The market recovered the morning losses but failed to support the gains in the last hour of trading due to trading pressure at higher levels and was finally resolved by medium-term losses combined on Sept. 7. The stocks of Nifty IT, Metal, Pharma and PSU banks are pulling the market. down.

The BSE Sensex dropped 17.43 points to 58,279.48, while the Nifty50 dropped 15.15 points to 17,362.10 and formed a bearish candlestick on the daily charts as the closing was lower than the opening levels.

“On the daily chart, the indicator has established a bearish candle with long shadows on each side, indicating excessive instability at higher levels. The indicator is moving upwards and Higher Bottom formation on the daily chart indicating a trend,” said Rajesh Palviya, VP – Technical and Derivative Research. by Axis Securities.

He also said that the chart pattern shows that if Nifty falls and tightens above the 17,400 level, it will prove a buy that will lead the index to 17,500-17,600 levels. However, if the index falls below the 17,350 level, it will prove sales could take the index to 17,300-17,230, he added.

He said, “Nifty is selling more than its 20-day SMA which shows good bias in the short term. Nifty continues to remain in the medium term, so buying with chips continues to be our favorite strategy.”

Wide markets are also closed in unfavorable areas. The Nifty Midcap 100 index fell 0.25 percent and the Smallcap 100 index decreased by 0.09 percent.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,287.23, followed by 17,212.37. If the index moves up, the key resistance levels to watch out for are 17,436.73 and 17,511.37.

Nifty Bank

The Nifty Bank fell further, down 123.55 points to close at 36,468.80 on September 7. The important pivot level, which will act as crucial support for the index, is placed at 36,185.16, followed by 35,901.53. On the upside, key resistance levels are placed at 36,719.16 and 36,969.53 levels.

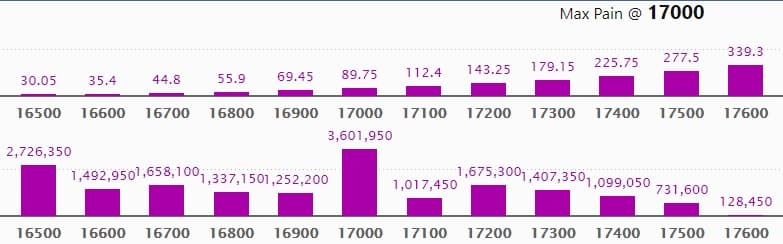

Call Option Data

Maximum Call open interest of 17.57 lakh contracts was seen at 17500 strike, which will act as a crucial resistance level in the September series.

This is followed by 17400 strike, which holds 14.71 lakh contracts, and 17300 strike, which has accumulated 13.98 lakh contracts.

Call writing was seen at 17400 strike, which added 1.35 lakh contracts, followed by 18000 strike, which added 73,600 contracts and 17800 strike which added 52,300 contracts.

Call unwinding was seen at 17200 strike, which shed 1.1 lakh contracts, followed by 17000 strike, which shed 78,525 contracts, and 17100 strike which shed 72,800 contracts.

Put Option Data

Maximum Put open interest of 36.01 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the September series.

This is followed by 16500 strike, which holds 27.26 lakh contracts, and 17200 strike, which has accumulated 16.75 lakh contracts.

Put writing was seen at 17400 strike, which added 1.77 lakh contracts, followed by 17000 strike which added 1.37 lakh contracts, and 17500 strike which added 1.17 lakh contracts.

Put unwinding was seen at 16500 strike, which shed 2.47 lakh contracts, followed by 16800 strike which shed 46,600 contracts and 16700 strike which shed 44,650 contracts.

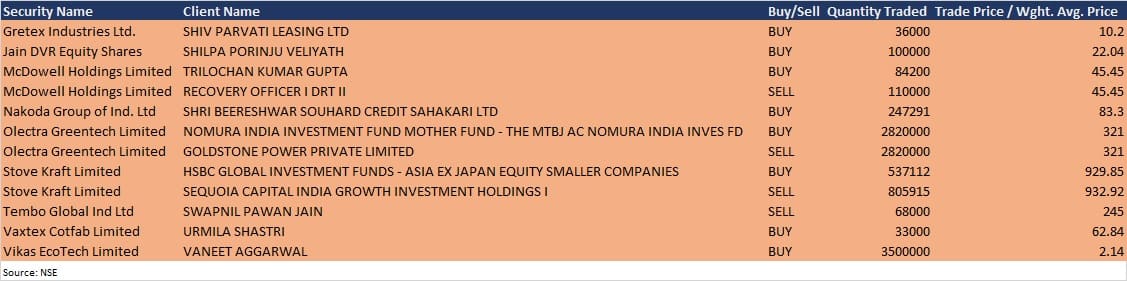

Bulk Deals

McDowell Holdings: Recovery Officer I DRT (Debt Recovery Tribunal) II continued to offload shares in the company, selling additional 1.1 lakh equity shares in the company at Rs 45.45 per share. However, Trilochan Kumar Gupta acquired 84,200 equity shares in the company at Rs 45.45 per share on the NSE, the bulk deals data showed.

Olectra Greentech: Nomura India Investment Fund Mother Fund – The MTBJ AC Nomura India Investment FD bought 28.2 lakh equity shares in the company at Rs 321 per share. However, Goldstone Power sold 28.2 lakh equity shares in the company at Rs 321 per share on the NSE, the bulk deals data showed.

Stove Kraft: HSBC Global Investment Funds – Asia Ex-Japan Equity Smaller Companies acquired 5,37,112 equity shares in the company at Rs 929.85 per share. However, Sequoia Capital India Growth Investment Holdings I sold 8,05,915 equity shares in the company at Rs 932.92 per share on the NSE, the bulk deals data showed.

International Conveyors: Promoter entity IGE (India) acquired over 3.23 lakh equity shares in the company via open market transaction, increasing shareholding to 63.34% from 62.86% earlier.

Analysts/Investors Meeting

Adani Enterprises: The company’s officials will meet investors in Elara Capital Virtual Conference on September 9.

Tube Investments of India: The company’s officials will meet analysts and institutional investors on September 8, September 9, September 14, September 20, and September 22.

Stocks In The News

PSP Projects: The company is in receipt of Letter of Intent(s) for projects worth Rs 132.57 crore towards industrial and precast segment from different clients in Gujarat.

ICRA: Life Insurance Corporation of India sold more than 2.07 lakh equity shares in the company via open market transaction, reducing shareholding to 5.81% from 7.96% earlier.

Pil Italica Lifestyle: Promoter entity Dawood Investment sold 46 lakh equity shares in the company via open market transaction, reducing shareholding to 52.50% from 54.46% earlier.

EID Parry India: The company has approved the setting up of a 120 KLPD grain/sugar syrup/molasses based Distillery at Sankili unit in Andhra Pradesh.

Bajaj Consumer Care: ICICI Prudential Asset Management Company sold 1.5 lakh equity shares in the company via open market transaction, reducing shareholding to 3.83% from 3.93% earlier.

FII And DII Data

Foreign institutional investors (FIIs) net sold shares worth Rs 145.45 crore, while domestic institutional investors (DIIs) net offloaded shares worth Rs 136.57 crore in the Indian equity market on September 7, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Two stocks – Indiabulls Housing Finance and NALCO – are under the F&O ban for September 8. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.