The market started off the week on a positive note as the benchmark indices and broader markets traded higher throughout the session before closing in green on July 5. Banking and financials, metals, select auto and FMCG stocks supported the market.

The BSE Sensex climbed 395.33 points to 52,880, while the Nifty50 rose 112.20 points to 15,834.40 and formed a bullish candle on the daily charts.

“The daily price action has formed a sizable bullish candle forming higher High-Low compared to the previous session and closed above the same indicating strength ahead. The next higher level to be watched is around 15,900. Any sustainable move above 15,900 levels may cause momentum towards 16,000-16,100 levels,” Rajesh Palviya, VP – Technical and Derivative Research at Axis Securities.

On the downside, any violation of an intraday support zone of 15,800 levels may cause profit booking towards 15,750-15,700 levels, he said.

The Nifty Midcap 100 and Smallcap 100 indices gained 0.53 percent and 0.79 percent respectively.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,782.2, followed by 15,730.1. If the index moves up, the key resistance levels to watch out for are 15,866.2 and 15,898.1.

Nifty Bank

The Nifty Bank jumped 402.10 points or 1.16 percent to 35,212 on July 5. The important pivot level, which will act as crucial support for the index, is placed at 35,014.17, followed by 34,816.33. On the upside, key resistance levels are placed at 35,322.07 and 35,432.14 levels.

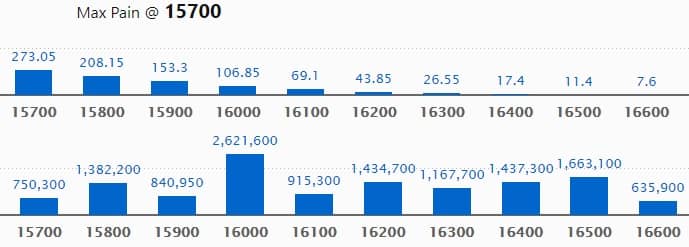

Call Option Data

Maximum Call open interest of 26.21 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the July series.

This is followed by 16500 strike, which holds 16.63 lakh contracts, and 16400 strike, which has accumulated 14.37 lakh contracts.

Call writing was seen at 16200 strike, which added 1.58 lakh contracts, followed by 16500 strike which added 1.11 lakh contracts, and 16300 strike which added 71,400 contracts.

Call unwinding was seen at 15700 strike, which shed 1.56 lakh contracts, followed by 15800 strike which shed 71,000 contracts.

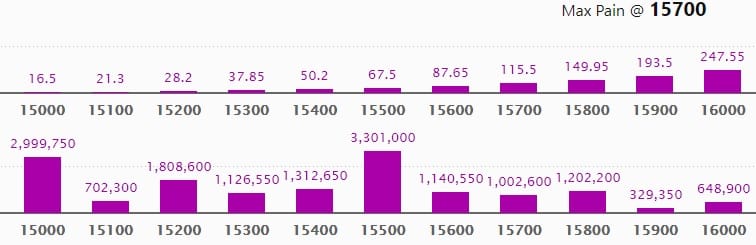

Put Option Data

Maximum Put open interest of 33.01 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the July series.

This is followed by 15000 strike, which holds 29.99 lakh contracts, and 15200 strike, which has accumulated 18.08 lakh contracts.

Put writing was seen at 15600 strike, which added 2.71 lakh contracts, followed by 15800 strike which added 1.95 lakh contracts, and 15,900 strike which added 99,550 contracts.

Put unwinding was seen at 15000 strike, which shed 21,600 contracts, followed by 15500 strike which shed 4,600 contracts and 16500 strike which shed 4,150 contracts.

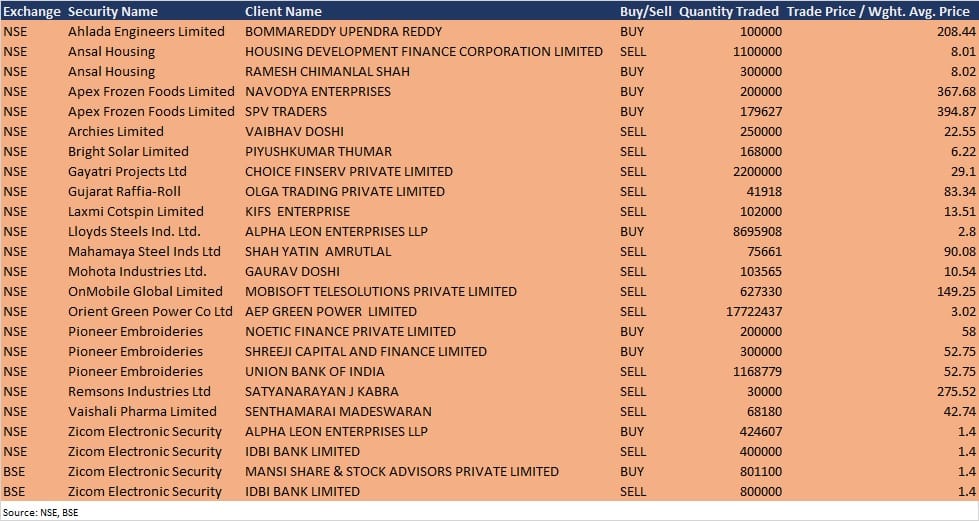

Bulk Deals

Analysts/Investors Meeting

Lumax Auto Technologies: The company officials to meet investors and analysts on July 6.

Deepak Fertilisers & Petrochemicals Corporation: The company officials to meet Mirae Asset Capital Markets (India) on July 6.

Surya Roshni: The company management to meet institutional investors and analysts on July 6.

Affle India: The officials to meet Malabar Investments on July 6, Franklin Templeton and Janchor Partners on July 7.

Yash Pakka: To meet analysts and investors on July 7.

L&T Finance Holdings: The company executives to meet institutional investors and analysts on July 19.

Stocks In The News

Maruti Suzuki India: The company produced 1,65,576 units in June 2021, against 50,742 units of production in June 2020. Production in June 2020 was far from normal owing to Covid-19 related lockdowns and disruptions.

Themis Medicare: CARE has upgraded long term credit rating on the company’s bank facilities to B+/Stable, from B/Stable.

SH Kelkar and Company: On a consolidated basis, the company’s sales in Q1FY22 stood at around Rs 355 crore, and on the balance sheet front, its net debt position stood at around Rs 386 crore as of June 2021 compared to Rs 380 crore as of March 2021.

NMDC: The Government of India, the promoter, proposed to sell up to 11,72,24,234 equity shares in NMDC (representing 4 percent of the total paid-up equity), with an option to additionally sell 10,22,78,144 equity shares (3.49%) in case of oversubscription, via offer for sale, on July 6-7.

IOL Chemicals & Pharmaceuticals: CARE has upgraded the credit rating by one notch for the banking facilities availed by the company, to A+/Stable, from A/Stable.

Force Motors: The company announced production of 1,757 units of commercial vehicles, utility vehicles and tractors in June 2021, and sales of 1,925 units in June 2021.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 338.43 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 645.59 crore in the Indian equity market on July 5, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Three stocks – Indiabulls Housing Finance, NALCO and Punjab National Bank – are under the F&O ban for July 6. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.