The Nifty50 is now approaching a minimum of 14-15 trading hours at 14,500 levels, which could be a bad omen, said Nagaraj Shetti of HDFC Securities.

The market declined for the fourth consecutive session on March 17 when estimates fell by more than one percent between banking, finance, automotive, metals and pharma figures.

The S&P BSE Sensex declined 562.34 points or 1.12 percent to close to 49,801.62, while the Nifty50 fell by 189.20 points or 1.27% to 14,721.30 forming a bearish candlestick on the daily charts.

“A long bad candle is being built, closed below 14,745 levels. The market is now going to enter the lowest of 14-15 trading hours at 14,500 levels. This could be a negative signal and movements below 14,450 may open up serious shortcomings in the near future,” Nagaraj said. Shetti, HDFC Securities Technology Research Researcher.

Shetti feels that there is likely to be a huge explosion from this important group support around 14,500-14,450 levels over the next few sessions. “Strengthening the market while looking up may not be necessary to hold on to support and show a steady explosion. Immediate resistance is set at 14,850,” he said.

Wide markets have also seen major adjustments, in addition to previous indices. The Nifty Midcap 100 and Smallcap 100 indicators saw a fall of 2.48 percent and 2.21 percent, respectively.

Basic Support And Nifty Resistance Levels

According to pivot charts, the key Nifty support levels are set at 14,626.03, followed by 14,530.77. If the index rises, the opposition levels are 14,886.53 and 15,051.77.

Nifty Bank

The Nifty Bank index fell by 575.30 points or 1.65 percent to 34,229.30. The pivot rate, which will serve as an important indicator support, is set at 33,870.56, followed by 33,511.93. In addition, key resistance levels were set at 34,844.16 and 35,459.13 levels.

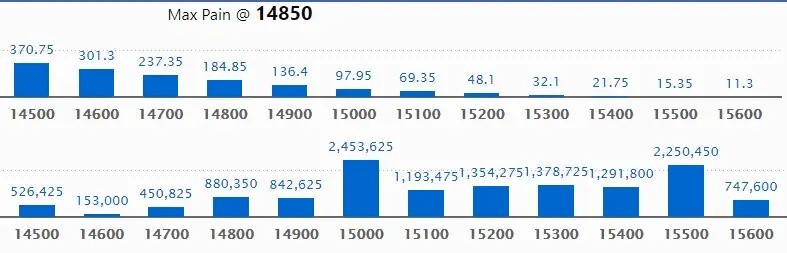

Call Option Data

The open interest rate of Mall Maximum for 24.53 lakh contracts was seen in the 15,000 strike, which will serve as an important resistance level in the March series.

This is followed by a strike of 15,500, which holds 22.50 lakh contracts, and a 15,300 strike, which collected 13.78 lakh contracts.

Phone calls were seen in the 15,000 strike, which added 6.11 lakh contracts, followed by a strike of 14,800 adding 3.43 lakh contracts and a 14,900 strike that added 3.35 lakh contracts.

Telephone strikes were seen in the 15,400 strike, which terminated 1.66 lakh contracts, followed by the 15,600 strike that terminated 81,675 contracts and the 15,500 strike that destroyed 45,975 contracts.

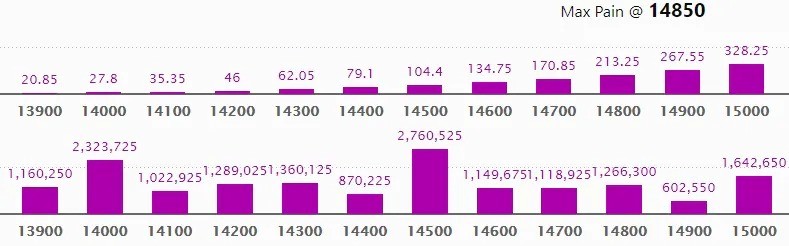

Put Option Data

Maximum Put The open interest of 27.60 lakh contracts was seen in the 14,500 strike, which will serve as an important level of support for the March series.

This is followed by a strike of 14,000, which holds 23.23 lakh contracts, and a strike of 15,000, which collected 16.42 lakh contracts.

Put writing appeared on a strike of 14,200, which added 2,37 lakh contracts, followed by a strike of 14,100, which added 1 lakh contracts and a 14,400 strike that added 73,650 contracts.

Put unwinding was seen in the 15,000 lakh strike, which terminated 1.68 lakh contracts, followed by a 14,000 strike that terminated 1.66 lakh contracts and a 14,800 strike that terminated 1.35 lakh contracts.

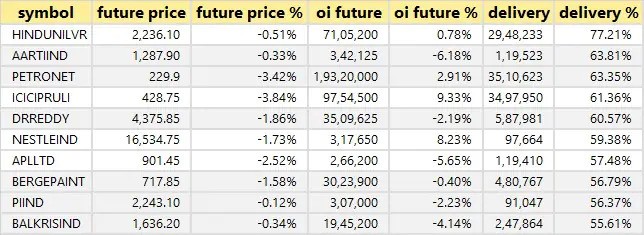

Shares Have A High Delivery Rate

A high percentage of submissions suggest that investors are showing interest in these stocks.

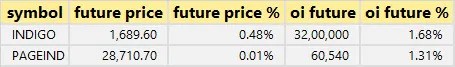

2 Stocks Saw A Long Build

Depending on the percentage of open future interest, here are 2 stocks where long construction has been observed.

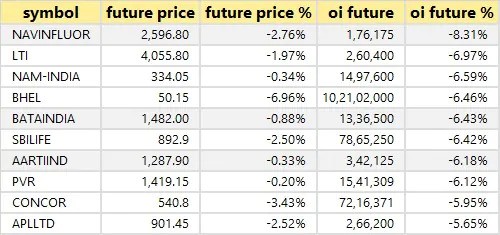

99 Stocks Saw A Long-Term Outflow

Depending on the future percentage of open interest, here are the top 10 stocks where long-term stocks have been found.

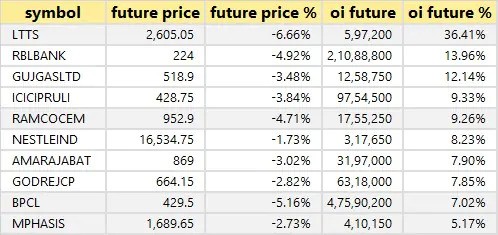

54 Shares Saw A Short Build

The increase in open interest rates, as well as the decline in prices, indicate the formation of shorter positions. Depending on the percentage of open future interest, here are the top 10 stocks where short construction has been observed.

4 Shares Saw A Short Cover

Open interest rates, as well as price increases, are particularly indicative of short coverage. Depending on the percentage of open future interest, here are 4 stocks where short coverage was seen.

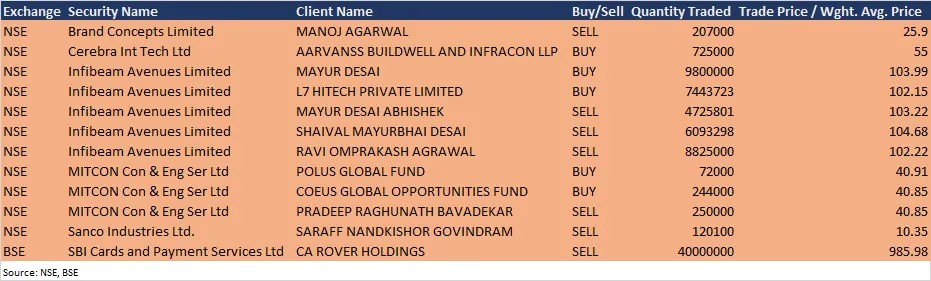

Bulk Deals

Analysts / Board Meetings

Magma Fincorp: Company officials will contact Think Investment on March 17 and Wellington management on March 18.

Tube Investments India: Digital access conference with institutional investor scheduled for March 18.

Ceat: Company executives will participate in analysts and an institutional investment conference hosted by Axis Securities on March 18th.

Vidi Specialty Food Ingredients: Company officials will contact analysts / investors on March 19, March 24 and March 25.

IRCON International: Company executives will participate in the institutional investment conference organized by Prabhudas Lilladher March 19.

Paisalo Digital: A Committee Meeting is scheduled for March 20 to consider the distribution of flexible literature, to organizations under the group of facilitators.

Bajaj Funds: Company officials will contact Columbia Threadneedle Investments on March 19, Arohi Asset Management and ICICI Prudential Mutual Fund on March 22.

Can Can Homes: Girish Kousgi, Managing Director & CEO, and Shreekant M Bhandiwad, CEO of the company, will work with Avendus Capital and Principal Mutual Fund on March 22, Flowering Tree Investment Management, Nippon Mutual Fund and -Franklin Templeton Investments March 23.

Stocks in the news

IRCTC: Indian Railway Catering and Tourism Corporation said there was no significant impact on the termination of mobile catering contracts for the 2020-21 financial year.

Bharat Heavy Electricals: state-owned engineering company BHEL said the company has come out as the lowest buyer of Rs 10,800 crore fleet mode floating tender by Nuclear Power Corporation of India (NPCIL) for 6×700 MW Turbine Island packages.

Satin Creditcare Network: Microfinance Satin Creditcare Network in its BSE filing has said its promoters have reduced their securities percentage from 8.90% on July 16, 2020, to 3.09% from March 16, 2021.

Indian Metals & Ferro Alloys: Indian Metals and Ferro Alloys have said ICRA has improved its credit rating at the company’s long-term and short-term lending institutions from banks.

HFCL: Optical fiber cable manufacturer HFCL holds an order of Rs 221.16 crore from Uttar Pradesh Metro Rail Corporation.

FII and DII data

Foreign institutional investors (FIIs) are buying shares worth Rs 2,625.82 crore, while local institutional investors (DIIs) are selling shares worth Rs 562.15 crore on the Indian financial market on March 17, according to short-term data available on the NSE.

Shares are under F&O ban on the NSE

One stock – Sun TV Network – is subject to the F&O ban on March 18. Security during the ban under the F&O segment includes companies where security exceeds 95 percent of the market position limit.