Nagaraj Shetti of HDFC Securities feels like Nifty’s short-term trend seems to have been postponed after a small outburst.

The market has fallen sharply in the wake of weak global trends and rising COVID-19 cases in the country, falling more than 1.7 percent on March 24 as bears held tight on Dalal Street.

IBSE Sensex jumped 871.13 points or 1.74 percent to 49,180.31, while Nifty50 dropped 265.40 points or 1.79 percent to 14,549.40 and formed a bearish candlestick on daily charts, before the end of March futures and election contracts on Thursday .

“A bad long candle is being built and this shows a change over the past few seasons. So Tuesday’s high-profile candlestick pattern has become a volatile pattern right now. This is a bad sign and a bad signal in future plans,” Nagaraj Shetti, research specialist at HDFC Securities.

“Nifty’s short-term trend looks set to be reversed after a small upward trend. The next low levels will be watched around 14,350-14,300 in the next few sessions before showing any further upside from the top. Any retreat rally can find resistance around 14,675-14,750, “he said.

Wide markets have also adjusted in line with predecessors as the Nifty Midcap 100 and Smallcap 100 indicators have dropped by about 2 percent each.

Basic Support And Nifty Resistance Levels

According to pivot charts, the key Nifty support levels set at 14,472.17, followed by 14,394.93. If the index rises, the key resistance levels should be 14,689.47 and 14,829.53.

Nifty Bank

The Nifty Bank index scored 891.15 points or 2.61 percent to close to 33,293.25 on March 24. The pivot rate, which will serve as an important indicator support, is set at 33,007.53, followed by 32,721.86. In addition, key resistance levels were set at 33,774.73 levels and 34,256.27 levels.

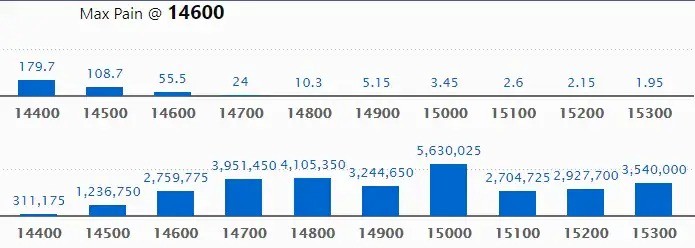

Call Option Data

The open interest rate of Mall Maximum for 56.30 lakh contracts was seen in the 15,000 strike, which will serve as an important resistance level in the March series.

This is followed by a strike of 14,800, which holds 41.05 lakh contracts, and a strike of 14,700, which collected 39.51 lakh contracts.

Phone calls were seen in the 14,700 strike, which added 28.04 lakh contracts, followed by 14,600 strikes adding 18.47 lakh contracts and 14,800 strikes adding 16.36 lakh contracts.

The so-called unwinding was seen in the 15,200 strike, which lost 2.22 lakh contracts, followed by the 14,000 strike that destroyed 60,000 contracts and the 13,700 strike that destroyed 3,900 contracts.

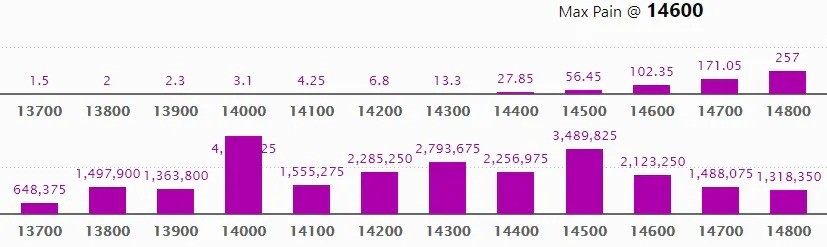

Put Option Data

Maximum Put The open interest of 41.39 lakh contracts was seen in the 14,000 strike, which will serve as an important level of support for the March series.

This is followed by a strike of 14,500, with 34.89 lakh contracts, and a 14,300 strike, which collected 27.93 lakh contracts.

The writing was recorded on a strike of 14,300, adding 2.21 lakh contracts

Put unwinding was seen in the 14,800 strike, which lost 12.57 lakh contracts, followed by the 14,700 strike that terminated 11.04 lakh contracts and the 14,000 strike that terminated 8.65 lakh contracts.

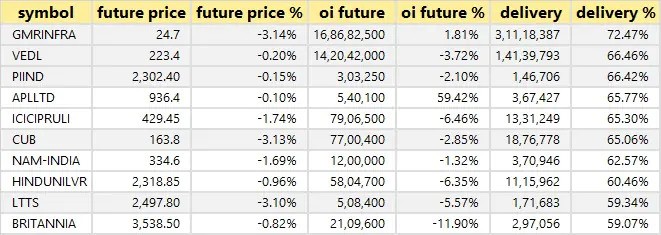

Shares Have A High Delivery Rate

A high percentage of submissions suggest that investors are showing interest in these stocks.

4 Stocks Saw A Long Build

Depending on the percentage of open future interest, here are 4 stocks where long construction has been observed.

108 Stocks Saw A Long-Term Outflow

Depending on the future percentage of open interest, here are the top 10 stocks where long-term stocks have been found.

42 Shares Saw A Short Build

The increase in open interest rates, as well as the decline in prices, indicate the formation of shorter positions. Depending on the percentage of open future interest, here are the top 10 stocks where short construction has been observed.

3 Shares Saw A Short Cover

Open interest rates, as well as price increases, are particularly indicative of short coverage. Depending on the percentage of open future interest, here are 3 stocks where short coverage was seen.

Bulk Deals

Analysts / Board Meetings

United Spirits: Institutions / institutional investor meetings to be held on March 25 and March 26.

Eicher Motors: Company officials will contact Sharekhan and JP Morgan India on March 25.

Developers of Mahindra Lifespace: Company officials will contact UBS Securities India on March 26.

Tube Investments of India: Company officials will contact institutional investors / analysts on March 26 and March 31.

Hindalco Industries: Company officials will take part in the visual session of the ESG CXO Series hosted by Edelweiss Securities on March 25.

Stocks In The News

Jubilant FoodWorks: Jubilant Foodworks has entered into a special franchise and development agreement with PLK APAC Pte Ltd, a subsidiary of Restaurant Brands International Inc. The agreement will enable the company to establish, establish, own and operate, and licens franchisees to develop, start, manage and operate, Popeyes restaurants in India, Bangladesh, Nepal and Bhutan.

Time Technoplast: Time Technoplast has obtained information from a company that develops a company with a significant reduction in their securities stake in the company’s equity. “The share mortgage has dropped from 9.55% of the payroll to only 4.22%. Not to mention, at one point the promised share was about 18%,” the company said in its BSE file.

Pokarna: Pokarna Engineered Stone, a company owned entirely by Pokarna, has begun commercial production at its second state-of-the-art quartz technology center, since March 24. The plant is located in Mekaguda village in Telangana.

Vakrangee: Vakrangee has entered into a joint venture agreement with TransUnion CIBIL (TUCIBIL), one of India’s largest credit information companies under the control of the Reserve Bank of India. The agreement will help the company conduct financial investments by providing easy access to CIBIL points and reporting to consumers through the Nextgen Vakrangee Kendra network.

Wabco India: ZF International UK will sell 17,17,388 shares or 9.05% of shares in Wabco India for a sale that will sell on March 25 and March 26. The company will also sell another 17,17,387 shares or 9.05% of the company with offers sold on the same day. The minimum retail price is set at Rs 5,450 per share.

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 1,951.90 crore, while domestic institution (DII) investors bought shares worth Rs 612.80 crore on the Indian financial market on March 24, according to short-term data available on the NSE.

Shares are under F&O ban on the NSE

One stock – Vodafone Idea – is subject to the F&O ban on March 25. Security during the ban under the F&O segment includes companies where security exceeds 95 percent of the broad market position limit.