The market gradually extended losses as the day progressed and finally settled with nearly a percent down on July 8, dented by weak global cues and selling pressure in banking and financials, auto, metals, pharma, and FMCG stocks.

The BSE Sensex fell 485.82 points to close at 52,568.94, while the Nifty50 declined 151.80 points to 15,727.90 and formed a bearish candle on the daily charts.

“A long negative candle was formed that has negated the short term positive indication created after the upside bounce of Wednesday. The formation of Gravestone Doji of June 6 remains intact and the intraday double top formation is also alive at 15,915 levels,” Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

“Nifty is now placed at the support of 20-day EMA and minor up sloping trend line support around 15,720-15,700 levels. A decisive move below this support is likely to bring more weakness in the short term,” he said.

He further said the uncertainty of bulls at the crucial hurdle of 15,900 continued, as the market tumbled down sharply from near the hurdle. “Although Nifty placed at the minor support of 15,700-15,640 levels, a sharp follow through weakness could open decline towards 15,450 in the near term. Any pullback rally from here could initially find resistance at 15,800 levels,” he added.

The broader markets witnessed less selling pressure compared to benchmark indices. The Nifty Midcap 100 index was down 0.42 percent and Smallcap 100 index declined 0.04 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,645.27, followed by 15,562.63. If the index moves up, the key resistance levels to watch out for are 15,848.17 and 15,968.43.

Nifty Bank

The Nifty Bank dropped 497.20 points or 1.39 percent to 35,274.10 on July 7. The important pivot level, which will act as crucial support for the index, is placed at 35,002.13, followed by 34,730.17. On the upside, key resistance levels are placed at 35,678.53 and 36,082.96 levels.

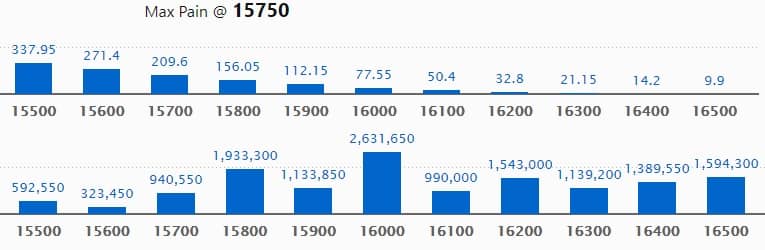

Call Option Data

Maximum Call open interest of 26.31 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the July series.

This is followed by 15800 strike, which holds 19.33 lakh contracts, and 16500 strike, which has accumulated 15.94 lakh contracts.

Call writing was seen at 15800 strike, which added 5.84 lakh contracts, followed by 15700 strike which added 3.21 lakh contracts, and 15900 strike which added 2.29 lakh contracts.

Call unwinding was seen at 16000 strike, which shed 1.69 lakh contracts, followed by 16500 strike which shed 48,950 contracts.

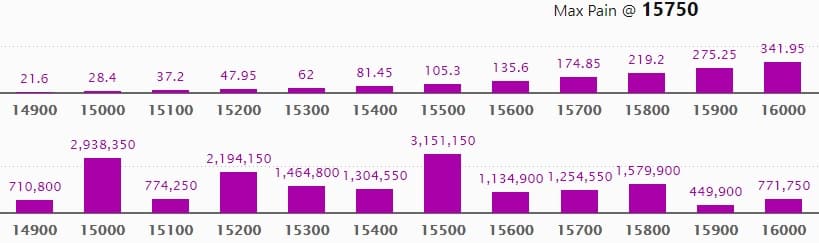

Put Option Data

Maximum Put open interest of 31.51 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the July series.

This is followed by 15000 strike, which holds 29.38 lakh contracts, and 15200 strike, which has accumulated 21.94 lakh contracts.

Put writing was seen at 15800 strike, which added 2.2 lakh contracts, followed by 15300 strike which added 1.52 lakh contracts, and 15400 strike which added 1.37 lakh contracts.

Put unwinding was seen at 15500 strike, which shed 2.54 lakh contracts, followed by 15600 strike which shed 1.71 lakh contracts.

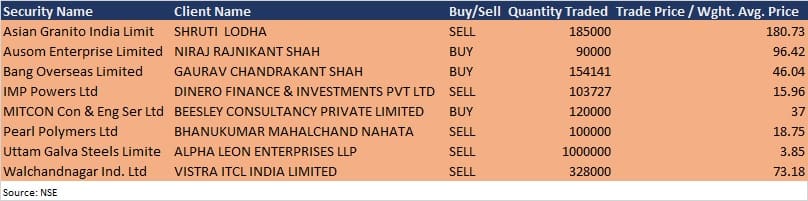

Bulk Deals

Results On July 9 & 10

Results on July 9: Delta Corp, Excel Realty N Infra, Integrated Capital Services, K&R Rail Engineering, Madhucon Projects, Mapro Industries, Metalyst Forgings, Pil Italica Lifestyle, Suryavanshi Spinning Mills, Valencia Nutrition, and Vikas Lifecare will release quarterly earnings on July 9.

Results on July 10: Avenue Supermarts, PTC Industries, Castex Technologies, Gujarat Hotels, Indo-City Infotech, and Oriental Trimex will release quarterly earnings on July 10.

Analysts/Investors Meeting

Galaxy Surfactants: The company’s officials will meet analysts and investors on July 9.

HPL Electric & Power: The company’s officials will meet Abakkus Asset Management on July 9.

Aptech: The company’s officials will meet Haitong Securities on July 9.

Rushil Decor: The company’s officials will meet analysts and investors in an Institutional Conference organised by Asian Markets Securities (AMSEC) on July 9.

HFCL: The company’s officials will meet analysts and investors on July 13.

Finolex Cables: The company’s officials will meet HDFC Standard Life on July 14, and Capital World Investors on July 15.

Stocks In The News

Tata Consultancy Services: The company reported lower consolidated profit at Rs 9,008 crore in Q1FY22 against Rs 9,246 crore in Q4FY21, revenue increased to Rs 45,411 crore from Rs 43,705 crore YoY.

Tata Steel: CARE upgraded long term credit rating on the company to AA+ from AA and the outlook to Stable from Negative.

Bharat Dynamics: The company has signed a contract worth about Rs 499 crore with the Ministry of Defence for the manufacture and supply of Akash Missiles to the Indian Air Force.

Texmaco Rail & Engineering: CARE reaffirmed long term credit rating on the company at A-, but downgraded outlook to Negative from Stable.

Jammu & Kashmir Bank: The Reserve Bank of India has imposed a penalty of Rs 1 crore on the bank, on account of contravention of directions contained in circulars on ‘Lending to Non-Banking Financial Companies (NBFCs) and Bank Finance to Non-Banking Financial Companies (NBFCs)’.

Sangam Renewables: The company divested its entire stake in its subsidiary Waacox Energy to Aditya Birla Renewable at an enterprise value of Rs 81,57,55,500 on the transaction. The company will use these proceeds to reduce its short-term debt by Rs 40,32,92,379 on a standalone basis.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 554.92 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 949.18 crore in the Indian equity market on July 8, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Five stocks – Indiabulls Housing Finance, NALCO, NMDC, Punjab National Bank, and SAIL – are under the F&O ban for July 9. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.