The market was heavily traded after recovering at the end of the deal during the downturn and was finally resolved with a modest gain on July 23, backed by banks and funds, shares of FMCG and IT.

BSE Sensex increased by 138.59 points to 52,975.80, while Nifty50 scored 32 points in 15,856 closures and formed a Doji Cross pattern on the daily charts as the close approached its opening levels. During the week, the index dropped 0.4 percent but formed a bullish candle on the weekly scale as the closing was higher than opening levels.

“This approach to the daily charts reflects a state of confusion among participants and one can expect a combination of consolidation or minor adjustments at the next meeting,” said Nagaraj Shetti, Research Technology Researcher at HDFC Securities.

He said the key area to resist the July 19 previous opening gap has been fully filled, but the top of the 15 900 gap has served as a barrier and has led to minor intraday vulnerabilities from the top. “More than 15,900 stable movements could only open up more in the short term,” he added.

You feel like Nifty’s short-term rise always works well.

“It is possible to combine other things or fix minor things from the beginning of the week early next week. Any weakness can find support at 15,750 levels,” he said.

Wide markets ended up mixed as the Nifty Midcap 100 index was up 0.17 percent and the Smallcap 100 index was down 0.46 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,783, followed by 15,710. If the index moves up, the key resistance levels to watch out for are 15,914.4 and 15,972.8.

Nifty Bank

The Nifty Bank rallied 357.10 points or 1.03 percent to close at 35,034.40 on July 23. The important pivot level, which will act as crucial support for the index, is placed at 34,596.8, followed by 34,159.2. On the upside, key resistance levels are placed at 35,280 and 35,525.6 levels.

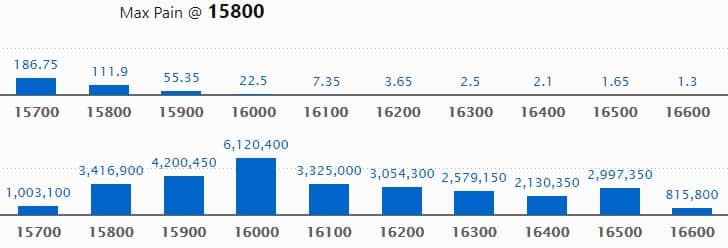

Call Option Data

Maximum Call open interest of 61.20 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the July series.

This is followed by 15900 strike, which holds 42 lakh contracts, and 15800 strike, which has accumulated 34.16 lakh contracts.

Call writing was seen at 16000 strike, which added 17.60 lakh contracts, followed by 15900 strike which added 15.27 lakh contracts and 16100 strike which added 11.63 lakh contracts.

Call unwinding was seen at 15700 strike, which shed 2.69 lakh contracts, followed by 15600 strike which shed 1.66 lakh contracts, and 15500 strike which shed 8,800 contracts.

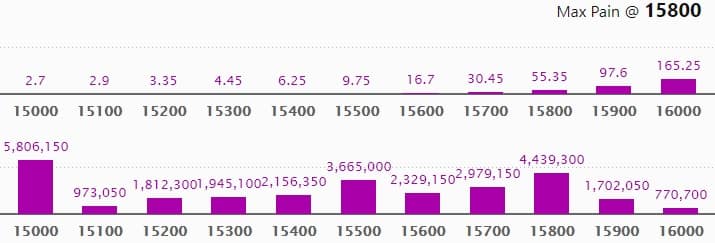

Put Option Data

Maximum Put open interest of 58.06 lakh contracts was seen at 15000 strike, which will act as a crucial support level in the July series.

This is followed by 15800 strike, which holds 44.39 lakh contracts, and 15500 strike, which has accumulated 36.65 lakh contracts.

Put writing was seen at 15800 strike, which added 18.84 lakh contracts, followed by 15000 strike which added 14.94 lakh contracts, and 15900 strike which added 8.83 lakh contracts.

Put unwinding was seen at 15400 strike, which shed 28,400 contracts, followed by 16500 strike which shed 11,100 contracts, and 16300 strike which shed 6,200 contracts.

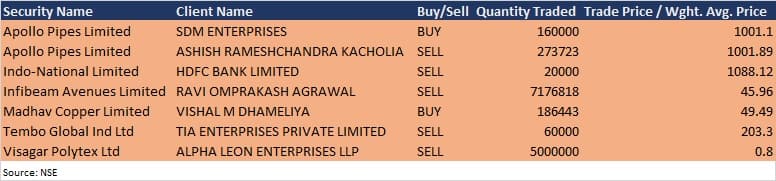

Bulk Deals

Apollo Pipes: Ace investor Ashish Rameshchandra Kacholia sold 2,73,723 equity shares in the company at Rs 1,001.89 per share on the NSE, whereas SDM Enterprises acquired 1.6 lakh equity shares in the company at Rs 1,001.1 per share, the bulk deals data showed.

Infibeam Avenues: Investor Ravi Omprakash Agrawal sold 71,76,818 equity shares in the company at Rs 45.96 per share on the NSE, the bulk deals data showed.

Results On July 26

Axis Bank, Kotak Mahindra Bank, Larsen & Toubro, Tata Motors, SBI Life Insurance Company, Vedanta, Alembic Pharmaceuticals, Apollo Pipes, Coromandel International, DLF, Glaxosmithkline Pharmaceuticals, Garden Reach Shipbuilders & Engineers, Jindal Stainless, KPIT Technologies, M&M Financial Services, Navin Fluorine International, Phillips Carbon Black, Ramkrishna Forgings, Sun Pharma Advanced Research Company, Vakrangee, and Zensar Technologies will release quarterly earnings on July 26.

Analysts/Investors Meeting

SBI Life Insurance Company: The company’s officials will meet analysts and investors on July 26 to update financial results.

Ramco Cements: The company’s officials will meet analysts and investors on July 27 to discuss financial performance.

The Anup Engineering: The company’s officials will meet analysts and investors on July 27 to discuss financial results.

KPIT Technologies: The company’s officials will meet analysts and investors on July 27 to discuss financial results.

Welspun India: The company’s officials will meet analysts and investors on July 28.

Filatex India: The company’s officials will meet analysts and investors on July 28 to discuss Q1FY22 results.

TCI Express: The company’s officials will meet analysts and investors on July 28 to discuss un-audited financial results.

KPR Mill: The company’s officials will meet analysts and investors on July 29 to discuss Q1FY22 results.

Firstsource Solutions: The company’s officials will meet analysts and investors on July 30 to discuss financial performance.

Equitas Small Finance Bank: The company’s officials will meet investors and analysts on July 31 to discuss financial performance.

Blue Star: The company’s officials will meet analysts and investors on August 5 to discuss financial results.

Stocks In The News

ITC: The company reported sharply higher profit at Rs 3,013.5 crore in Q1FY22 against Rs 2,342.7 crore in Q1FY21, revenue jumped to Rs 12,959.2 crore from Rs 9,502 crore YoY.

ICICI Bank: The bank reported sharply higher profit at Rs 4,616 crore in Q1FY22 against Rs 2,599.2 crore in Q1FY21, net interest income rose to Rs 10,935.7 crore from Rs 9,279.8 crore YoY.

GNA Axles: The company reported higher profit at Rs 29.5 crore in Q1FY22 against Rs 27.6 crore in Q1FY21, revenue rose to Rs 329 crore from Rs 310.2 crore YoY.

Reliance Industries: The company reported consolidated profit at Rs 12,273 crore in Q1FY22 against Rs 13,227 crore in Q4FY21, revenue at Rs 1,44,372 crore against Rs 1,54,896 crore QoQ.

Ambuja Cements: The company reported sharply higher standalone profit at Rs 723.08 crore in Q2CY21 against Rs 453.4 crore in Q2CY20, revenue jumped to Rs 3,371.2 crore from Rs 2,176.8 crore YoY.

United Spirits: The company reported profit at Rs 69.1 crore in Q1FY22 against loss of Rs 215.3 crore in Q1FY21, revenue jumped to Rs 1,615.1 crore from Rs 1,030.2 crore YoY.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 163.31 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 2,187.80 crore in the Indian equity market on July 23, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Five stocks – Cadila Healthcare, Canara Bank, Vodafone Idea, NALCO, and Sun TV Network – are under the F&O ban for July 26. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.