The market witnessed a good recovery in the last hour of trade and settled the volatile session on a positive note on July 2 led by select banking & financials, technology stocks.

BSE Sensex gained 166.07 points to close at 52,484.67, while the Nifty50 rose 42.20 points to 15,722.20. Nifty formed Hammer pattern on the daily charts and a Bearish Belt Hold pattern on the weekly scale, with a 0.9 percent decline.

“A small body of positive candle was formed on the daily chart with long lower shadow. Technically, this pattern signals a formation of a bullish Hammer candle pattern at the lows (not a classical Hammer). This is a positive indication and could be considered as a bullish reversal after the confirmation,” Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

According to Shetti, bulls have managed to defend support levels and have gradually pushed the said level upwards from 15,450 to now 15,650. This shows that another rally to 15,900 levels could be in the offing.

“Confirmation of bullish reversal by the way of follow-through upmove is likely to open further upside towards 15,900 levels again in the near term. Immediate support is placed at 15,650 levels,” he said.

The broader markets outperformed frontliners as the Nifty Midcap 100 index gained half a percent and Smallcap 100 rallied 1 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,659.37, followed by 15,596.53. If the index moves up, the key resistance levels to watch out for are 15,761.67 and 15,801.13.

Nifty Bank

The Nifty Bank rose 125.90 points to 34,809.90 on July 2. The important pivot level, which will act as crucial support for the index, is placed at 34,663.53, followed by 34,517.17. On the upside, key resistance levels are placed at 34,925.33 and 35,040.76 levels.

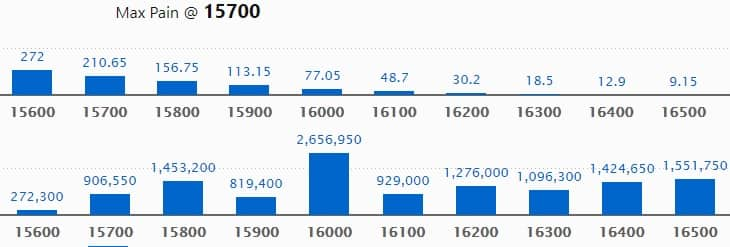

Call Option Data

Maximum Call open interest of 26.56 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the July series.

This is followed by 16500 strike, which holds 15.51 lakh contracts, and 15800 strike, which has accumulated 14.53 lakh contracts.

Call writing was seen at 16100 strike, which added 1.62 lakh contracts, followed by 16200 strike which added 1.29 lakh contracts, and 15700 strike which added 95,950 contracts.

Call unwinding was seen at 16500 strike, which shed 96,550 contracts, followed by 15900 strike which shed 73,450 contracts.

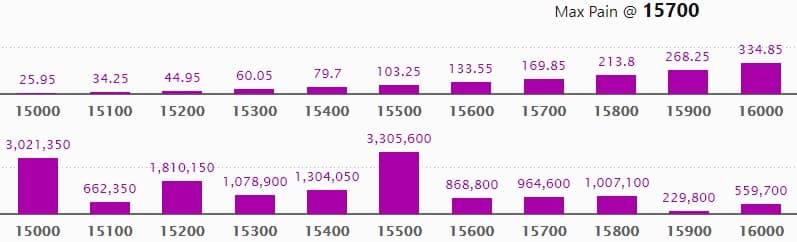

Put Option Data

Maximum Put open interest of 33.05 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the July series.

This is followed by 15000 strike, which holds 30.21 lakh contracts, and 15200 strike, which has accumulated 18.10 lakh contracts.

Put writing was seen at 15000 strike, which added 2.52 lakh contracts, followed by 15500 strike which added 1.54 lakh contracts, and 15,400 strike which added 1.26 lakh contracts.

Put unwinding was seen at 15800 strike, which shed 76,350 contracts, followed by 15900 strike which shed 30,250 contracts and 15100 strike which shed 17,400 contracts.

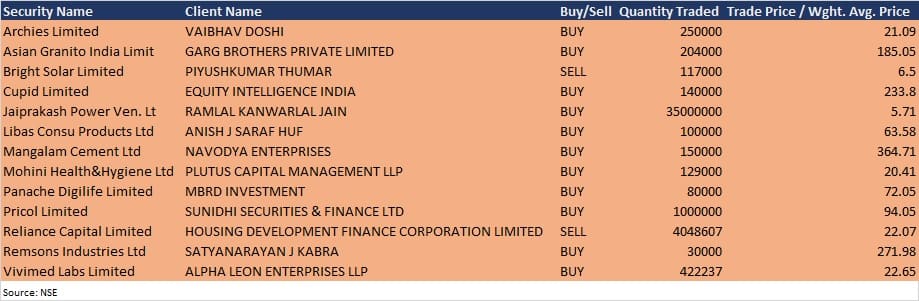

Bulk Deals

Cupid: Equity Intelligence India bought 1,40,000 equity shares of Cupid at Rs 233.8 per share on the NSE, the bulk deals data showed.

Mangalam Cement: Navodya Enterprises bought 1.5 lakh equity shares of the company at Rs 364.71 per share on the NSE, the bulk deals data showed.

Mohini Health & Hygiene: Plutus Capital Management LLP acquired 1.29 lakh equity shares of the company at Rs 20.41 per share on the NSE, the bulk deals data showed.

Pricol: Sunidhi Securities & Finance acquired 10 lakh equity shares of the company at Rs 94.05 per share on the NSE, the bulk deals data showed.

Vivimed Labs: Alpha Leon Enterprises LLP bought 4,22,237 equity shares of the company at Rs 22.65 per share on the NSE, the bulk deals data showed.

Analysts/Investors Meeting

Allcargo Logistics: To meet BOB Capital Markets on July 5.

Graphite India: To meet Kotak Mutual Fund on July 5.

Avenue Supermarts: To meet analysts/investors on July 22.

JSW Steel: To meet analysts/investors in a Citi -APAC Materials Day 2021 on July 6 and July 7.

Stocks In The News

India Pesticides: India Pesticides will list its equity shares on the bourses on July 5. The final price has been fixed at Rs 296 per share.

Indian Hume Pipe Company: The company has received the Letter of Acceptance for the work of about Rs 257.60 crore from Madurai City Municipal Corporation

Aarey Drugs & Pharmaceuticals: The company reported a profit of Rs 1.4 crore in Q4 FY21 against Rs 0.99 crore in Q4 FY20, revenue rose to Rs 178.25 crore from Rs 110.68 crore YoY.

Udaipur Cement Works: CARE has upgraded the company’s credit rating for its various long term borrowings by one notch to ‘AA’ (Credit Enhancement-CE)/Stable; from ‘AA-‘ (CE)/Stable, which is based on credit enhancement on the back of the corporate guarantee provided by the holding company, JK Lakshmi Cement for its borrowings.

Avenue Supermarts: Its standalone revenue from operations stood at Rs 5,031.75 crore in Q1 FY22, increasing from Rs 3,833.23 crore in the corresponding quarter of last fiscal. The total number of stores as of June 30, 2021 stood at 238.

CSB Bank: Total provisional deposits in June quarter 2021 at Rs 18,652.80 crore increased by 14.17% YoY, and gross advances grew by 23.71% to Rs 14,146 crore including advances against gold & gold jewellery that increased 46.16% to Rs 5,617.68 crore YoY.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 982.8 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 930.39 crore in the Indian equity market on July 2, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Two stocks – NALCO and Punjab National Bank – are under the F&O ban for July 5. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.