The market ended the gain in the afternoon, but managed to reduce some profits from late trading and closed with limited profits on August 9. However, broad markets that were previously underperforming as the Nifty Midcap 100 index fell 0.73 percent and the Smallcap 100 index decreased 0.91 percent .

BSE Sensex scored 125.13 points to close at 54,402.85, while Nifty50 rose by 20.10 points to 16,258.30 and formed a bearish candle-like Doji pattern on the daily charts as the close was close to opening levels.

“The daily price action creates a small bearish candlestick that makes it very low compared to the previous session, indicating short-term respite. Axis Technology and Removal Security.

He added, “The next high levels to be considered are 16,350 levels. Any sustainable movement above 16,350 levels could create momentum at 16,400-16,450 levels.”

“Worse, any violation of the support area within 16,180 levels could result in a profit booking of 16,100-16,000 levels,” he added.

Key Support And Resistance Levels On The Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,184.53, followed by 16,110.87. If the index moves up, the key resistance levels to watch out for are 16,326.33 and 16,394.47.

Nifty Bank

The Nifty Bank outperformed benchmark indices, rising 219.70 points to close at 36,028.95 on August 9. The important pivot level, which will act as crucial support for the index, is placed at 35,707.5, followed by 35,386.1. On the upside, key resistance levels are placed at 36,255.1 and 36,481.3 levels.

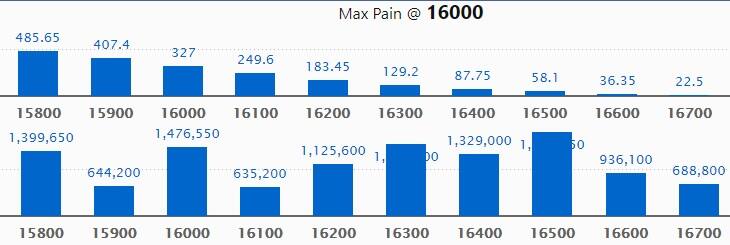

Call Option Data

Maximum Call open interest of 17.96 lakh contracts was seen at 16500 strike, which will act as a crucial resistance level in the August series.

This is followed by 16300 strike, which holds 15.43 lakh contracts, and 16000 strike, which has accumulated 14.76 lakh contracts.

Call writing was seen at 16300 strike, which added 1.8 lakh contracts, followed by 16200 strike, which added 1.04 lakh contracts and 16400 strike which added 83,350 contracts.

Call unwinding was seen at 16500 strike, which shed 2.71 lakh contracts, followed by 15900 strike which shed 1.93 lakh contracts, and 15800 strike which shed 1.42 lakh contracts.

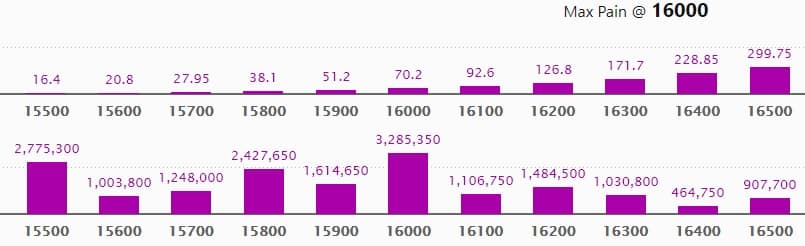

Put Option Data

Maximum Put open interest of 32.85 lakh contracts was seen at 16000 strike, which will act as a crucial support level in the August series.

This is followed by 15500 strike, which holds 27.75 lakh contracts, and 15800 strike, which has accumulated 24.27 lakh contracts.

Put writing was seen at 16000 strike, which added 2.35 lakh contracts, followed by 16500 strike which added 1.91 lakh contracts, and 16100 strike which added 1.68 lakh contracts.

Put unwinding was seen at 15900 strike, which shed 85,800 contracts, followed by 15700 strike which shed 68,300 contracts, and 16,600 strike which shed 24,150 contracts.

Bulk Deals

Glenmark Life Science: Polar Capital Funds Plc – Healthcare Opportunities Fund acquired 8.36 lakh equity shares in the company at Rs 732.55 per share on the NSE, the bulk deals data showed.

Mukand: Rajesh V Shah and his family members, Suketu V Shah and his family members, Isarnan Steel & Minerals, and Sidya Investments have collectively sold and transferred 2,34,25,628 equity shares of Mukand (or 16.57% of paid up equity), to Bajaj Sevashram, Bachhraj & Company, Bachhraj Factories and Sanrajnayan Investments in an inter-se transfer of shares between the promoter group entities of the company.

Rolex Rings: HSBC Pooled Investment Fund-HSBC Pooled Asian Equity Fund acquired 1,44,823 equity shares in the company at Rs 1,250 per shares on the NSE, the bulk deals data showed.

Quess Corp: Smallcap World Fund Inc bought 41,30,467 equity shares in the company at Rs 900 per share, whereas Ajit Isaac sold 20 lakh shares at Rs 900 per share and Fairbridge Capital (Mauritius) sold 30 lakh shares at Rs 899.99 per share on the BSE, the bulk deals data showed.

Zeal Aqua: TCG Funds Fund 1 bought 1.26 lakh equity shares in the company at Rs 158 per share on the BSE, the bulk deals data showed.

Results On August 10

Zomato, Coal India, Lupin, Power Grid Corporation of India, Aarti Surfactants, Ahluwalia Contracts (India), Aarey Drugs & Pharmaceuticals, Ashoka Buildcon, Balaji Telefilms, Mrs Bectors Food Specialities, Brookfield India Real Estate Trust REIT, Computer Age Management Services, Capacite Infraprojects, Century Plyboards, Chalet Hotels, Cochin Shipyard, Deepak Fertilisers, Eveready Industries, Galaxy Surfactants, Godrej Agrovet, Heranba Industries, Infibeam Avenues, IRB Infrastructure Developers, Jindal Steel & Power, Krishna Institute of Medical Sciences, Linde India, Manappuram Finance, Max Financial Services, Motherson Sumi Systems, Prestige Estates Projects, Pricol, Reliance Infrastructure, Sequent Scientific, Siemens, Spencers Retail, Trent, Tata Teleservices (Maharashtra), Whirlpool of India, and Wonderla Holidays will release quarterly earnings on August 10.

Analysts/Investors Meeting

HeidelbergCement India: The company’s officials will meet representatives of Franklin Templeton and Global Alpha Capital Management on August 10.

Nippon Life India Asset Management: The company’s officials will meet analysts and investors on August 10, in a Emkay Confluence – Ideas for Tomorrow, and August 26 in DART India Virtual Conference Series 2021.

Ceat: The company’s officials will meet investors and analysts on August 10 & 11, in Emkay Annual Flagship Investor Conference 2021 – Ideas for Tomorrow, and August 24 in Edelweiss Auto Ancillary e-Conference.

Mahindra & Mahindra: The company’s officials will meet several funds and investors on August 11, in Emkay Virtual Investor Conference.

Nath Bio-Genes (India): The company’s officials will meet analysts and investors on August 11, to discuss Q1FY22 earnings.

Suryoday Small Finance Bank: The company’s officials will meet analysts and investors on August 12, to discuss the financial results.

Kirloskar Oil Engines: The company’s officials will meet analysts and investors on August 13, to discuss its Q1FY22 financial results.

Stocks In The News

Bombay Dyeing: The company reported consolidated loss at Rs 107.9 crore in Q1FY22 against loss of Rs 129.1 crore in Q1FY21, revenue jumped to Rs 380.8 crore from Rs 91.2 crore YoY.

Shree Cement: The company reported sharply higher profit at Rs 661.7 crore in Q1FY22 against Rs 370.8 crore in Q1FY21, revenue jumped to Rs 3,449.5 crore from Rs 2,332.4 crore YoY.

Motilal Oswal Financial Services: ICRA upgraded the credit rating on long term debt instruments of Motilal Oswal Home Finance, a material subsidiary of the company to ‘AA-/Stable’ from ‘A+/Stable’.

Texmo Pipes and Products: The company has received orders from multiple contractors of HDPE Pipes worth Rs 121.59 crore to be executed within 6-7 months.

Timken India: The company reported higher profit at Rs 56.72 crore in Q1FY22 against Rs 3.15 crore in Q1FY21, revenue jumped to Rs 467.85 crore from Rs 160.23 crore YoY.

Tata Investment Corporation: The company reported higher consolidated profit at Rs 53.89 crore in Q1FY22 against Rs 18.40 crore in Q1FY21, revenue jumped to Rs 61.90 crore from Rs 30.90 crore YoY.

FII And DII Data

Foreign institutional investors (FIIs) net bought shares worth Rs 211.91 crore, while domestic institutional investors (DIIs) net offloaded shares worth Rs 716.15 crore in the Indian equity market on August 9, as per provisional data available on the NSE.

Stocks Under F&O Ban On NSE

Six stocks – Canara Bank, Indiabulls Housing Finance, NALCO, RBL Bank, SAIL and Sun TV Network – are under the F&O ban for August 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.