Geojit Financial Services, Greenpanel Industries, Grindwell Norton, Happiest Minds Technologies, Heritage Foods, HSIL, ICRA, IDBI Bank, Intellect Design Arena, JM Financial, Mahindra Lifespace Developers, Mahanagar Gas, Mold-Tek Packaging, Pfizer, Radico Khaitan, Ramco Systems, Route Mobile, RPG Life Sciences, Sagar Cements, SRF, Tata Coffee, TCI Express, TeamLease Services, United Breweries, UTI Asset Management Company, and Welspun India will release quarterly earnings on July 28.

Analysts/Investors Meeting

United Drilling Tools: The company’s officials will meet analysts and investors on July 28, to discuss financial results.

Union Bank of India: The company’s officials will meet analysts and investors on July 29, to discuss financial results.

Aegis Logistics: The company’s officials will meet analysts and investors on July 30 to discuss operational & financial performance.

Welspun Corp: The company’s officials will meet analysts and investors on July 30 to discuss Q1FY22 results.

ADF Foods: The company’s officials will meet analysts and investors on July 30 to discuss financial results.

Motilal Oswal Financial Services: The company’s officials will meet analysts and investors on July 30 to discuss the financial performance.

Nazara Technologies: The company’s officials will meet analysts and investors on August 2 to discuss financial results.

Alkem Laboratories: The company’s officials will meet analysts and investors on August 6, to discuss the Q1FY22 financial results.

Stocks In The News

InterGlobe Aviation: The company posted a loss of Rs 3,174.2 crore in Q1FY22 against loss of Rs 2,844.3 crore in Q1FY21, revenue jumped to Rs 3,006.9 crore from Rs 766.73 crore YoY.

IndusInd Bank: The bank reported sharply higher profit at Rs 974.95 crore in Q1FY22 against Rs 460.64 crore in Q1FY21, net interest income jumped to Rs 3,563.71 crore from Rs 3,309.19 crore YoY.

Foseco India: The company reported profit at Rs 6.3 crore in Q1FY22 against loss of Rs 2.92 crore in Q1FY21, revenue jumped to Rs 75.07 crore from Rs 27.65 crore YoY.

Karnataka Bank: The bank reported profit at Rs 106.08 crore in Q1FY22 against profit of Rs 196.38 crore in Q1FY21, net interest income rose to Rs 574.79 crore from Rs 535.12 crore YoY.

IIFL Finance: The company reported sharply higher consolidated profit at Rs 265.82 crore in Q1FY22 against Rs 31.83 crore in Q1FY21, revenue jumped to Rs 1,514.4 crore from Rs 1,286.95 crore YoY.

VST Industries: The company reported profit at Rs 70.44 crore in Q1FY22 against Rs 75.71 crore in Q1FY21, revenue jumped to Rs 368.11 crore from Rs 314.91 crore YoY.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,459.08 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 729.96 crore in the Indian equity market on July 27, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Two stocks – Vodafone Idea, and SAIL – are under the F&O ban for July 28. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.