The market turned volatile after opening flat and gained strength in late trade to close higher on July 7, led by buying interest in metals, select banking and financials, FMCG, IT, and pharma stocks.

The BSE Sensex climbed 193.58 points to 53,054.76, while the Nifty50 rose 61.40 points to 15,879.70 and formed a bullish candle on the daily charts.

“The daily price action has formed a bullish candlestick pattern carrying a long lower shadow indicating buying support at lower levels. The next higher levels to be watched are around 15,900 levels. Any sustainable move above 15,900 levels may cause momentum towards 16,000-16,050 levels,” said Rajesh Palviya, VP – Technical and Derivative Research at Axis Securities.

On the downside, any violation of an intraday support zone of 15,800 levels may cause profit booking towards 15,750-15,700 levels, he added.

The broader markets outweighed frontliners with the Nifty Midcap 100 and Smallcap 100 indices rising 0.66 percent and 0.62 percent respectively.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,808.43, followed by 15,737.17. If the index moves up, the key resistance levels to watch out for are 15,922.23 and 15,964.77.

Nifty Bank

The Nifty Bank gained 192.10 points to close at 35,771.30 on July 7. The important pivot level, which will act as crucial support for the index, is placed at 35,534, followed by 35,296.7. On the upside, key resistance levels are placed at 35,902.2 and 36,033.1 levels.

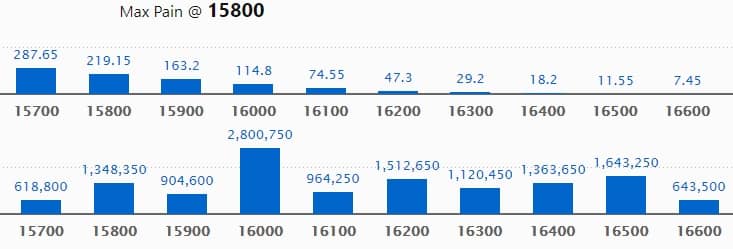

Call Option Data

Maximum Call open interest of 28 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the July series.

This is followed by 16500 strike, which holds 16.43 lakh contracts, and 16200 strike, which has accumulated 15.12 lakh contracts.

Call writing was seen at 16000 strike, which added 1.56 lakh contracts, followed by 15800 strike which added 42,700 contracts, and 15900 strike which added 23,800 contracts.

Call unwinding was seen at 16300 strike, which shed 57,450 contracts, followed by 16400 strike which shed 28,400 contracts.

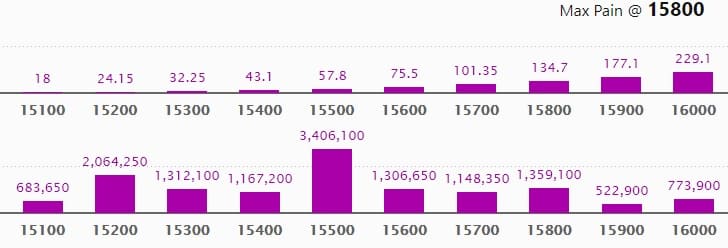

Put Option Data

Maximum Put open interest of 34.06 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the July series.

This is followed by 15,200 strike, which holds 20.64 lakh contracts, and 15,800 strike, which has accumulated 13.59 lakh contracts.

Put writing was seen at 15,200 strike, which added 2.21 lakh contracts, followed by 15,800 strike which added 1.6 lakh contracts, and 16,300 strike which added 1.47 lakh contracts.

Put unwinding was seen at 15,500 strike, which shed 79,400 contracts, followed by 15,400 strike which shed 72,750 contracts.

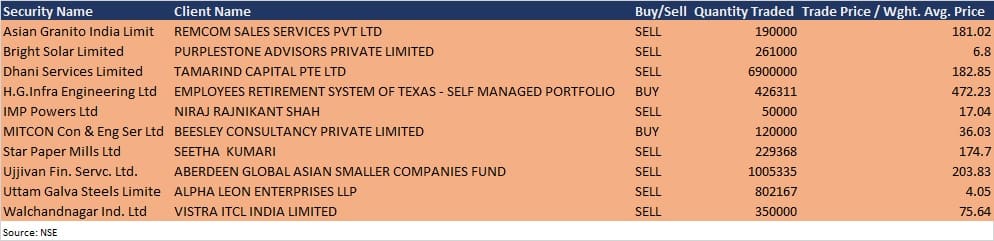

Bulk Deals

Dhani Services: Tamarind Capital Pte Ltd sold 69 lakh equity shares in the company at Rs 182.85 per share on the NSE, the bulk deals data showed.

HG Infra Engineering: Employees Retirement System of Texas – Self Managed Portfolio bought 4,26,311 equity shares in the company at Rs 472.23 per share on the NSE, the bulk deals data showed.

Ujjivan Financial Services: Aberdeen Global Asian Smaller Companies Fund sold 10,05,335 equity shares in the company at Rs 203.83 per share on the NSE, the bulk deals data showed.

Results On July 8

Tata Consultancy Services, Gammon Infrastructure Projects, and Shyam Metalics and Energy will release quarterly earnings on July 8.

Analysts/Investors Meeting

Jindal Stainless: The company management to meet investors on July 8.

Somany Home Innovation: The company executives to meet MK Ventures, and Dimensional Securities on July 8.

Dishman Carbogen Amcis: Officials to meet Motilal Oswal Financial Services on July 8.

Paisalo Digital: To meet Dalal and BroachaStock Broking on July 8.

Endurance Technologies: To meet ICICI Prudential MF on July 8.

Tata Steel: To meet fund houses, broking houses at Citi: APAC Materials Day 2021, on July 8

Graphite India: To meet DSP Mutual Fund on July 8.

Stocks In The News

Angel Broking: ICICI Prudential Asset Management Company sold 0.09 percent equity stake in the company via open market sale on July 5, reducing shareholding to 3.03 percent from 3.11 percent earlier.

Hindustan Oil Exploration: HDFC sold 2.46 percent equity stake in the company, reducing shareholding to 8.75 percent from 11.21 percent earlier.

Zuari Global: The company has acquired 13.19 percent shares of Forte Furniture Products India from Indian Furniture Products (IFPL) subsidiary of the company.

Bajaj Healthcare: The company received license from Defence Research and Development Organisation (DRDO) to manufacture and market ‘2-Deoxy-D-Glucose’ (2-DG), used in control and treatment of COVID-19.

RailTel Corporation of India: The company has received a work order amounting to Rs 23.43 crore (excluding GST) from Sagar Cable Network towards providing multicast drop and carry with 1.5G capacity at 66 locations for a period of 5 years.

Garware Hi-Tech Films: CARE has upgraded its rating and outlook regarding the bank facilities of the company, to A+/Stable, from A/Positive.

FII And DII Data

Foreign institutional investors (FIIs) net bought shares worth Rs 532.94 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 231.80 crore in the Indian equity market on July 7, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Five stocks – Indiabulls Housing Finance, NALCO, NMDC, Punjab National Bank, and SAIL – are under the F&O ban for July 8. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.