A decision-making decision below 14,500 levels is likely to cause widespread market weakness and in such a case, Nifty could test 14,000 levels next week, said Nagaraj Shetti of HDFC Securities.

The sale of the afternoon session wiped out all morning profits, making the estimates resolved by the percentage determined on March 18. The increase in U.S. securities has been overshadowed by investors’ sentiments. Technology, banking and finance, and pharma shares remain under pressure.

BSE Sensex declined 585.10 points or 1.17 percent to close at 49,216.52, while Nifty50 dropped 163.40 points or 1.11 percent to 14,557.90 and formed a bearish candlestick on the daily charts.

“A long non-light candle with a small shadow is built. Nifty broke slightly below the trend line support line of 14,680 and closed below. The market now enters a significant support of about 14,500 people (previously declining on February 26 and 10 weeks of time. EMA 14,560), “Nagaraj Shetti, Technical Research Researcher at HDFC Securities.

Earlier, a few times ago, the 10th weekly EMA served as an important market base and Nifty saw critical evidence of support or slightly violated that area of funding, he said.

You feel Nifty’s short-term tendencies continue to weaken. “Given the low support of 14,500 levels, one needs to be aware of any ups and downs. Taking a decision below 14,500 levels could cause widespread market weakness and in such a case, Nifty could test 14,000 more levels next week,” he said.

The broader markets also performed in line with estimates as the Nifty Midcap 100 and Smallcap 100 indicators fell by 1.37 percent and 1.28 percent, respectively.

Basic Support And Nifty Resistance Levels

According to pivot charts, Nifty key support levels were set at 14,399.2, followed by 14,240.6. If the index rises, the key resistance levels should be 14,795.8 and 15,033.8.

Nifty Bank

The Nifty Bank index fell by 372.50 points or 1.09 percent to 33,856.80 on March 18. The pivot rate, which will serve as an important indicator support, is set at 33,382.97, followed by 32,909.14. In addition, key resistance levels were set at 34,545.27 and 35,233.73 levels.

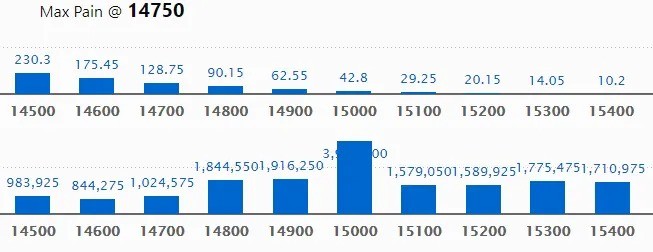

Call Option Data

The open interest rate of Mall Maximum for 39.16 lakh contracts was seen in the 15,000 strike, which will serve as an important resistance level in the March series.

This is followed by a strike of 14,900, which holds 19.16 lakh contracts, and a strike of 14,800, which collected 18.44 lakh contracts.

Phone calls were seen in the 15,000 strike, which added 14.63 lakh contracts, followed by a 14,900 strike that added 10.73 lakh contracts and a 14,800 strike that added 9.64 lakh contracts.

There were no phone calls seen on March 18.

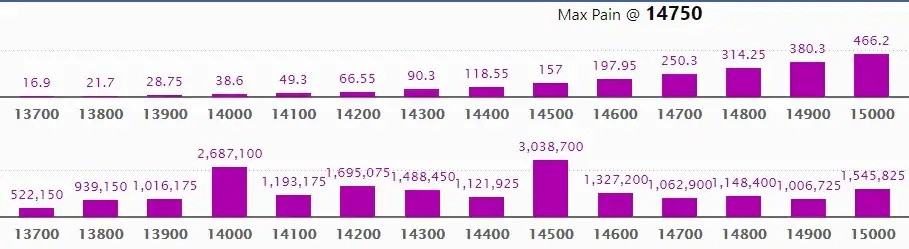

Put Option Data

Maximum Put The open interest of 30.38 lakh contracts was seen in the 14,500 strike, which will serve as an important level of support for the March series.

This is followed by a strike of 14,000, with 26.87 lakh contracts, and a strike of 14,200, contracting 16.95 lakh contracts.

Put writing appeared on a strike of 14,200, which added 4.06 lakh contracts, followed by a strike of 14,900, which added 4.04 lakh contracts and a 14,000 strike that added 3.63 lakh contracts.

Put unwinding was seen in the 13,900 strikes, which terminated 1.44 lakh contracts, followed by the 15,300 strike that terminated 1.43 lakh contracts and the 14,800 strike that terminated 1.17 lakh contracts.

Shares Have A High Delivery Rate

A high percentage of submissions suggest that investors are showing interest in these stocks.

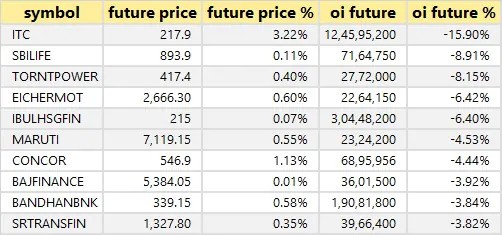

8 Shares Have Seen A Long Build

Depending on the percentage of open future interest, here are the top 8 stocks where long-term construction has been observed.

67 Stocks Saw A Long-Term Outflow

Depending on the future percentage of open interest, here are the top 10 stocks where long-term stocks have been found.

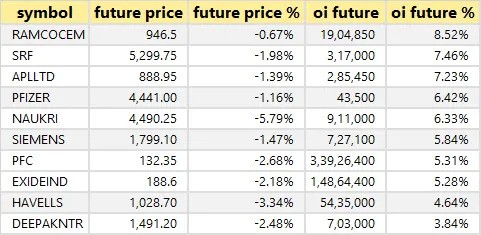

58 Shares Saw A Short Build

The increase in open interest rates, as well as the decline in prices, indicate the formation of shorter positions. Depending on the percentage of open future interest, here are the top 10 stocks where short construction has been observed.

25 Shares Saw A Short Cover

Open interest rates, as well as price increases, are particularly indicative of short coverage. Depending on the percentage of open future interest, here are the top 10 stocks where short coverage was observed.

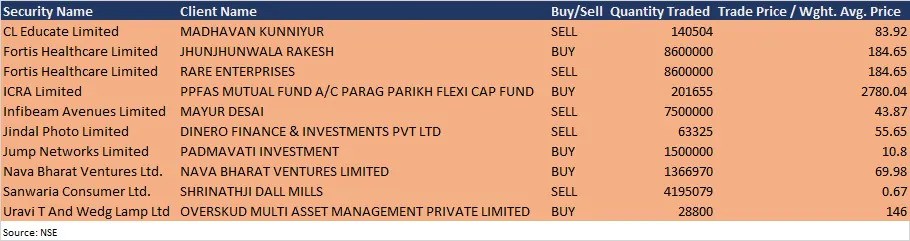

Bulk Deals

Analysts / Board Meetings

Va Tech Wabag: Company officials will visit PL – Capital Goods Day on March 19.

Tata Steel: Officials of the company will contact Investec Capital Service, and Neuberger Berman on March 22, and will attend the 24th Credit Suisse Asia Investment conference on March 23.

Ramco Cement: The company will be participating in the Cement Sector Conference scheduled for March 22 organized by Institutional Research – Systematix Shares and Stocks (India).

NACL Industries: A company board meeting is scheduled to be held on March 23 to consider the payment of the second interim allocation, if any, for the 2020-21 financial year.

NBCC India: NBCC has confirmed its participation in the Motilal Oswal Investors Conference 2021 on March 23 with a video conference.

Centum Electronics: Company officials will contact the SBI Mutual Fund on March 19.

DCM Shriram: The company chief will contact TA Associates Adv. Pvt. March 22.

Stocks In The News

GAIL India: State-owned natural gas company GAIL India and Ranchi Municipal Corporation have signed a memorandum of understanding to establish a biogas press in Ranchi.

Godrej Industries: Godrej Industries has informed the trade agency that the ICRA rating agency has awarded the ‘AA’ rating to the proposed fixed-income company for up to Rs 1,500 crore.

Deepak Nitrite: Deepak Nitrite said rating firm CRISIL has developed a long-term vision for the company’s Rs 750 banking institutions, from ‘AA- / Positive’ to ‘A / Stable.

Indo Count Industries: The Indo Count Industries Project Management Committee has approved a 20 percent increase in bed linen capacity from its annual capacity of 90 million to 108 million meters by demolishing and measuring its facilities.

Vaibhav Global: Shop TJC Limited, UK, a subsidiary of Vaibhav Global, has acquired E-retailer Shop LC GmbH, Germany (100% subsidiary). The company’s goal is to grow the business in Germany by selling products to consumers who sell through television and e-commerce websites, Vaibhav Global said in a BSE file.

Hathway Cable & Datacom: Hathway Cable & Datacom has entered into an agreement to dispose of all 50% of its equivalent equity shares valued at Rs 10 per Net 9 Online Hathway, a joint venture, on March 18. The company received consideration of Rs 99 lakh after selling a stake to a joint venture, Hathway said in his BSE file.

FII And DII Data

Foreign institutional investors (FIIs) bought shares worth Rs 1,258.47 crore, while local institutional investors (DIIs) sold shares worth Rs 1,116.17 crore on the Indian financial market on March 18, according to short-term data available on the NSE.

Shares Are Under F&O Ban On The NSE

Two stocks – Vodafone Idea and SAIL – are subject to the F&O ban on March 19. Security during the ban under the F&O component includes companies where security exceeds 95 percent of the market performance limit.