The market closed with an unpopular session on July 26, following mixed leads. Choose banks and currencies, auto and FMCG stocks to save the market, while buying on selected IT, metals and pharma shares has reduced market pressure.

BSE Sensex was down 123.53 points at 52,852.27, while Nifty50 dropped 31.50 points to 15,824.50 and formed a bearish candlestick on daily charts.

“A small candlestick was formed on the daily chart with a small amount of bottom and bottom. Technically, this pattern indicates a type of deficit in the market. This action indicates the possibility of several such movements in the short term,” said Nagaraj Shetti, Technical Analyst at HDFC Securities.

You feel that Nifty’s short-term trend is slim and the same movement can be expected in the next episode. “A very high range observed about 15,900-15,760 times in the next 1-2 meetings. Sustainable movement above 15,900 could open further up to 16,000-16,100 in the short term,” he said.

Wide markets continued to end in a mixed frenzy. The Nifty Midcap 100 index fell 0.04 percent, while the Nifty Smallcap 100 index fell 0.27 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,783.23, followed by 15,741.97. If the index moves up, the key resistance levels to watch out for are 15,879.53 and 15,934.57.

Nifty Bank

The Nifty Bank fell 84.70 points to 34,949.70 on July 26. The important pivot level, which will act as crucial support for the index, is placed at 34,700.14, followed by 34,450.57. On the upside, key resistance levels are placed at 35,168.73 and 35,387.77 levels.

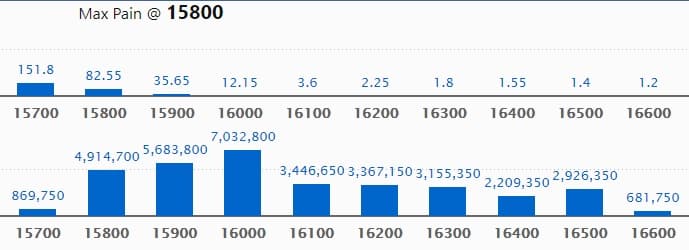

Call Option Data

Maximum Call open interest of 70.32 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the July series.

This is followed by 15900 strike, which holds 56.83 lakh contracts, and 15800 strike, which has accumulated 49.14 lakh contracts.

Call writing was seen at 15800 strike, which added 14.97 lakh contracts, followed by 15900 strike which added 14.83 lakh contracts and 16000 strike which added 9.12 lakh contracts.

Call unwinding was seen at 16600 strike, which shed 1.34 lakh contracts, followed by 15700 strike which shed 1.33 lakh contracts, and 16500 strike which shed 71,000 contracts.

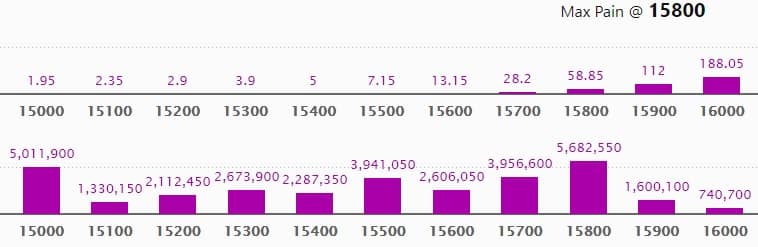

Put Option Data

Maximum Put open interest of 56.82 lakh contracts was seen at 15800 strike, which will act as a crucial support level in the July series.

This is followed by 15000 strike, which holds 50.11 lakh contracts, and 15700 strike, which has accumulated 39.56 lakh contracts.

Put writing was seen at 15800 strike, which added 12.43 lakh contracts, followed by 15700 strike which added 9.77 lakh contracts, and 15300 strike which added 7.28 lakh contracts.

Put unwinding was seen at 15000 strike, which shed 7.94 lakh contracts, followed by 15900 strike which shed 1.01 lakh contracts, and 16000 strike which shed 30,000 contracts.

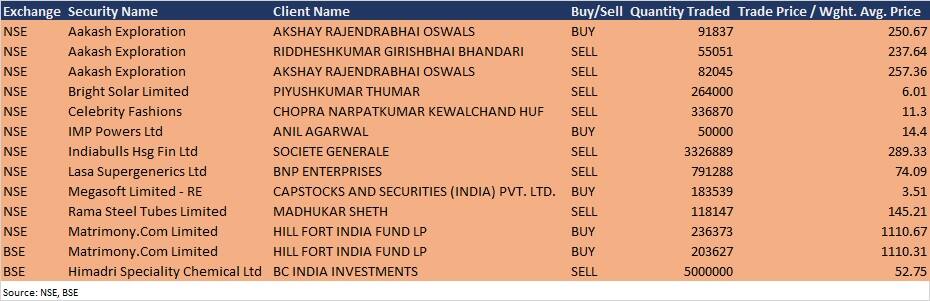

Bulk Deals

Indiabulls Housing Finance: Societe Generale sold 33,26,889 equity shares in the company at Rs 289.33 per share on the NSE, the bulk deals data showed.

Lasa Supergenerics: BNP Enterprises sold 7,91,288 equity shares in the company at at Rs 74.09 per share on the NSE, the bulk deals data showed.

Matrimony.Com: Hill Fort India Fund LP acquired 2,36,373 equity shares in the company at Rs 1,110.67 per share on the NSE, and 2,03,627 equity shares at Rs 1,110.31 per share on the BSE, the bulk deals data showed.

Himadri Speciality Chemical: BC India Investments sold 50 lakh equity shares in the company at Rs 52.75 per share on the BSE, the bulk deals data showed.

Results On July 27

Dr Reddy’s Laboratories, IndusInd Bank, InterGlobe Aviation, Canara Bank, Aarti Drugs, Ansal Housing, The Anup Engineering, Apar Industries, Arihant Capital Markets, Bhageria Industries, BLS International Services, Confidence Petroleum India, Dalmia Bharat, Dixon Technologies, EIH Associated Hotels, Elantas Beck India, Filatex India, GM Breweries, Godawari Power & Ispat, Granules India, Greenlam Industries, Hindustan Fluorocarbons, IIFL Finance, Karnataka Bank, Lux Industries, Mahindra Logistics, Mirza International, Ramco Cements, Sanofi India, Sharda Cropchem, Shemaroo Entertainment, Snowman Logistics, Torrent Pharmaceuticals, TTK Prestige, UCO Bank and VST Industries will release quarterly earnings on July 27.

Analysts/Investors Meeting

Gland Pharma: The company’s officials will meet Fidelity International on July 27.

DLF: The company’s officials will meet analysts and investors on July 27.

Mahanagar Gas: The company’s officials will meet analysts and investors on July 29 for earnings conference call.

Mahindra Holidays & Resorts India: The company’s officials will meet analysts and investors on July 30.

Snowman Logistics: The company’s officials will meet investors and analysts on July 29 for un-audited financial results.

SRF: The company’s officials will meet investors and analysts on July 29 for discussion on Q1FY22 results.

Dr Lal PathLabs: The company’s officials will meet investors and analysts on July 30 to discuss financial and operating performance.

Gokaldas Exports: The company’s officials will meet analysts and investors on August 2 for first quarter earnings.

Rossari Biotech: The company’s officials will meet investors and analysts on August 2.

Stocks In The News

Larsen & Toubro: The company reported profit at Rs 1,174.4 crore in Q1FY22 against Rs 303 crore in Q1FY21, revenue jumped to Rs 29,334.7 crore from Rs 21,260 crore YoY.

Axis Bank: The bank reported sharply higher profit at Rs 2,160.15 crore in Q1FY22 against Rs 1,112.17 crore in Q1FY21, net interest income increased to Rs 7,760.27 crore from Rs 6,985.31 crore YoY.

Vedanta: The company reported sharply higher profit at Rs 4,224 crore in Q1FY22 against Rs 1,033 crore in Q1FY21, revenue jumped to Rs 28,412 crore from Rs 15,973 crore YoY. The company will spend Rs 6,600 crore on BALCO smelter expansion.

DLF: The company reported profit at Rs 337.2 crore in Q1FY22 against loss of Rs 71.5 crore in Q1FY21, revenue jumped to Rs 1,139.5 crore from Rs 548.6 crore YoY.

Tata Motors: The company reported loss at Rs 4,450.92 crore in Q1FY22 against loss of Rs 8,437.99 crore in Q1FY21, revenue jumped to Rs 66,406.45 crore from Rs 31,983.06 crore YoY.

GlaxoSmithKline Pharmaceuticals: The company reported higher consolidated profit at Rs 121.08 crore in Q1FY22 against Rs 110.83 crore in Q1FY21, revenue rose to Rs 789.99 crore from Rs 648.59 crore YoY.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,376.79 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,551.27 crore in the Indian equity market on July 26, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Four stocks – Canara Bank, Vodafone Idea, NALCO, and SAIL – are under the F&O ban for July 27. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.