Sustainable movement in addition to the immediate resistance of 14,800 levels is expected to draw the Nifty to the next level of 15,050-15,200 levels in the near future, said Nagaraj Shetti of HDFC Securities.

The market saw widespread trade and closed the apartment with a negative bias on March 22, caused by bank and financial calculators. However, the purchase of FMCG, IT, metals and pharma shares closed the downside.

Measurement indicators adjusted the intraday percentage between volatility and saw a recovery in trading too late. The S&P BSE Sensex declined 86.95 points to close at 49,771.29, while the Nifty50 dropped by 7.60 points to 14,736.40 and formed the Doji pattern on the daily charts as the close approached the opening levels.

“A small candle with a long shadow at the bottom has been built. This pattern indicates an opportunity to be bought in the market by a wide range of actions.

“Sustainable movement beyond the opposition of 14,800 levels is expected to draw Nifty to the next half of the 15,050-15,200 levels in the near future. Immediate support has been set at 14,600,” he said.

Wide markets are closed. The Nifty Midcap 100 index was up 0.82 percent while the Smallcap 100 index was up 0.03 percent.

Basic Support And Nifty Resistance Levels

According to pivot charts, the key Nifty support levels are set at 14,634.83, followed by 14,533.27. If the indicator goes up, the main resistance levels you should be aware of are 14,800.93 and 14,865.47.

Nifty Bank

The Nifty Bank index performed well on benchmark indicators, down sharply by 558.15 points or 1.63 percent to close to 33,603.45. The pivot rate, which will serve as an important indicator support, is set at 33,278.7, followed by 32,954. In addition, key resistance levels were set at 34,038.5 levels and 34,473.6 levels.

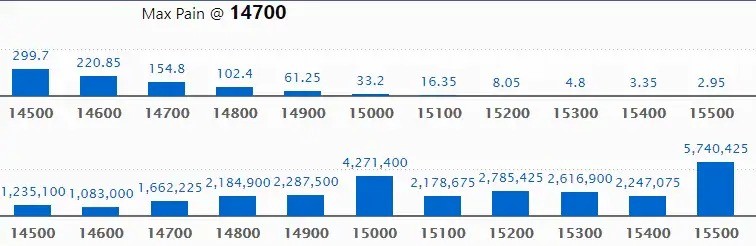

Call Option Data

The open interest rate of Mall Maximum for 57.40 lakh contracts was seen in the 15,500 strike, which will serve as an important resistance level in the March series.

This is followed by a strike of 15,000, which holds 42.71 lakh contracts, and a strike of 15,200, which collected 27.85 lakh contracts.

Phone calls were seen in the 15,500 strike, which added 18.02 lakh contracts, followed by 15,000 strikes adding 9.38 lakh contracts and 14,900 strikes adding 5.88 lakh contracts.

Telephone strikes were seen in the 14,500 strike, which lost 3.53 lakh contracts, followed by the 14,400 strike that broke 1.47 lakh contracts and the 14,600 strike that destroyed 1.21 lakh contracts.

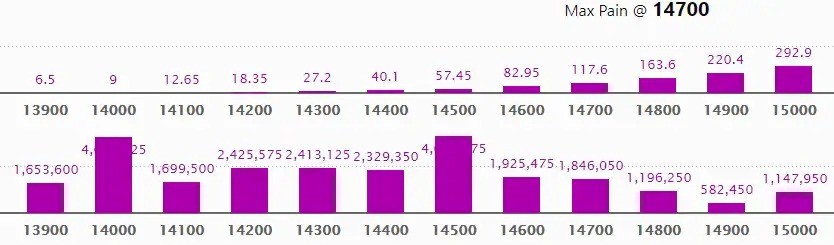

Put Option Data

Maximum Put The open interest of 40.86 lakh contracts was seen in the 14,500 strike, which will serve as an important level of support for the March series.

This is followed by a 14,000 strike, with 40.34 lakh contracts, and a 14,200 strike, with 24.25 lakh contracts.

Put writing was seen in the 14,000 strike, which added 4.82 lakh contracts, followed by a strike of 14,700, which added 3.93 lakh contracts and a 14,300 strike that added 3.41 lakh contracts.

Put unwinding was seen in the 15,000 strike, which lost 96,225 contracts, followed by 14,900 strikes that lost 43,125 contracts and 14,500 strikes that destroyed 41,250 contracts.

Shares Have A High Delivery Rate

A high percentage of submissions suggest that investors are showing interest in these stocks.

46 Shares Have Seen A Long Build

Depending on the percentage of open future interest, here are the top 10 stocks where long-term construction has been observed.

23 Stocks Saw A Long-Term Outflow

Depending on the future percentage of open interest, here are the top 10 stocks where long-term stocks have been found.

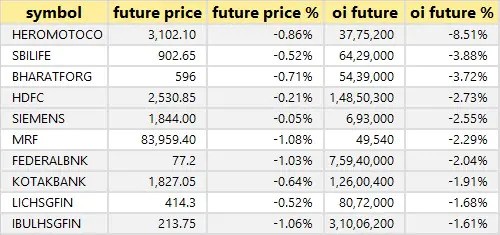

40 Shares Saw A Short Build

The increase in open interest rates, as well as the decline in prices, indicate the formation of shorter positions. Depending on the percentage of open future interest, here are the top 10 stocks where short construction has been observed.

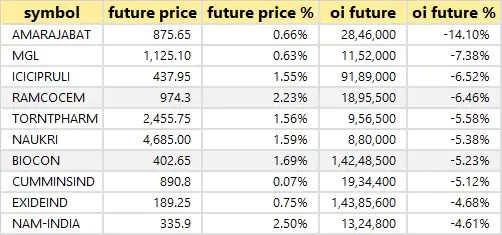

49 Shares Saw A Short Cover

Open interest rates, as well as price increases, are particularly indicative of short coverage. Depending on the percentage of open future interest, here are the top 10 stocks where short coverage was observed.

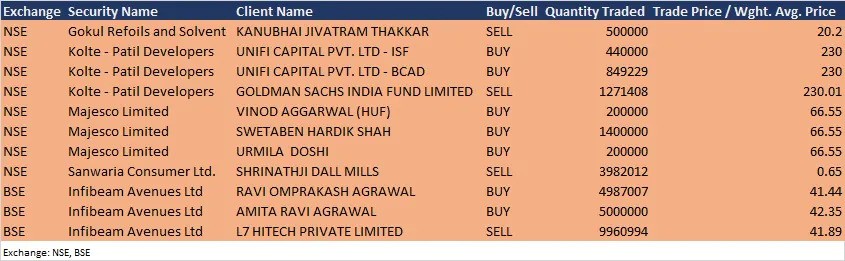

Bulk Deals

Analysts / Board Meetings

VIP Industries: Collaborations / meetings are scheduled to be held with analysts / institutional investors on March 23.

Escorts: The company will be in contact with Macquarie Capital, Segantii Capital Management and IIFL – Institutional Equities on March 24.

Take the solution: Company officials will contact Karma Capital and Profusion Capital on March 24.

Delta Corp: A visual conference is scheduled for March 24.

Sterlite Technologies: The company will participate in bright stars, small and medium-sized investors on March 24.

ISGEC Heavy Engineering: The company will attend a conference call with investors / institutional analysts organized by Centrum Broking on March 25.

HKG: A meeting of the company’s board of directors is scheduled for March 25 to consider the appointment of Deependra Shukla as the new executive and non-executive director of the company.

Stocks In The News

Bharat Petroleum Corporation: The state-owned oil refining and marketing company BPCL said the company’s board of directors had approved the Bharat Gas Resources Integration Scheme for the company.

KEC International: Large EPC infrastructure KEC International has received new orders of Rs 1,429 crore in all its various businesses.

Madhav Infra Projects: Madhav Infra received a solar project award from Gujarat State Electricity Corporation (GSECL) with a contract value of Rs 87.27 crore.

Jubilant Ingrevia: Rakesh Jhunjhunwala, an Ace investor, said participants at his concert bought 3,04,009 shares in Jubilant Ingrevia on March 19, resulting in the company’s shares being 99,33,809 shares or 6.2367% of the total paid price Jubilant Ingrevia.

Varroc Engineering: Varroc Engineering has authorized the proposed fund to be expanded in the form of appropriate financial investment institutions. The QIP case opened on March 22.

Maruti Suzuki India: South Africa’s largest car manufacturer Maruti Suzuki India has increased car prices since April 2021, due to various installation costs.

FII And DII Data

Foreign institutional investors (FIIs) sold shares worth Rs 786.98 crore, while domestic institutional investors (DIIs) bought shares worth Rs 542.70 on the Indian stock market on March 22, according to interim data available on the NSE.

Shares Are Under F&O Ban On The NSE

Two stocks – Vodafone Idea and SAIL – are subject to the F&O ban on March 23. Security during the ban under the F&O segment includes companies where security exceeds 95 percent of the broader market position limit.