The market erased all its gains at the last trading hour, amplifying the decline of the fourth consecutive session on June 30. All sector indicators, blocking IT, are closed at the bottom.

BSE Sensex dropped 66.95 points to 52,482.71, while Nifty50 declined 27 points to 15,721.50 and formed a bearish candle that resembled the Inverted Hammer pattern on daily charts.

“The daily price action creates a bearish candlestick that makes the High-Low low compared to the previous session which is still a bad sign. Worse, any violation of the support base within 15 700 levels could result in a profit booking at 15,650-15,600 levels,” he said. Rajesh Palviya, VP – Research and Derivative Research at Axis Securities.

However, “the next high levels to be observed are 15,800 levels. Any sustainable movement above 15,800 levels can create momentum up to 15,900-16,000 levels,” he said.

Wide markets, however, surpassed the forefront as the Nifty Midcap 100 index rose 0.26 percent and the Smallcap 100 index gained 0.22 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,673.83, followed by 15,626.17. If the index moves up, the key resistance levels to watch out for are 15,804.13 and 15,886.77.

Nifty Bank

The Nifty Bank slipped 238.10 points to close at 34,772.20 on June 30. The important pivot level, which will act as crucial support for the index, is placed at 34,596.77, followed by 34,421.33. On the upside, key resistance levels are placed at 35,081.27 and 35,390.33 levels.

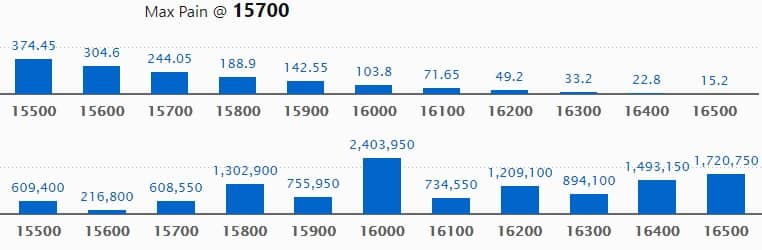

Call Option Data

Maximum Call open interest of 24.03 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the July series.

This is followed by 16500 strike, which holds 17.20 lakh contracts, and 16400 strike, which has accumulated 14.93 lakh contracts.

Call writing was seen at 16000 strike, which added 1 lakh contracts, followed by 15700 strike which added 81,500 contracts, and 16200 strike which added 14,850 contracts.

Call unwinding was seen at 16500 strike, which shed 78,300 contracts, followed by 16100 strike which shed 63,550 contracts.

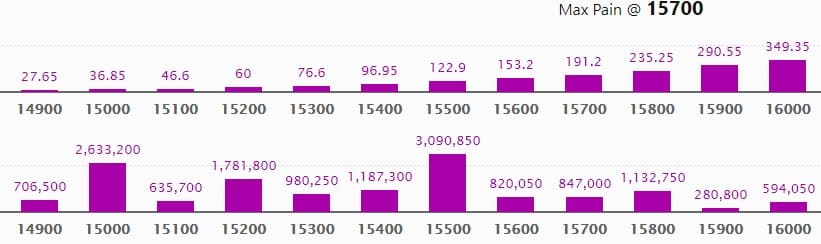

Put Option Data

Maximum Put open interest of 30.9 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the July series.

This is followed by 15000 strike, which holds 26.33 lakh contracts, and 15200 strike, which has accumulated 17.81 lakh contracts.

Put writing was seen at 15500 strike, which added 2.2 lakh contracts, followed by 15400 strike which added 62,000 contracts, and 16,300 strike which added 55,800 contracts.

Put unwinding was seen at 15600 strike, which shed 74,700 contracts, followed by 16000 strike which shed 45,600 contracts and 15800 strike which shed 31,150 contracts.

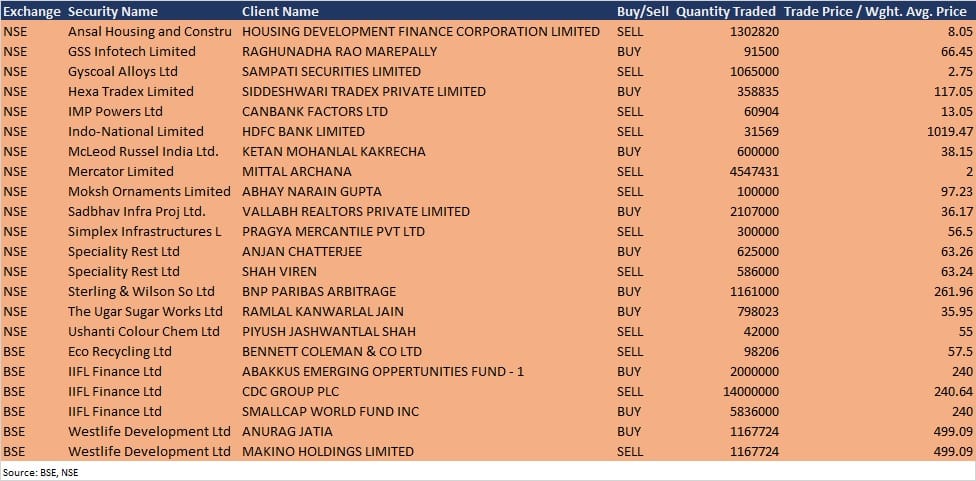

Bulk Deals

Ansal Housing and Construction: HDFC sold 13,02,820 equity shares in the company at Rs 8.05 per share on the NSE, the bulk deals data showed.

Speciality Restaurants: Promoter Anjan Chatterjee acquired 6.25 lakh equity shares in the company at Rs 63.26 per share. However, Shah Viren sold 5.86 lakh equity shares in the company at Rs 63.24 per share on the NSE, the bulk deals data showed.

Sterling & Wilson Solar: BNP Paribas Arbitrage bought 11.61 lakh equity shares in the company at Rs 261.96 per share on the NSE, the bulk deals data showed.

IIFL Finance: Abakkus Emerging Opportunities Fund – 1 purchased 20 lakh equity shares and Smallcap World Fund Inc acquired 58.36 lakh equity shares in the company at Rs 240 per share each. However, CDC Group Plc sold 1.4 crore equity shares in the company at Rs 240.64 per share on the BSE, the bulk deals data showed.

Analysts/Investors Meeting

Eicher Motors: The company’s officials will meet SBI Life Insurance Company on July 1, Invesco Asset Management (India) on July 2, and Sylebra Capital on July 5.

Sobha: The company’s officials will meet CLSA India on July 2, and Fidelity International – India Business and Research Services on July 5.

Coromandel International: The company’s officials will meet investors in a panel discussion, organised by India Alpha Capital, IndiaSpend and DSP Investment Managers, on July 1.

Vodafone Idea: The company’s officials will meet analysts/investors on July 2.

Affordable Robotic & Automation: The company’s officials will meet analysts and investors on July 3.

TCS: The company’s officials will meet analysts/investors on July 8.

Stocks In The News

Agro Tech Foods: The company purchased land in Kothur (Telangana), which is adjacent to its existing plant and amounts to approximately 25 percent of the current land area of the existing plant. The land will be utilised for continued expansions of the company’s manufacturing operations.

Dish TV India: The company reported consolidated loss at Rs 1,415.23 crore in Q4FY21 against a loss of Rs 1,456.25 crore in Q4FY20, revenue fell to Rs 751.75 crore from Rs 869.06 crore YoY.

Fiem Industries: The company reported higher consolidated profit at Rs 28.02 crore in Q4FY21 against Rs 22.33 crore in Q4FY20, revenue jumped to Rs 421.16 crore from Rs 322.24 crore YoY.

Best Agrolife: The company recorded higher standalone profit at Rs 25.26 crore in Q4FY21 against Rs 15.2 crore in Q4FY20, revenue rose to Rs 208.12 crore from Rs 178.28 crore YoY.

Liberty Shoes: The company reported higher profit at Rs 6.97 crore in Q4FY21 against Rs 1.17 crore in Q4FY20, revenue fell to Rs 162.42 crore from Rs 199.84 crore YoY.

Jain Irrigation Systems: The company reported consolidated profit at Rs 49.09 crore in Q4FY21 against loss of Rs 324.16 crore in Q4FY20, revenue increased to Rs 1,793.8 crore from Rs 1,505.39 crore YoY.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,646.66 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,520.18 crore in the Indian equity market on June 30, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

One stock – NALCO – is under the F&O ban for July 1. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.