The market remains under pressure amidst volatility all the time and was resolved by half a percentage on Friday, August 20, as all sector indicators, which block the FMCG, are closed in red. Weak world indicators and the rise of various Delta cases around the world.

BSE Sensex was down 300.17 points to 55,329.32, while Nifty50 adjusted 118.30 points to 16,450.50 and formed a bullish candlestick on daily charts as the closure was higher than opening levels. The index forms a small bearish candlestick on the weekly scale as these are half the percentage.

“The index has reached its previous exit and going forward will serve as a good support base of 16,350-16,250. said Rohit Singre, Senior Technical Analyst at LKP Securities.

Typically, a 16,500 site will serve as a construction or breakout on the high side, you feel.

Wide markets have fallen sharply, the previous indicators malfunctioning. The BSE Midcap 100 index fell 1.99 percent and the Smallcap index fell 2.16 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,381.13, followed by 16,311.77. If the index moves up, the key resistance levels to watch out for are 16,514.73 and 16,578.97.

Nifty Bank

The Nifty Bank plunged 520.65 points or 1.46 percent to 35,033.85 on August 20. The important pivot level, which will act as crucial support for the index, is placed at 34,871.43, followed by 34,708.96. On the upside, key resistance levels are placed at 35,251.43 and 35,468.96 levels.

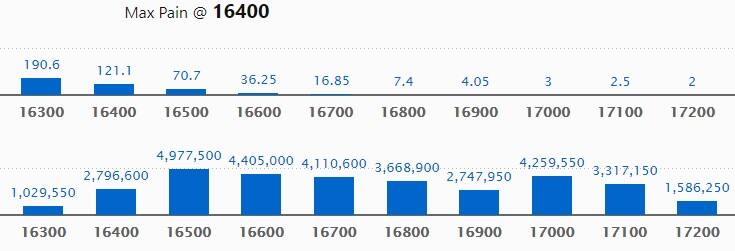

Call Option Data

Maximum Call open interest of 49.77 lakh contracts was seen at 16500 strike, which will act as a crucial resistance level in the August series.

This is followed by 16600 strike, which holds 44.05 lakh contracts, and 17000 strike, which has accumulated 42.59 lakh contracts.

Call writing was seen at 16500 strike, which added 23.61 lakh contracts, followed by 17100 strike, which added 21.52 lakh contracts and 16400 strike which added 19.25 lakh contracts.

Call unwinding was seen at 16000 strike, which shed 91,250 contracts, followed by 15900 strike which shed 90,400 contracts, and 16200 strike which shed 66,950 contracts.

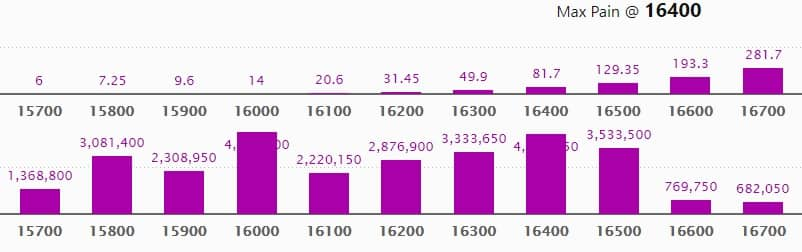

Put Option Data

Maximum Put open interest of 43.72 lakh contracts was seen at 16000 strike, which will act as a crucial support level in the August series.

This is followed by 16400 strike, which holds 42.79 lakh contracts, and 16500 strike, which has accumulated 35.33 lakh contracts.

Put writing was seen at 16400 strike, which added 13.15 lakh contracts, followed by 16300 strike which added 8.7 lakh contracts, and 15900 strike which added 5.95 lakh contracts.

Put unwinding was seen at 16600 strike, which shed 11.72 lakh contracts, followed by 16500 strike which shed 10.54 lakh contracts and 16700 strike which shed 3.87 lakh contracts.

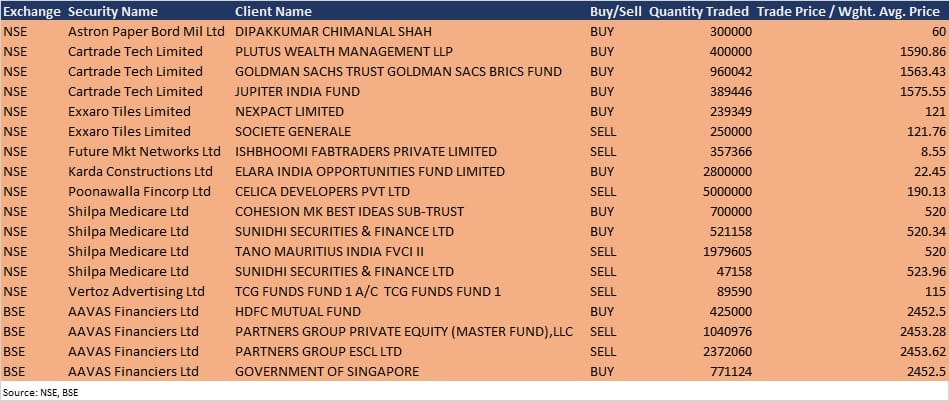

Bulk Deals

Cartrade Tech: Plutus Wealth Management LLP acquired 4 lakh equity shares in the company at Rs 1,590.86 per share, Goldman Sachs Trust Goldman Sacs BRICS Fund bought 9,60,042 equity shares at Rs 1,563.43 per share, and Jupiter India Fund purchased 3,89,446 equity shares in the company at Rs 1,575.55 per share on the NSE, the bulk deals data showed.

Exxaro Tiles: Nexpact acquired 2,39,349 equity shares in the company at Rs 121 per share, whereas Societe Generale sold 2.5 lakh equity shares in the company at Rs 121.76 per share on the NSE, the bulk deals data showed.

Karda Constructions: Elara India Opportunities Fund further increased stake in the company, buying additional 28 lakh equity shares at Rs 22.45 per share on the NSE, the bulk deals data showed.

Poonawalla Fincorp: Celica Developers sold 50 lakh equity shares in the company at Rs 190.13 per share on the NSE, the bulk deals data showed.

AAVAS Financiers: HDFC Mutual Fund acquired 4.25 lakh equity shares in the company at Rs 2,452.5 per share and Government of Singapore bought 7,71,124 equity shares at same price on the BSE. However, Partners Group Private Equity (Master Fund), LLC sold 10,40,976 equity shares in the company at Rs 2,453.28 per share, and Partners Group ESCL Ltd offloaded 23,72,060 equity shares at Rs 2,453.62 per share, the bulk deals data showed.

Analysts/Investors Meeting

Rajratan Global Wire: The company’s officials will meet B&K Securities on August 23 in a “Fireside Chat” as a part of the Ideation Series.

Crompton Greaves Consumer Electricals: The company’s officials will meet Principal Mutual Fund on August 23 and JM Financial on August 30. To meet investors in a Nirmal Bang – Virtual Investors Conference on August 26 and 27.

Mindtree: The company’s officials will meet analysts and investors in Jefferies India IT Summit on August 24.

Khadim India: The company’s officials will meet analysts and investors on August 24.

R Systems International: The company’s officials will meet investors and analysts on August 24 to discuss the financial results.

Allcargo Logistics: The company’s officials will meet Locus Investment Group on August 24.

Meghmani Finechem: The company’s officials will meet investors in a conference organized by Dolat Capital Market on August 24.

EKI Energy Services: The company’s officials will meet investors & analysts on August 25 to discuss the unaudited financial results.

Rushil Decor: The company’s officials will meet investors and analysts on August 27 post earnings.

Indoco Remedies: The company’s officials will meet investors and analysts in Ashwamedh, Elara India Dialogue 2021 on September 7, and ITUS Capital on September 8.

Stocks In The News

Adani Enterprises: Sebi held Adani Wilmar IPO due to investigation against Adani Enterprises.

Arvind Fashions: The company raised Rs 439 crore from marquee investors including promoters at a price of Rs 218.50 per equity share.

Aurobindo Pharma: The company approved the termination of binding agreements with Cronus Pharma Specialities India for acquisition of 51% ownership in Cronus Pharma, for Rs 420 crore.

Cadila Healthcare: Zydus Cadila has received the Emergency Use Authorization (EUA) from the Drug Controller General of India (DCGI) for ZyCoV-D, the world’s first Plasmid DNA vaccine for Covid-19.

Adani Total Gas: The company to acquire 50% stake in Smartmeters Technologies.

TTK Prestige: Long-term settlement has been reached with the permanent workmen at manufacturing unit at Khardi, Maharashtra.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,287.03 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 119.30 crore in the Indian equity market on August 20, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Six stocks – Canara Bank, NALCO, NMDC, Punjab National Bank, Sun TV Network and Vedanta – are under the F&O ban for August 23. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.