The market increased its earnings for a new record but failed to hold on to those profits due to pressure trading and interest bookings for very early deals, and closed on September 1. IT, Metals and Pharma shares pulling the market down.

BSE Sensex dropped 214.18 points to 57,338.21, while Nifty50 dropped 55.90 points to 17,076.30 and formed a bearish candlestick on daily charts as the closing was lower than opening levels.

“The daily price action forms a very large bearish candlestick. However, it continues to build a High High Low compared to the previous session. -16,950, “said Rajesh Palviya, VP – Research and Derivative Research at Axis Securities.

However, looking up, he said: “The highest levels to be observed are 17,150 levels. Any sustainable movement above 17,150 levels could create momentum at 17,200-17,300 levels.”

But broader markets have achieved benchmarks, with the Nifty Midcap 100 index gaining 0.75 percent, while the Smallcap 100 index rising 0.34 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,012.27, followed by 16,948.33. If the index moves up, the key resistance levels to watch out for are 17,182.97 and 17,289.73.

Nifty Bank

The Nifty Bank climbed 149.70 points to close at 36,574.30, outperforming benchmark indices on September 1. The important pivot level, which will act as crucial support for the index, is placed at 36,375.03, followed by 36,175.77. On the upside, key resistance levels are placed at 36,885.63 and 37,196.96 levels.

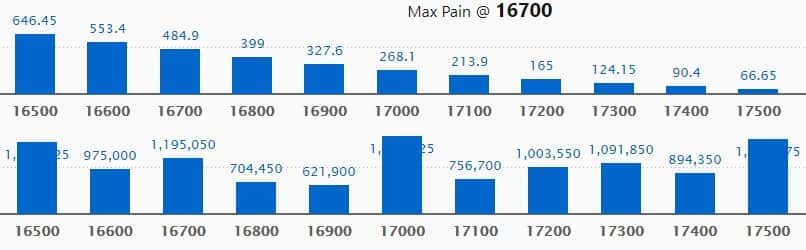

Call Option Data

Maximum Call open interest of 16.57 lakh contracts was seen at 17000 strike. This is followed by 17500 strike, which holds 16.03 lakh contracts, and 16,500 strike, which has accumulated 15.39 lakh contracts.

Call writing was seen at 17,500 strike, which added 2.97 lakh contracts, followed by 17,200 strike, which added 1.57 lakh contracts and 17,700 strike which added 94,650 contracts.

Call unwinding was seen at 17,000 strike, which shed 1.56 lakh contracts, followed by 16,700 strike, which shed 1.27 lakh contracts, and 16,600 strike which shed 1.26 lakh contracts.

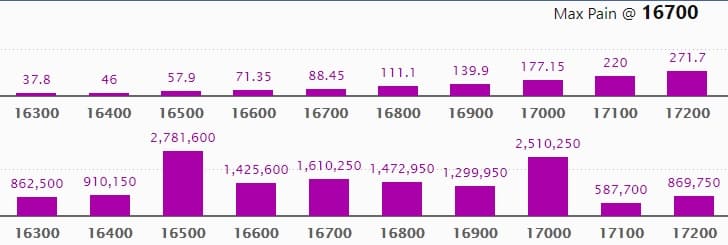

Put Option Data

Maximum Put open interest of 27.81 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the September series.

This is followed by 17,000 strike, which holds 25.10 lakh contracts, and 16,700 strike, which has accumulated 16.10 lakh contracts.

Put writing was seen at 17,000 strike, which added 3.23 lakh contracts, followed by 16,900 strike which added 2.49 lakh contracts, and 17,100 strike which added 2.31 lakh contracts.

Put unwinding was seen at 16,400 strike, which shed 4.36 lakh contracts, followed by 16,300 strike which shed 3.11 lakh contracts, and 16,500 strike which shed 2 lakh contracts.

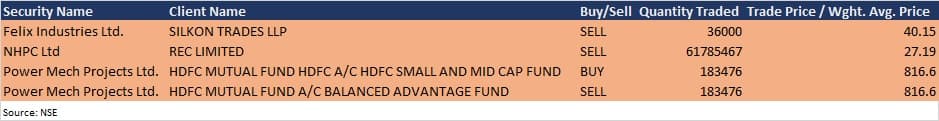

Bulk Deals

NHPC: State-owned REC sold 6,17,85,467 equity shares in the company at Rs 27.19 per share on the NSE.

Analysts/Investors Meeting

Affle India: The company’s officials will meet Asian Markets Securities (AMSEC) on September 2, Prudential Global (India) on September 3, Spark Capital Advisors on September 6, and Polen Capital on September 7.

Max Ventures and Industries: The company’s officials will meet investors and analysts on September 2.

Stocks In The News

Eicher Motors: Royal Enfield sales volume declined 9 percent to 50,144 motorcycles in August 2021, against 45,860 motorcycles in August 2020.

Peninsula Land: Dinesh Jain has resigned as Chief Financial Officer of the company.

Mahindra CIE Automotive: ACACIA II Partners LP & Others sold 67,85,291 equity shares in the company via an open market transaction on August 30, reducing shareholding to 4.07 percent from 5.86 percent earlier.

Aashka Hospitals: The company and Vaidehi — Backbone Hospital, Rajkot have agreed to a non-binding Memorandum of Understanding for a tie-up between the two hospitals whereby the management and operations of Vaidehi-Backbone will be integrated with Aashka Hospitals in a phased manner.

Kernex Microsystems (India): Virender Singh & Others acquired over 8.88 lakh equity shares in the company via open market transactions, increasing shareholding to 9.95 percent from 7.11 percent earlier.

Minda Corporation: Subsidiary Spark Minda Green Mobility Systems has signed Shares Subscription and Shareholders Agreement with EVQPOINT Solutions and its promoters and other ancillary agreements with EVQPOINT including Technology Licence Agreement (TLA).

FII And DII Data

Foreign institutional investors (FIIs) net bought shares worth Rs 666.66 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 1,287.87 crore in the Indian equity market on September 1, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Not a single stock is under the F&O ban for September 2. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.