The market lost its first hours of earnings after the Reserved Bank of India’s monetary policy decision met with analysts’ expectations, and remained in a negative position during the break to close the 0.4 percent lower on August 6th.

BSE Sensex declined 215.12 points to close at 54,277.72, while Nifty50 dropped 56.40 points to 16,238.20 and formed a bearish candlestick on daily charts. During the week, the index gained 3 percent and formed a pattern of bullish candles on the weekly scale.

“Technically, on the weekly charts, Nifty has established a strong resilience, indicating a significant increase in current levels. We are of the view that medium-term trends are rising and buying dips and sales at meetings could be a good strategy for position traders,” said Shrikant Chouhan, Vice President. Equity Technical Research eKotak Securities.

“The level of 16,150-16,050 will be a strong support for the index. Trading above the same, the uptrend wave is likely to continue up to 16,400-16,550 levels. Below 16,050, outgoing traders may choose to opt out of trading at longer positions,” he said.

Wide markets have been able to surpass estimates. The Nifty Midcap 100 index and the Smallcap 100 index received 0.06 percent and 0.04 percent, respectively.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,195.4, followed by 16,152.6. If the index moves up, the key resistance levels to watch out for are 16,308.9 and 16,379.6.

Nifty Bank

The Nifty Bank declined 25.55 points to close at 35,809.25 on August 6. The important pivot level, which will act as crucial support for the index, is placed at 35,646.37, followed by 35,483.53. On the upside, key resistance levels are placed at 36,026.07 and 36,242.94 levels.

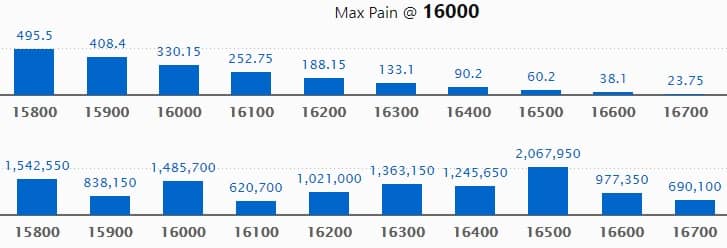

Call Option Data

Maximum Call open interest of 20.67 lakh contracts was seen at 16500 strike, which will act as a crucial resistance level in the August series.

This is followed by 15800 strike, which holds 15.42 lakh contracts, and 16000 strike, which has accumulated 14.85 lakh contracts.

Call writing was seen at 16600 strike, which added 77,300 contracts, followed by 16700 strike, which added 47,050 contracts and 16400 strike which added 30,550 contracts.

Call unwinding was seen at 16000 strike, which shed 1.01 lakh contracts, followed by 16500 strike which shed 87,200 contracts, and 16300 strike which shed 69,550 contracts.

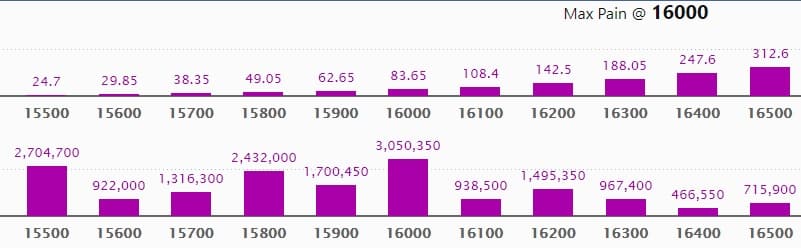

Put Option Data

Maximum Put open interest of 30.50 lakh contracts was seen at 16000 strike, which will act as a crucial support level in the August series.

This is followed by 15500 strike, which holds 27.04 lakh contracts, and 15800 strike, which has accumulated 24.32 lakh contracts.

Put writing was seen at 16400 strike, which added 2.37 lakh contracts, followed by 16000 strike which added 1.43 lakh contracts, and 16300 strike which added 84,000 contracts.

Put unwinding was seen at 15800 strike, which shed 3.99 lakh contracts, followed by 15900 strike which shed 1.13 lakh contracts, and 16,100 strike which shed 89,550 contracts.

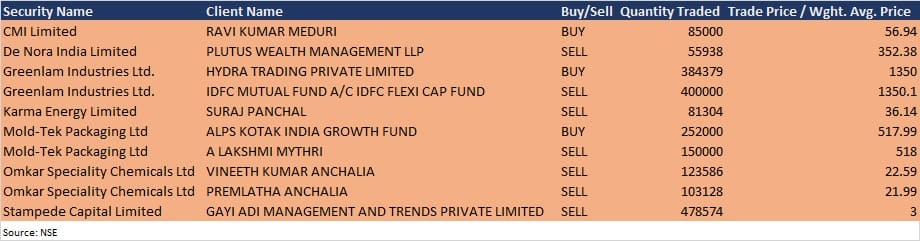

Bulk Deals

De Nora India: Plutus Wealth Management LLP sold 55,938 equity shares in the company at Rs 352.38 per share on the NSE, the bulk deals data showed.

Mold-Tek Packaging: ALPS Kotak India Growth Fund acquired 2.52 lakh equity shares in the company at Rs 517.99 per share, whereas A Lakshmi Mythri sold 1.5 lakh shares in the company at Rs 518 per share on the NSE, the bulk deals data showed.

Results On August 9

Shree Cement, Astrazeneca Pharma India, Balrampur Chini Mills, Birla Tyres, Bombay Dyeing, Chemcon Speciality Chemicals, Clean Science and Technology, Gati, Gujarat State Petronet, Indian Hotels, Laxmi Organic Industries, MRF, Nilkamal, Reliance Power, Satin Creditcare Network, Shalby, Shankara Building Products, Subex, Suven Life Sciences, Timken India, and Venky’s (India) will release quarterly earnings on August 9.

Analysts/Investors Meeting

Welspun Corp: The company’s officials will meet analysts and investors on August 9, in a virtual conference ‘Emkay Confluence – Ideas for Tomorrow’.

PSP Projects: The company’s officials will meet analysts and investors in the Spark Capital’s Annual Monsoon conference, on August 9.

Rajratan Global Wire: The company’s officials will meet several analysts and investors in a group meeting on August 9.

JSW Energy: The company’s officials will meet analysts and investors on August 10, in a virtual conference ‘Emkay Confluence – Ideas for Tomorrow’.

Saregama India: The company’s officials will meet analysts and investors on August 10, in the Emkay conference.

Satin Creditcare Network: The company’s officials will meet investors and analysts on August 10, to discuss on financial results & future outlook.

Capacite Infraprojects: The company’s officials will meet investors and analysts, on August 11, to discuss the operational and financial performance.

Aster DM Healthcare: The company’s officials will meet analysts/ institutional investors on August 12, to discuss the financial results.

Aurobindo Pharma: The company’s officials will meet analysts and investors on August 13, to discuss the financial results.

Ashok Leyland: The company’s officials will meet analysts and investors on August 13, to discuss the financial results.

Stocks In The News

Rolex Rings: The stock will list its equity shares on the bourses on August 9.

Bank of Baroda: The bank reported profit at Rs 1,280.6 crore in Q1FY22 against loss of Rs 864.3 crore in Q1FY21, net interest income rose to Rs 7,891.9 crore from Rs 6,816.1 crore YoY.

Amber Enterprises India: The company reported profit at Rs 11.2 crore in Q1FY22 against loss of Rs 23.9 crore in Q1FY21, revenue jumped to Rs 707.9 crore from Rs 259.5 crore YoY.

NALCO: The company reported sharply higher profit at Rs 347.7 crore in Q1FY22 against Rs 16.6 crore in Q1FY21, revenue surged to Rs 2,474.5 crore from Rs 1,380.6 crore YoY.

Affle India: The company reported sharply higher profit at Rs 35.9 crore in Q1FY22 against Rs 18.8 crore in Q1FY21, revenue surged to Rs 152.5 crore from Rs 89.8 crore YoY.

SAIL: The company reported consolidated profit at Rs 3,897.4 crore in Q1FY22 against loss of Rs 1,226.5 crore in Q1FY21, revenue jumped to Rs 20,643 crore from Rs 9,067 crore YoY.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 69.37 crore, while domestic institutional investors (DIIs) net offloaded shares worth Rs 631 crore in the Indian equity market on August 6, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Six stocks – Canara Bank, Indiabulls Housing Finance, NALCO, RBL Bank, SAIL and Sun TV Network – are under the F&O ban for August 9. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.