The market continued to boost for the fifth consecutive session as the price indexing indicators finally made history on August 13, driven by banking and financial services, metals, IT shares and FMCG.

IBSE Sensex collected 593.31 points or 1.08 percent to 55,437.29, while Nifty50 exceeded 164.70 points or 1.01 percent to 16,529.10 and formed a bullish candlestick on daily charts. During the week, the index gained 1.79 percent and formed a bullish candle on the weekly scale.

“The market has seen a continuous positive trend, after funding above the 16,350 level. The market has broken the key resistance level of 16,500. If the market continues above the 16,500 level, the market expects to gain momentum, leading to”

“Strength indicators such as the RSI and MACD will remain positive and the market range will improve, further strengthening the short-term outlook,” he added.

However, broad markets were not performing well in the past as the Nifty Midcap 100 index was less than a third, while the Smallcap 100 index fell a quarter of a percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,422.4, followed by 16,315.7. If the index moves up, the key resistance levels to watch out for are 16,589.7 and 16,650.3.

Nifty Bank

The Nifty Bank gained 232.25 points to close at 36,169.35 on August 13. The important pivot level, which will act as crucial support for the index, is placed at 35,993.24, followed by 35,817.07. On the upside, key resistance levels are placed at 36,289.44 and 36,409.47 levels.

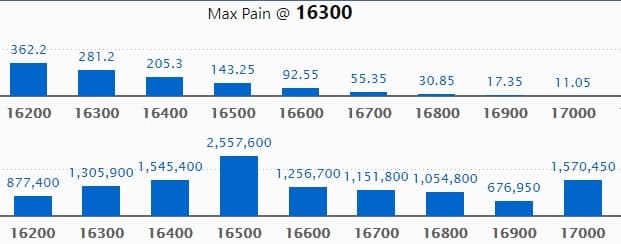

Call Option Data

Maximum Call open interest of 25.57 lakh contracts was seen at 16500 strike, which will act as a crucial resistance level in the August series.

This is followed by 17000 strike, which holds 15.70 lakh contracts, and 16400 strike, which has accumulated 15.45 lakh contracts.

Call writing was seen at 16800 strike, which added 3.87 lakh contracts, followed by 17000 strike, which added 3.5 lakh contracts and 16700 strike which added 3.27 lakh contracts.

Call unwinding was seen at 16300 strike, which shed 4.59 lakh contracts, followed by 16200 strike which shed 2.38 lakh contracts, and 15800 strike which shed 55,700 contracts.

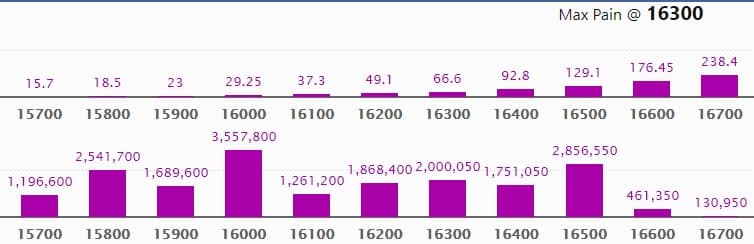

Put Option Data

Maximum Put open interest of 35.57 lakh contracts was seen at 16000 strike, which will act as a crucial support level in the August series.

This is followed by 16500 strike, which holds 28.56 lakh contracts, and 15800 strike, which has accumulated 25.41 lakh contracts.

Put writing was seen at 16500 strike, which added 9.54 lakh contracts, followed by 16400 strike which added 9.08 lakh contracts, and 16600 strike which added 2.84 lakh contracts.

Put unwinding was seen at 15700 strike, which shed 1.06 lakh contracts.

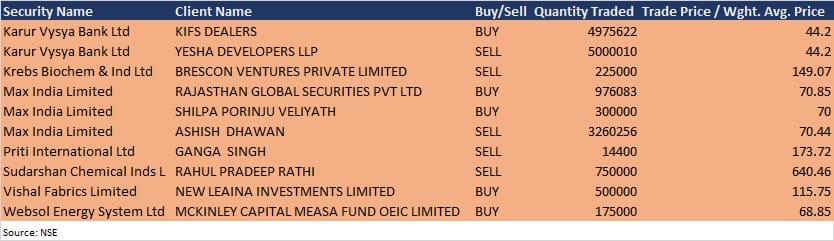

Bulk Deals

Krebs Biochem: Brescon Ventures sold 2.25 lakh equity shares in the company at Rs 149.07 per share on the NSE, the bulk deals data showed.

Max India: Rajasthan GLOBAL Securities acquired 9,76,083 equity shares in the company at Rs 70.85 per share and Shilpa Porinju Veliyath bought 3 lakh shares at Rs 70 per share on the NSE. However, Ashish Dhawan sold 32,60,256 equity shares in the company at Rs 70.44 per share on the NSE, the bulk deals data showed.

Websol Energy System: Mckinley Capital Measa Fund OEIC bought 1.75 lakh equity shares in the company at Rs 68.85 per share on the NSE, the bulk deals data showed.

Analysts/Investors Meeting

Rolex Rings: The company’s officials will meet analysts and investors on August 16, to discuss results for Q1FY22.

Greaves Cotton: The company’s officials will meet L&T Mutual Fund on August 16.

VIP Industries: The company’s officials will meet Dalal & Broacha Portfolio Managers on August 16.

Deep Industries: The company’s officials will meet investors and analysts on August 16 to discuss the financial results.

Borosil: The company’s officials will meet institutional investors and analysts on August 17, to discuss unaudited results.

Voltas: The company’s officials will meet investors in Edelweiss India CXO e-Conference 2021, Asia Pacific I ‘India 2025 – The New Order’ on August 17; Jefferies India Investor Call on August 18; and Boston Common Investor on August 19.

TCI Express: The company’s officials will meet institutional investors, mutual funds & analysts in a Logistics Conference organized by Ambit Capital on August 17.

PG Electroplast: The company’s officials will meet investors and analysts on August 17 to discuss financial performance.

Apex Frozen Foods: The company’s officials will meet analysts and investors on August 17, to discuss the financial performance.

Bigbloc Construction: The company’s officials will meet analysts and investors on August 18 to discuss on Q1FY22 results and business outlook.

Stocks In The News

Devyani International, Krsnaa Diagnostics, Windlas Biotech, and Exxaro Tiles: All these companies will list their equity shares on the bourses on August 16.

ONGC: The company’s profit fell to Rs 4,334.8 crore in Q1FY22 against Rs 6,734 crore in Q4FY21, revenue increased to Rs 23,021.6 crore from Rs 21,189 crore QoQ.

Petronet LNG: The company reported higher profit at Rs 635.6 crore in Q1FY22 against Rs 623 crore in Q4FY21, revenue rose to Rs 8,598 crore from Rs 7,575 crore QoQ.

Glenmark Pharma: The company reported sharply higher profit at Rs 306.5 crore in Q1FY22 against Rs 254 crore in Q1FY21, revenue jumped to Rs 2,965 crore from Rs 2,344.8 crore YoY.

Apollo Hospitals Enterprises: The company reported profit at Rs 500.68 crore in Q1FY22 against loss of Rs 226.24 crore in Q1FY21, revenue jumped to Rs 3,760.2 crore from Rs 2,171.5 crore YoY.

Sobha: The company reported sharply higher consolidated profit at Rs 1.08 crore in Q1FY22 against Rs 0.66 crore in Q1FY21, revenue jumped to Rs 51.2 crore from Rs 35 crore YoY.

FII And DII Data

Foreign institutional investors (FIIs) net bought shares worth Rs 819.77 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 149.50 crore in the Indian equity market on August 13, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Eight stocks – Cadila Healthcare, Canara Bank, Indiabulls Housing Finance, NALCO, Punjab National Bank, RBL Bank, SAIL and Sun TV Network – are under the F&O ban for August 16. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.