The market widens the losses for the second consecutive session and closed with moderate losses on July 9, invested by the bank and finance, car shares and IT.

BSE Sensex dropped 182.75 points to 52,386.19, while Nifty50 declined 38.10 points to 15,689.80 and formed a Doji pattern pattern on the daily charts. The index fell 0.2 percent during the week, confirming the formation of bearish candles on the weekly scale.

“The daily price action creates a ‘Doji’ candle pattern that makes High-Low lower than the previous session showing weakness. Worse, any violation of the internal support area of 15,650 levels could result in a profit booking at 15,600-15,550 levels,” Rajesh said. Palviya, VP – Research and Derivative Research for Axis Securities.

He added, “The next high levels to be considered are 15,730 levels. Any sustainable movement above 15,730 levels could create momentum at 15,800-15,900 levels.”

Wide markets improved their previous indicators as the Nifty Midcap 100 index gained 0.62 percent while the Smallcap 100 index rose 0.54 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,638.13, followed by 15,586.47. If the index moves up, the key resistance levels to watch out for are 15,736.13 and 15,782.47.

Nifty Bank

The Nifty Bank slipped 202.15 points to 35,071.95 on July 9. The important pivot level, which will act as crucial support for the index, is placed at 34,879.46, followed by 34,687.03. On the upside, key resistance levels are placed at 35,244.77 and 35,417.63 levels.

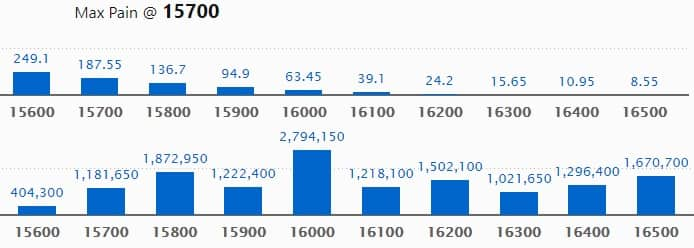

Call Option Data

Maximum Call open interest of 27.94 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the July series.

This is followed by 15800 strike, which holds 18.72 lakh contracts, and 16500 strike, which has accumulated 16.70 lakh contracts.

Call writing was seen at 15700 strike, which added 2.41 lakh contracts, followed by 16100 strike which added 2.28 lakh contracts, and 16000 strike which added 1.62 lakh contracts.

Call unwinding was seen at 16300 strike, which shed 1.17 lakh contracts, followed by 16400 strike which shed 93,150 contracts.

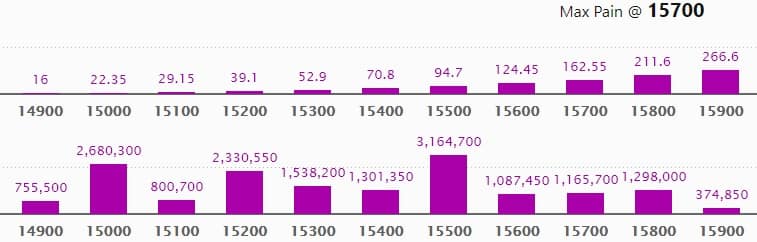

Put Option Data

Maximum Put open interest of 31.64 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the July series.

This is followed by 15000 strike, which holds 26.80 lakh contracts, and 15200 strike, which has accumulated 23.30 lakh contracts.

Put writing was seen at 15200 strike, which added 1.36 lakh contracts, followed by 15300 strike which added 73,400 contracts, and 14900 strike which added 44,700 contracts.

Put unwinding was seen at 15800 strike, which shed 2.81 lakh contracts, followed by 15000 strike which shed 2.58 lakh contracts.

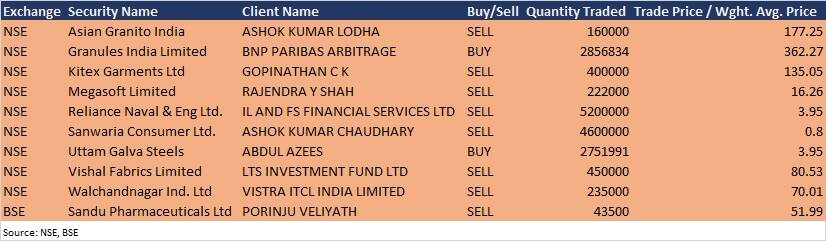

Bulk Deals

Granules India: BNP Paribas Arbitrage acquired 28,56,834 equity shares in Granules at Rs 362.27 per share on the NSE, the bulk deals data showed.

Vishal Fabrics: LTS Investment Fund sold 4.5 lakh equity shares in the company at Rs 80.53 per share on the NSE, the bulk deals data showed.

Sandu Pharmaceuticals: Porinju Veliyath sold 43,500 equity shares in the company at Rs 51.99 per share on the NSE, the bulk deals data showed.

Results On July 12

Results on July 12: HFCL, HMT, Steel Strips Wheels, Amit Securities, Dr Lalchandani Labs, Indbank Merchant Banking Services, Ind Bank Housing, ISMT, SM Gold, and Welcure Drugs & Pharmaceuticals will release quarterly earnings on July 12.

Analysts/Investors Meeting

Max Ventures and Industries: The company’s officials will meet investors and analysts on July 12.

Gati: The company’s officials will meet Sharekhan on July 12.

Housing & Urban Development Corporation: The company’s officials will meet institutional investors on July 12.

Indian Railway Catering and Tourism Corporation: The company’s officials will meet HSBC Global Asset Management (UK), Neuberger Berman Group LLC, Nippon Life lnsurance Company, SRS Investment Management, HDFC MF, Nippon, HDFC Life, Birla Sunlife MF, Mirae MF, UTI MF, Tata MF, and SBI Life on July 12.

Neogen Chemicals: The company’s officials will meet Mission Holdings on July 12 and Aditya Birla Sun Life AMC on July 13.

Finolex Cables: The company’s officials will meet Fidelity Investments on July 13.

Coromandel International: The company’s officials will meet analysts and investors in a conference call, hosted by Nirmal Bang Securities on July 27.

Stocks In The News

Bhansali Engineering Polymers: The company reported consolidated profit at Rs 77.38 crore in Q1FY22 against loss of Rs 1.38 crore in Q1FY21, revenue jumped to Rs 231.91 crore from Rs 99.39 crore YoY.

Avenue Supermarts: The company reported sharply higher standalone profit at Rs 115.13 crore in Q1FY22 against Rs 49.56 crore in Q1FY21, revenue jumped to Rs 5,031.75 crore from Rs 3,833.23 crore YoY.

Compucom Software: The company has won a tender and received a Letter of Acceptance for IT enablement of PESA/FRA Acts with other schemes for Tribal Area Development (TAD) Department, Government of Rajasthan and operations & maintenance services for a period of six months from RISL worth Rs 58.40 lakh inclusive all incident charges and taxes and excluding GST.

Unichem Laboratories: The company has received tentative approval for ANDA of Sitagliptin tablets USP, 25 mg, 50 mg, and 100 mg from the United States Food and Drug Administration (USFDA) for a generic version of Januvia (sitagliptin) tablets, 25 mg, 50 mg, and 100 mg, of Merck Sharpe and Dohme Corp (Merck).

Shaily Engineering Plastics: The company approved raising of funds upto Rs 300 crore, in one or more tranches by way of issuance of securities through a qualified institutions placement//preferential offer or a combination thereof.

Emkay Global Financial Services: Equity Intelligence India sold 0.76% stake in the company via open market transaction, reducing shareholding to 2.6% from 3.36% on July 7.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,124.65 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 106.55 crore in the Indian equity market on July 9, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Six stocks – Indiabulls Housing Finance, Vodafone Idea, NALCO, NMDC, Punjab National Bank, and SAIL – are under the F&O ban for July 12. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.