Nifty key support levels were set at 14,850.27, followed by 14,790.03. If the index goes up, the opposition levels to look at are 15,011.17 and 15,111.83.

India’s monetary estimates, S&P BSE Sensex and Nifty50, ended in red for the third consecutive session on March 16 as concerns over rising bond prices and rising inflation continue to weigh market sentiment.

Sensex scored 31 points, or 0.06 percent, down to 50,363.96 and Nifty finished with 19 points, or 0.13 percent, down 14,910.45.

Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services, is of the opinion that Nifty should fall hard and hold more than 15,000 mark to see increases to 15,150 and 15,250.

“India VIX is down 4.90 percent from 21.22 to 20.19 degrees. Cooling of VIX below 20 degrees is needed to hold and move the market,” Khemka said.

Basic Support And Nifty Resistance Levels

According to pivot charts, the key Nifty support levels are set at 14,850.27, followed by 14,790.03. If the index goes up, the opposition levels to look at are 15,011.17 and 15,111.83.

Nifty Bank

The Nifty Bank index dropped by 378 points to close to 34,804.60 on March 16. The pivot rate, which will serve as an important indicator support, is set at 34,564.44, followed by 34,324.27. In addition, key resistance levels were set at 35,224.94 levels and 35,645.27.

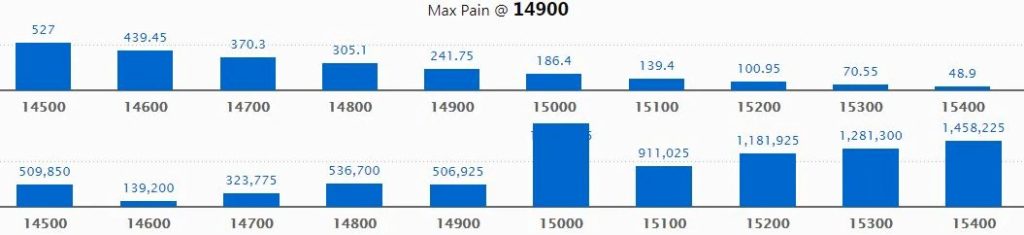

Call Option Data

The open interest rate of Mall Maximum for 18.42 lakh contracts was seen in the 15,000 strike, which will serve as an important resistance level in the March series.

This is followed by a strike of 15,400, which holds 14.6 lakh contracts, and a 15,300 strike, which has collected 12.81 lakh contracts.

Phone calls were seen in the 15,000 strike, which added 1.22 lakh contracts, followed by a 15,300 strike that added 50,475 contracts.

The so-called unwinding was seen in 14,900 strikes, which lost 96,375 contracts, followed by 15,400 strikes that lost 75,675 contracts and 15,200 strikes that destroyed 72,150 contracts.

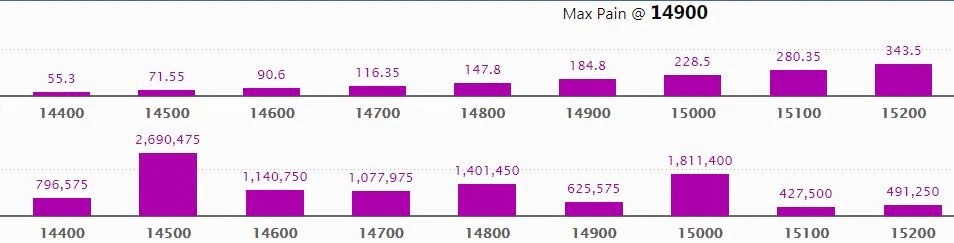

Put Option Data

Maximum Put The open interest of 26.90 lakh contracts was seen in the 14,500 strike, which will serve as an important level of support for the March series.

This is followed by a strike of 15,000, with contracts of 18.11 lakh, and a strike of 14,800, which collected 14.01 lakh contracts.

Put writing was seen in the 14,800 strike, which added 1.59 lakh contracts, followed by the 14,600 strike, which added 1.01 lakh contracts and the 14,900 strike that added 81,375 contracts.

Put unwinding was seen in the 15,200 strike, which awarded 51,150 contracts, followed by a 15,300 strike that destroyed 27,600 contracts.

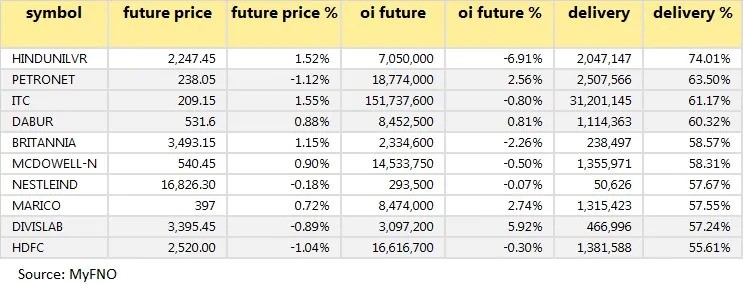

Shares Have A High Delivery Rate

A high percentage of submissions suggest that investors are showing interest in these stocks.

29 Shares Have Seen A Long Build

Depending on the percentage of open future interest, here are the top 10 stocks where long-term construction has been observed.

35 Stocks Saw A Long-Term Outflow

Depending on the future percentage of open interest, here are the top 10 stocks where long-term stocks have been found.

45 Shares Saw A Short Build

The increase in open interest rates, as well as the decline in prices, indicate the formation of shorter positions. Depending on the percentage of open future interest, here are the top 10 stocks where short construction has been observed.

46 Shares Saw A Short Cover

Open interest rates, as well as price increases, are particularly indicative of short coverage. Depending on the percentage of open future interest, here are the top 10 stocks where short coverage was observed.

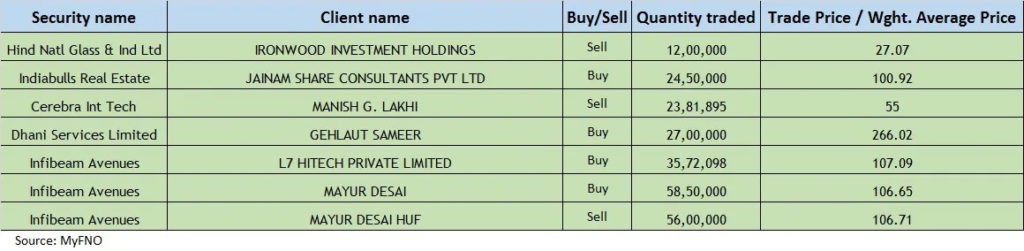

Bulk Deals

Board Meetings

Somany Ceramics: The Board will meet on March 17 to consider short-term benefits.

Jyoti Properties: The Board will meet on March 17 to consider and approve quarterly results.

Bal Pharma: The Board will meet on March 17 to consider and approve the preferred stock issue.

Stocks in the news

Shriram City Union Finance: The company’s Banking and Securities Management Committee on March 16, 2021, approved the issue of fixed asset-based (PP-MLD) fixed face value (NCDs) of face value of Rs 10,00,000 each , which includes up to 5,000 NCDs up to Rs 500 crore.

Karur Vysya Bank: The company has announced that promoter S Nirupama has promised 40,000 shares in the company on March 12, 2021, with Bajaj Finserv.

Asian Hotels (West): The company told law enforcement that Saurabh Kirpal, the company’s Independent Managing Director, has filed for resignation from March 15, 2021.

PNB Gilts: ICRA and CRISIL rating agencies on March 16, 2021, have verified the “ICRA A1 +” and “CRISIL A1 +” credit ratings, respectively, provided by the company’s $ 1,000 business plan .

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 1,692.31 crore, while domestic institutional investors (DIIs) traded shares worth rs 1,168.59 in the Indian stock market on March 16, according to short-term data available on the NSE.

Shares are under F&O ban on the NSE

Two stocks – BHEL and Sun TV Network – are subject to the F&O ban on March 17. Security during the ban under the F&O segment includes companies where security exceeds 95 percent of the market position limit.