If you are an IPO investor you should know the method how to apply IPO via ASBA. ASBA full form is Applications Supported by Blocked Amount. The method is used to Apply IPO via net banking offered by the banks that investors should use with easy steps given in the article.

In This Article

- What is ASBA?

- How to apply IPO through ASBA Online?

- ASBA Cut-Off Time offered by Banks on the Last Day of an IPO.

- How to check ASBA IPO Application Status?

- ASBA IPO Application Example of SBI Bank?

What is ASBA?

ASBA (Applications Supported by Blocked Amount) is a process developed by SEBI to apply IPOs, Rights issues, FPS, etc. As per the ASBA investors should apply the IPOs with ease and the amount will be blocked for till the IPO allotment comes out or before IPO listing day. The investors should follow the process to log in to their bank account via net banking and choose the ASBA option to apply for an IPO. After that select the IPO and fill in the detailed information as required by the ASBA Form.

It is easy if you are a tech-savvy guy. Just follow the steps and you will able to see the submitted application under ASBA in your bank account. If an investor will get the allotment the fund will be deducted from the bank account and will be notified via bank SMS, or the lien balance will be released as on the allotment date or before the IPO listing.

How to apply IPO through ASBA Online?

- Log-in to Bank Account via Net-Banking or Bank Mobile App

- Go to the Online IPO section or ASBA.

- Select the IPOs you want to apply

- Enter your depository details

- Fill in bidding details like category, quantity, and amount

- Place and confirm your Order

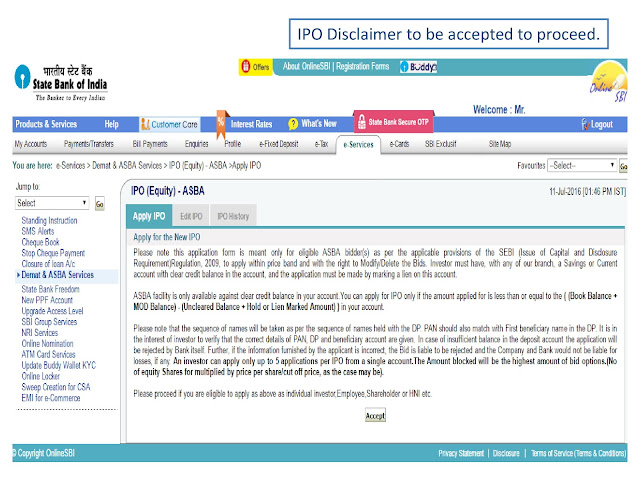

- Accept the “Terms & Conditions” before submitting the bid

- The IPO Application is Submitted

- IPO Application Bid will be sent to the stock exchange by Bank

- The exchange accepts the Bid and sends the Application number to Bank

- The bank shows the message for successful bid

- On the last day exchange shares details to the registrar

- Registrar completes the IPO allotment process as per the basis of the allotment

- If the investor get the allotment registrar transfer shares to the Demat account

- An investor can sell the shares on the IPO listing day

ASBA Cut-Off Time offered by Banks on the Last Day of an IPO.

There are different Bank ASBA timings as per their rules. Here are a few of the bank names that allow IPO Applications on the last day from 2PM to 4PM.

- SBI Bank – 2 PM

- Kotak Mahindra Bank – 2 PM

- Punjab National Bank – 2 PM

- Corporation Bank – 2 PM

- IndusInd Bank – 2 PM

- Bank of Baroda 3 PM

- Andhra Bank – 3 PM

- ICICI Bank – 3 PM

- Axis Bank – 3 PM

- Yes Bank – 3 PM

- Dena Bank – 3 PM

- IDBI Bank – 3 PM

- Bank of India (BoI) 3 PM

- RBL Bank – 3 PM

- HDFC Bank – 4 PM

- Central Bank – 4 PM

- Canara Bank – 4 PM

Note: The time might be varied, if anyone has a query regarding the same please inform us to update the same.

How to check ASBA IPO Application Status?

- Log on to our IPO Allotment Status page

- Click on the IPO name to check the status

- Choose the company name and enter the PAN Number

- Submit the request

ASBA IPO Application Example of SBI Bank?

- Login to SBI Bank NetBanking – https://www.onlinesbi.com/

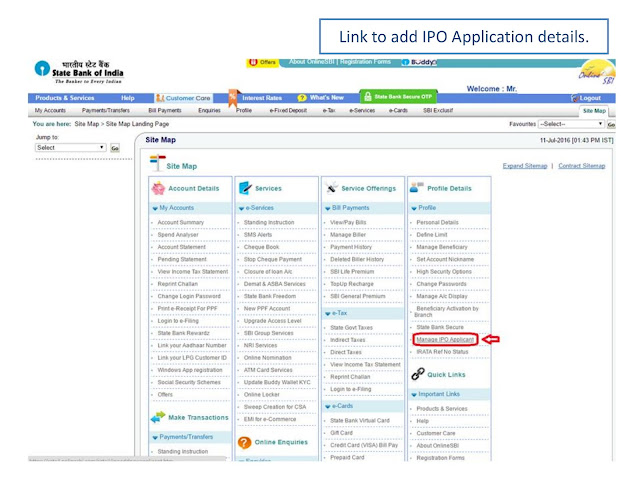

- Click on eServices Tab

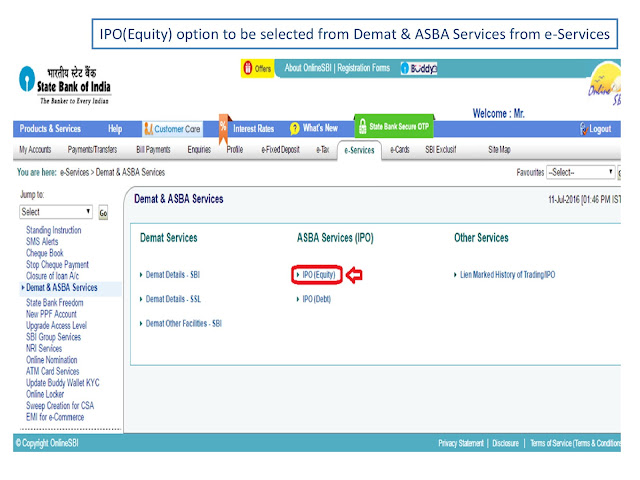

- Click on Demat & ASBA Services

- Click on IPO Equity

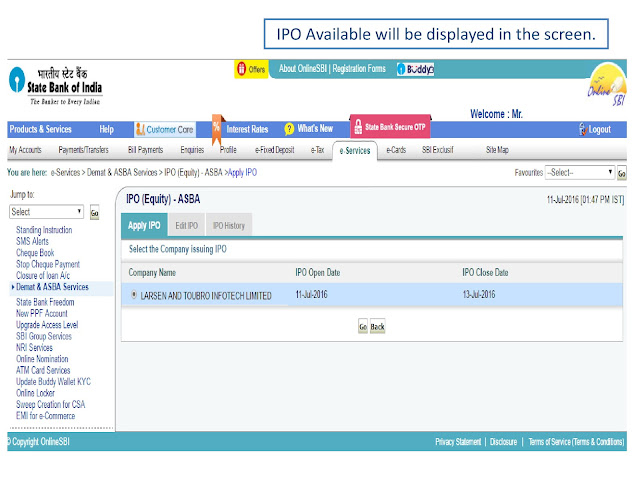

- Select IPO

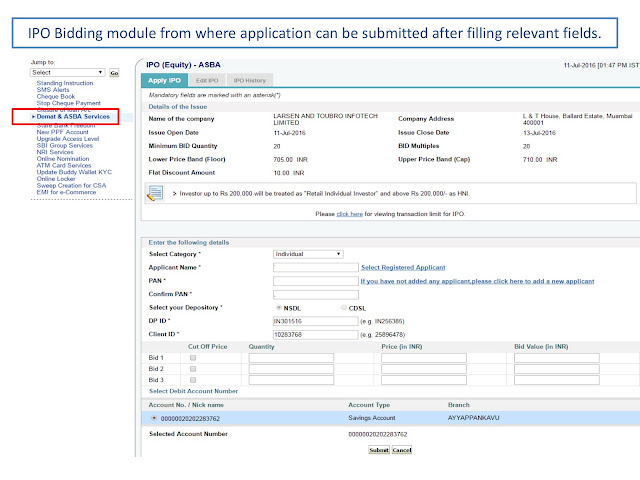

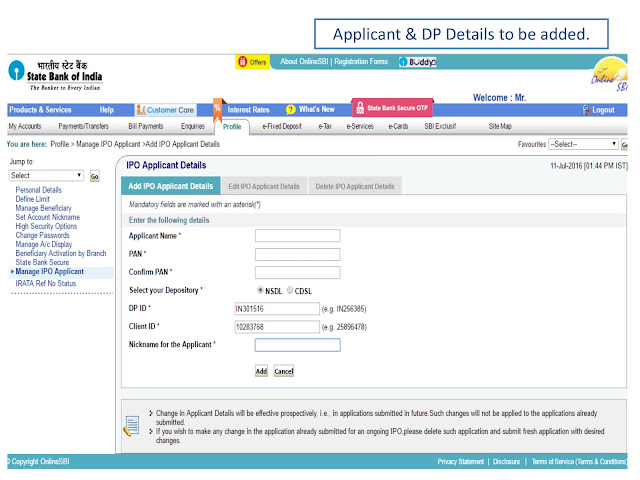

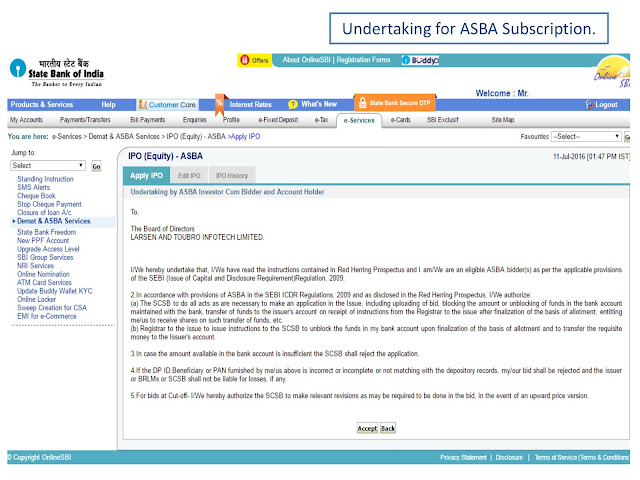

- Enter Details in the Form like DP ID, BID, Name, Pan Card and more

- Verify & Confirm Your Order

It’s Done. It’s easy and simple but you need funds in your SBI Bank account so that it can be blocked when you apply for the IPO through SBI NetBanking. Once you apply amount will be blocked and it can be used after the unblocking funds if you do not get the IPO allotment. If you get the allotment the shares of the company will be credited to your Demat Account.

# Add IPO Application Details:

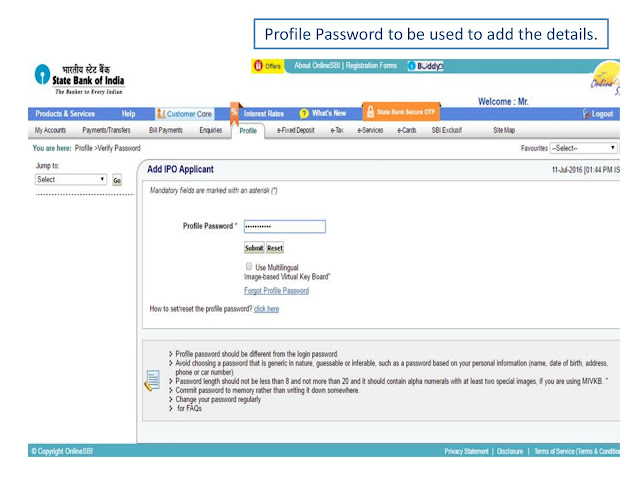

# Net-Banking Login with Profile Password:

# Add DP & Applicant Details:

# Select IPO from Demat & ASBA Services:

# Accept IPO Disclaimer or T&C:

# Select IPO from the List:

# Apply IPO through ASBA:

# IPO Bidding: