The market snapped three-day losing streak and closed the rangebound session on a positive note on July 29, the expiry day for July futures & options contracts, backed by select banking & financials.

The BSE Sensex climbed 209.36 points to close at 52,653.07, while the Nifty50 rose 69.10 points to 15,778.50 and formed a small bullish candle on the daily charts as the closing was higher than opening levels.

“The daily price action has formed a small bullish candle with a higher High-Low compared to previous session which remains a positive sign. However the medium term trend remains sideways within 15,900-15,500 levels,” said Rajesh Palviya, VP – Technical and Derivative Research at Axis Securities.

He feels the next higher level to be watched is around 15,830. “Any sustainable move above 15,830 levels may cause momentum towards 15,900-15,950 levels. On the downside, any violation of an intraday support zone of 15,750 levels may cause profit booking towards 15,650-15,550 levels,” he said.

The broader markets outpaced benchmark indices as the Nifty Midcap 100 index was up 0.72 percent and Smallcap 100 index rose 0.91 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,738.43, followed by 15,698.37. If the index moves up, the key resistance levels to watch out for are 15,817.93 and 15,857.37.

Nifty Bank

The Nifty Bank rose 158.60 points to 34,691.50 on July 29. The important pivot level, which will act as crucial support for the index, is placed at 34,531.77, followed by 34,372.03. On the upside, key resistance levels are placed at 34,814.67 and 34,937.84 levels.

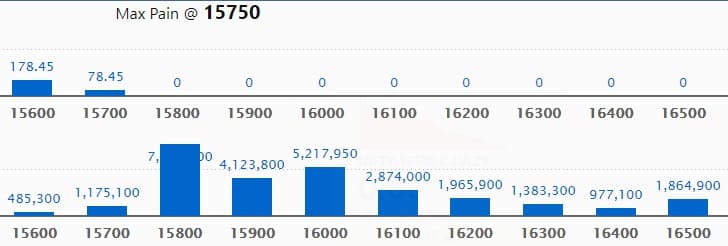

Call Option Data

Maximum Call open interest of 76.90 lakh contracts was seen at 15,800 strike, which will act as a crucial resistance level in the August series.

This is followed by 16,000 strike, which holds 52.17 lakh contracts, and 15,900 strike, which has accumulated 41.23 lakh contracts.

Call writing was seen at 15,800 strike, which added 11.27 lakh contracts.

Call unwinding was seen at 15,700 strike, which shed 31.15 lakh contracts, followed by 15,900 strike which shed 16.12 lakh contracts, and 16,000 strike which shed 11.64 lakh contracts.

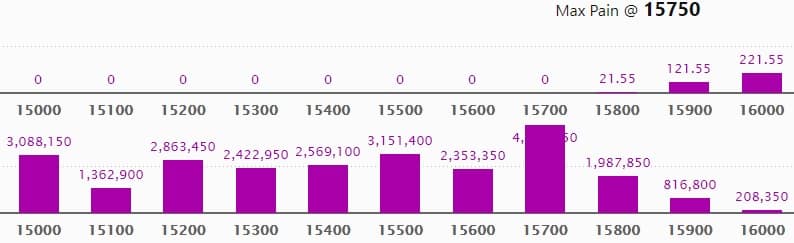

Put Option Data

Maximum Put open interest of 46.65 lakh contracts was seen at 15,700 strike, which will act as a crucial support level in the August series.

This is followed by 15,500 strike, which holds 31.51 lakh contracts, and 15,000 strike, which has accumulated 30.88 lakh contracts.

Put writing was seen at 15,700 strike, which added 11.39 lakh contracts, followed by 15,800 strike which added 4.25 lakh contracts, and 15300 strike which added 4.04 lakh contracts.

Put unwinding was seen at 15,500 strike, which shed 18.38 lakh contracts, followed by 15,600 strike which shed 15.17 lakh contracts, and 15,000 strike which shed 4.03 lakh contracts.

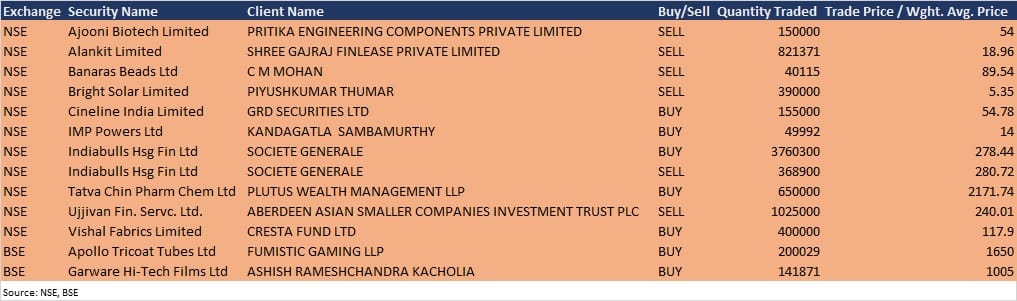

Bulk Deals

Apollo Tricoat Tubes: Fumistic Gaming LLP acquired additional 2,00,029 equity shares in the company at Rs 1,650 per share on the BSE, the bulk deal data showed.

Garware Hi-Tech Films: Ashish Rameshchandra Kacholia increased stake in the company, buying additional 1,41,871 equity shares at Rs 1,005 per share on the BSE, the bulk deal data showed.

Tatva Chintan Pharma Chem: Plutus Wealth Management LLP bought 6.5 lakh equity shares in the company at Rs 2,171.74 per share on the NSE, the bulk deal data showed.

Ujjivan Financial Services: Aberdeen Asian Smaller Companies Investment Trust Plc sold 10.25 lakh equity shares in the company at Rs 240.01 per share on the NSE, the bulk deal data showed.

Indiabulls Housing Finance: Societe Generale bought 33,91,400 equity shares in the company at Rs 278.44 per share on the NSE, the bulk deal data showed.

Vishal Fabrics: Cresta Fund acquired 4 lakh equity shares in the company at Rs 117.9 per share on the NSE, the bulk deal data showed.

Results On July 30

Britannia Industries, Sun Pharmaceutical Industries, UPL, Bandhan Bank, Indian Oil Corporation, Aditya Birla Fashion and Retail, Allied Digital Services, Asahi India Glass, Bharat Heavy Electricals, Birla Tyres, Blue Dart Express, Chemfab Alkalis, Cholamandalam Investment and Finance Company, LT Foods, Dalmia Bharat Sugar, Equitas Small Finance Bank, Exide Industries, Fairchem Organics, Finolex Industries, Gravita India, HIL, Hindustan Organic Chemicals, Jindal Saw, JK Paper, JSW Energy, Kansai Nerolac Paints, KEC International, Dr Lal PathLabs, Macrotech Developers, Marico, Nazara Technologies, PI Industries, Rossari Biotech, Shriram Transport Finance, Sundaram-Clayton, Sunteck Realty, V-Guard Industries, and Zydus Wellness will release their quarterly earnings on July 30.

Results On July 31

NTPC, IDFC First Bank, Action Construction Equipment, Bliss GVS Pharma, D-Link (India), KEI Industries, Relaxo Footwears, Reliance Home Finance, Sarda Energy & Minerals, Sobha, Surya Roshni, Titagarh Wagons, Unichem Laboratories, and Vinati Organics will release their quarterly earnings on July 31.

Analysts/Investors Meeting

Premier Explosives: The company’s officials will meet analysts and investors on July 30 to discuss the Q1FY22 financial results.

LT Foods: The company’s officials will meet analysts and investors on July 30 to discuss the financial performance.

Surya Roshni: The company’s officials will meet analysts and investors on August 2 to discuss the Q1FY22 financial results.

MCX India: The company’s officials will meet ITUS Capital on August 2, GIC Pvt Ltd on August 4, and Ward Ferry Management on August 9.

Crompton Greaves Consumer Electricals: The company’s officials will meet Capital International on August 2, ENAM AMC on August 6, and AGF Investments on August 10.

Indian Oil Corporation: The company’s officials will meet analysts and investors on August 2 to discuss the financial performance.

Varun Beverages: The company’s officials will meet investors and analysts on August 2.

V-Guard Industries: The company’s officials will meet analysts and institutional investors on August 2.

Sarda Energy & Minerals: The company’s officials will meet analysts, institutional investors, and Fund House etc, on August 3 to discuss business strategy and outlook post Q1FY22 results.

Balaji Amines: The company’s officials will meet analysts and investors on August 4 to discuss the Q1FY22 results.

Adani Green Energy: The company’s officials will meet equity investors and analysts on August 5 discuss the financial performance.

Stocks In The News

Tech Mahindra: The company reported a sharp increase in profit at Rs 1,353.2 crore in Q1FY22 against Rs 1,081.4 crore in Q4FY21, revenue rose to Rs 10,197.6 crore from Rs 9,729.9 crore QoQ.

Container Corporation of India: The company reported profit at Rs 258.4 crore for Q1FY22 against Rs 58.3 crore in Q1FY21, revenue jumped to Rs 1,819.9 crore from Rs 1,194.2 crore YoY.

Raymond: The company reported consolidated loss at Rs 157.1 crore in Q1FY22 against loss of Rs 247.6 crore in Q1FY21, revenue shot up to Rs 825.7 crore from Rs 163.2 crore YoY.

JK Lakshmi Cement: The company reported higher standalone net profit at Rs 118.7 crore in Q1FY22 against Rs 44.4 crore in Q1FY21, revenue surged to Rs 1,231.5 crore from Rs 825 crore YoY.

TVS Motor Company: The company reported profit of Rs 53.1 crore in Q1FY22 against loss of Rs 139.1 crore in Q1FY21, revenue jumped to Rs 3,934.4 crore from Rs 1,431.7 crore YoY.

Ajanta Pharma: The company reported higher profit at Rs 173.7 crore in Q1FY22 against Rs 147.8 crore in Q1FY21, revenue rose to Rs 748 crore from Rs 668.2 crore YoY.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 866.26 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 2,046.96 crore in the Indian equity market on July 29, as per provisional data available on the NSE.