Healthy purchases in many sectors helped market ratings, Sensex and Nifty, extend their profits for the second consecutive session on August 24th.

Sensex jumped 403 points, or 0.73 percent, to stay at 55,958.98 while Nifty finished the day with 128 points, or 0.78 percent, at 16,624.60.

Wide markets have made benches better. The BSE Midcap index closed at a profit of 1.52 percent while the smallcap index exceeded 1.69 percent.

Nifty builds a bullish candle at the daily rate with a long low signal indicating a decline in purchases.

“We can now expect the index to increase its move to a higher lifespan of 16 700-16,750, and on the negative side, support at 16,500 -16,380 levels,” said Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services.

Key Support And Resistance Levels For The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,530.9, followed by 16,437.2. If the index moves up, the key resistance levels to watch out for are 16,682.7 and 16,740.8.

Nifty Bank

The Nifty Bank surged 588 points, or 1.67 percent, to 35,712.10 on August 24. The important pivot level, which will act as crucial support for the index, is placed at 35,256.3, followed by 34,800.5. On the upside, key resistance levels are placed at 35,981.6 and 36,251.1 levels.

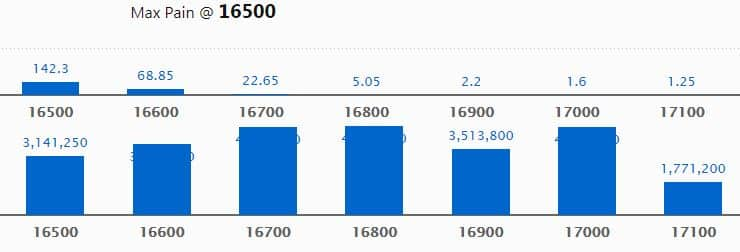

Call Option Data

Maximum Call open interest of 47.41 lakh contracts was seen at 16,800 strike, which will act as a crucial resistance level in the August series.

This is followed by 17,000 strike, which holds 46.9 lakh contracts, and 16,700 strike, which has accumulated 46.7 lakh contracts.

Call writing was seen at 16,800 strike, which added 7.93 lakh contracts, followed by 16,900 strike, which added 3.39 lakh contracts and 17,000 strike which added 1.07 lakh contracts.

Call unwinding was seen at 16,500 strike, which shed a whopping 21.6 lakh contracts, followed by 16,600 strike which shed 16.9 lakh contracts, and 16,400 strike which shed 5.98 lakh contracts.

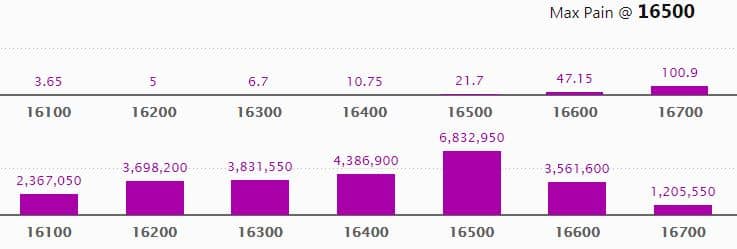

Put Option Data

Maximum Put open interest of 68.33 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the August series.

This is followed by 16,400 strike, which holds 43.87 lakh contracts, and 16,300 strike, which has accumulated 38.32 lakh contracts.

Put writing was seen at 16,600 strike, which added 25.96 lakh contracts, followed by 16,500 strike which added 24.22 lakh contracts, and 16,400 strike which added 5.57 lakh contracts.

Put unwinding was seen at 16,900 strike, which shed 1.5 lakh contracts, followed by 16,100 strike which shed 1.31 lakh contracts.

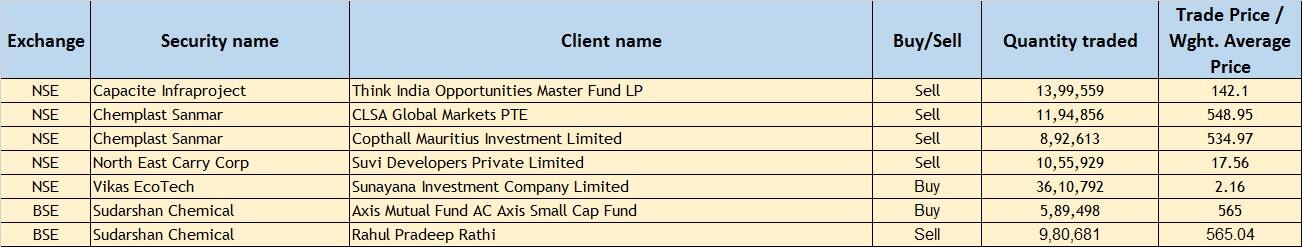

Bulk Deals

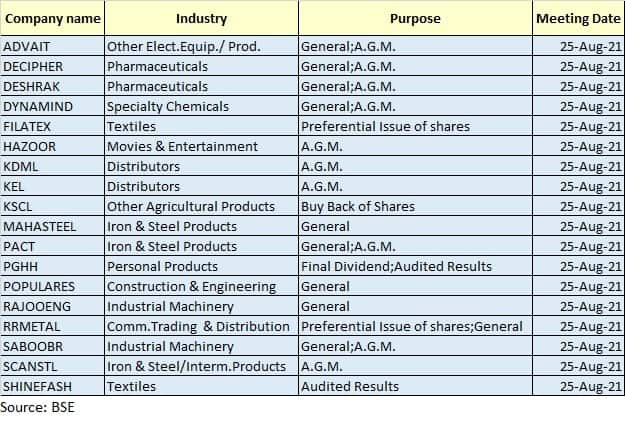

Board Meetings

Stocks In The News

Wipro: The company has been awarded a strategic multi-year contract to partner with E.ON in its digital transformation journey in the financial area. Besides, it said it will open a new delivery centre in Sherwood, Arkansas.

Tata Steel: Brickwork Ratings upgrades the ratings for the unsecured Non-Convertible Debentures/Bond Issues aggregating Rs 4,000 crore of the company from BWR AA/Stable to BWR AA+/Stable.

Dollar Industries: CARE Ratings revised the credit rating from CARE A+; Positive to CARE A+; Positive for long-term facilities and reaffirn1ed the existing credit rating CARE A1+ for short-term facilities/Commercial Paper issue.

IndusInd Bank: India Ratings assigns the bank’s Tier II Bonds rating at ‘IND AA+’/Stable.

CreditAccess Grameen: The company board approved the issuance of non-convertible debentures aggregating up to Rs 100 crore.

Sterling Tools: ICRA has reaffirmed the long-term as well as short-term credit ratings of the company.

Brigade Enterprises: CRISIL Ratings has upgraded the long-term rating for the credit limits of the company from banks to CRISIL A+/stable from CRISIL A/stable.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,644.91 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 2,380.05 crore in the Indian equity market on August 24, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Four stocks – Canara Bank, Vodafone Idea, NMDC and SAIL – are under the F&O ban for August 25. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.