The market remained extremely volatile at all times and was finally established on August 11. Metal stocks passed with more than 3 percent profit, and sales were reflected in pharma, select banks and currencies, shares of FMCG and IT.

The BSE Sensex fell 28.73 points to 54,525.93, while the Nifty50 rose by 2.20 points to 16,282.30 and formed a bearish candle-like pattern of the Change Man on the daily charts.

“Another significant omission from the current price action may be the fact that the buy immediately emerged from a low intraday of 16,162 levels after the indicator slipped into the bullish range of 16,176 – 16,146 bullish levels, registered on August 4. However, a near-term trend will continue to remain obscure as Nifty50 appears to be in the new trading area of 16,350 to 16,160 levels, “said Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory at Chartviewindia.in

“Therefore, in order to take sustainable action on any indicators a new exit is needed. In addition, in the last 5 days of trading, the ups and downs of the bears are becoming more and more popular and could lead to a market share that will be generally followed,” he said.

Wide markets traded lower today as the Nifty Midcap 100 index fell 0.12 percent and the Smallcap 100 index fell 0.69 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,183.53, followed by 16,084.87. If the index moves up, the key resistance levels to watch out for are 16,359.83 and 16,437.47.

Nifty Bank

The Nifty Bank dropped 227.70 points to close at 35,806.40 on August 11. The important pivot level, which will act as crucial support for the index, is placed at 35,482.66, followed by 35,158.93. On the upside, key resistance levels are placed at 36,178.87 and 36,551.34 levels.

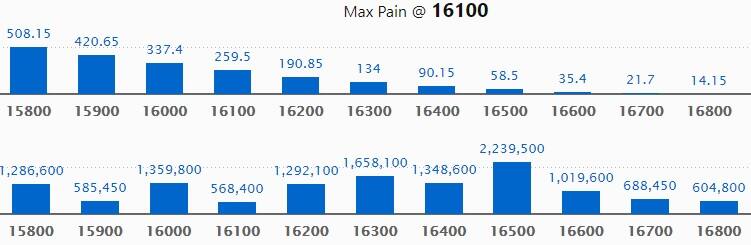

Call Option Data

Maximum Call open interest of 22.39 lakh contracts was seen at 16,500 strike, which will act as a crucial resistance level in the August series.

This is followed by 16,300 strike, which holds 16.58 lakh contracts, and 16,000 strike, which has accumulated 13.59 lakh contracts.

Call writing was seen at 16,500 strike, which added 2.08 lakh contracts, followed by 16,200 strike, which added 1.42 lakh contracts and 16,700 strike which added 39,650 contracts.

Call unwinding was seen at 16,000 strike, which shed 67,700 contracts, followed by 15,800 strike which shed 61,500 contracts, and 15,700 strike which shed 46,850 contracts.

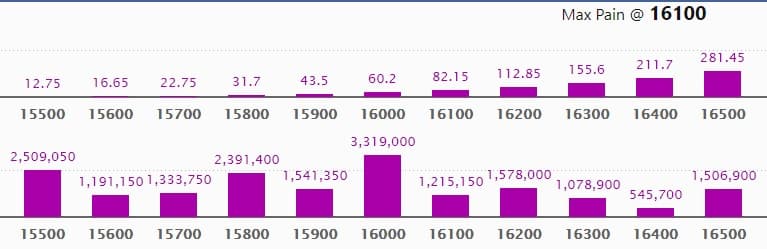

Put Option Data

Maximum Put open interest of 33.19 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the August series.

This is followed by 15,500 strike, which holds 25.09 lakh contracts, and 15,800 strike, which has accumulated 23.91 lakh contracts.

Put writing was seen at 16,500 strike, which added 3.46 lakh contracts, followed by 15,700 strike which added 1 lakh contracts, and 15,600 strike which added 82,800 contracts.

Put unwinding was seen at 15,500 strike, which shed 90,050 contracts, followed by 16,200 strike which shed 64,200 contracts, and 16,300 strike which shed 45,550 contracts.

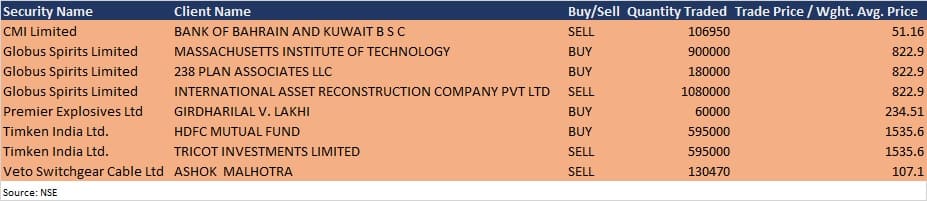

Bulk Deals

Globus Spirits: Massachusetts Institute of Technology acquired 9 lakh equity shares in Globus Spirits and 238 Plan Associates LLC bought 1.8 lakh shares in the company at Rs 822.9 per share on the NSE. However, International Asset Reconstruction Company sold 10.8 lakh shares in the company at the same price, the bulk deal data showed.

Timken India: HDFC Mutual Fund bought 5.95 lakh equity shares in the company at Rs 1,535.6 per share, whereas Tricot Investments was the seller for these shares on the NSE, the bulk deal data showed.

Results On August 12

Tata Steel, Eicher Motors, Hero MotoCorp, Aurobindo Pharma, BPCL, Oil India, Ashok Leyland, Bharat Forge, Ansal Properties & Infrastructure, Apollo Micro Systems, Ashapura Minechem, Avanti Feeds, Clariant Chemicals (India), Dishman Carbogen Amcis, Dish TV India, Engineers India, Finolex Cables, Gujarat Pipavav Port, GR Infraprojects, HCC, HealthCare Global Enterprises, HUDCO, Ind-Swift Laboratories, IRCON International, IRCTC, JB Chemicals, KNR Constructions, Matrimony.com, Max India, Mazagon Dock Shipbuilders, Mishra Dhatu Nigam, Minda Corporation, Natco Pharma, NMDC, Page Industries, Power Finance Corporation, RailTel Corporation of India, RCF, Redington (India), RITES, Sadbhav Infrastructure Project, Schneider Electric Infrastructure, Skipper, Sundram Fasteners, Suryoday Small Finance Bank, Thyrocare Technologies, Trident, Ujjivan Financial Services, and Venus Remedies will release their quarterly earnings on August 12.

Analysts/Investors Meeting

CESC: The company’s officials will meet investors on August 13 in Emkay Mega Confluence conference and August 23 in Maybank Kimeng Investors Meet.

Blue Star: The company’s officials will meet analysts and investors on August 13 in Spark Capital’s Annual Conference.

Inox Wind: The company’s officials will meet analysts and investors on August 13 after announcement of financial results.

RailTel Corporation of India: The company’s officials will meet institutional investors on August 13 in a conference call organised by Haitong Securities India.

General Insurance Corporation of India: The company’s officials will meet analysts and investors on August 14 to discuss financial results.

Oil and Natural Gas Corporation: The company’s officials will meet analysts and investors on August 14 to share details on financial performance.

Himatsingka Seide: The company’s officials will meet analysts and investors on August 16 to discuss financial results.

Stocks In The News

Bata India: The company reported loss at Rs 69.47 crore in Q1FY22 against loss of Rs 100.9 crore in Q1FY21, revenue jumped to Rs 267 crore from Rs 135.1 crore YoY.

MAS Financial Services: The company reported higher standalone profit at Rs 36.82 crore in Q1FY22 against Rs 36.59 crore in Q1FY21, revenue fell to Rs 147.73 crore from Rs 160.35 crore YoY.

HeidelbergCement India: The company entered into Power Purchase Agreement, Share Subscription Agreement and Shareholders Agreement with Lalganj Power (LPPL) for subscribing to 36,36,364 equity shares of Rs 10 each of LLPL at a premium of Rs 3.2 per share aggregating to Rs 4.8 crore in order to procure around 22 Gigawatt hours per annum of solar power under captive arrangement for operating its plant located at Madora, Uttar Pradesh.

Power Grid Corporation of India: The company approved proposal to infuse fresh equity up to Rs 425 crore in Energy Efficiency Services (EESL), a joint venture company of PowerGrid, NTPC, PFC and REC.

Gandhi Special Tubes: The company determined the final buyback price of Rs 550 per equity share.

Prakash Pipes: Promoter Ved Prakash Agarwal acquired 20,000 equity shares in the company via open market transaction, increasing stake to 15.26% from 15.18% earlier.

FII And DII Data

Foreign institutional investors (FIIs) net bought shares worth Rs 238.14 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 206.28 crore in the Indian equity market on August 11, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Six stocks – Canara Bank, Indiabulls Housing Finance, NALCO, Punjab National Bank, RBL Bank, and Sun TV Network – are under the F&O ban for August 12. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.