NIfty’s continued continuation will ensure a turnaround pattern and could open up the upcoming 14,900-15,000 upcoming sessions in the short term, said Nagaraj Shetti of HDFC Securities.

The market also expanded sharply after five days of trading pressure and closed with more than one percent gain on March 19, driven by purchases on FMCG, metals, pharma and banking & finance. Falling oil prices also supported the market.

BSE Sensex scored 641.72 points, or 1.30 percent, to close with 49,858.24, while Nifty50 increased by 186.10 points, or 1.28 percent, to 14,744 and formed the Piercing Line pattern on the daily chart. This week, Nifty declined 1.9 percent and built the Hammer lamp on a weekly scale.

“A long bull candle was formed on Friday after the low opening and this pattern indicates the formation of a bullish candle pattern ‘Piercing Line’. Usually, this bullish pattern is formed at low levels and is part of a short-term change. We expect a low of Friday’s 14,350 , “said Nagaraj Shetti, said the Technical Researcher at HDFC Securities.

“Continued continuation from here could confirm the turnaround pattern and could open up a glimpse into future plans at 14,900-15,000 levels in the short term. Immediate funding is provided at 14,600. “

Wide markets also made a profit. The Nifty midcap 100 index was up 1.2 percent and the smallcap 100 index gained 0.7 percent.

Basic Support And Nifty Resistance Levels

According to pivot charts, the key Nifty support levels are set at 14,466.67, followed by 14,189.33. If the index rises, the opposition levels are 14,904.77 and 15,065.53.

Nifty Bank

The Nifty Bank index rose by 304.80 points to 34,161.60 on March 19. The pivot rate, which will serve as an important indicator support, is set at 33,563.27, followed by 32,964.93. In addition, key resistance levels were set at 34,557.66 levels and 34,953.73 levels.

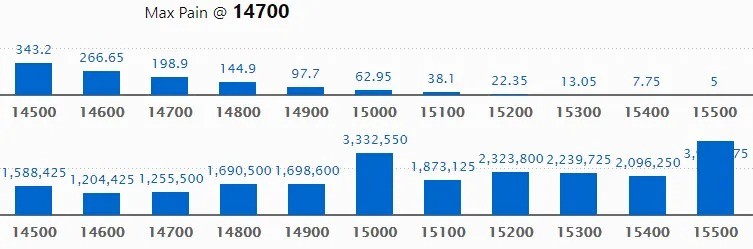

Call Option Data

The open interest rate of Mall Maximum for 39.37 lakh contracts was seen in the 15,500 strike, which will serve as an important resistance level in the March series.

This was followed by a strike of 15,000, with 33.32 lakh contracts, and a 15,200 strike, with 23,23 lakh contracts.

Phone calls were seen in the 15,500 strike, which added 12.70 lakh contracts, followed by a 15,200 strike that added 7.33 lakh contracts and a 14,500 strike that added 6.0 lakh contracts.

Telephone strikes were seen in the 15,000 strike, which cost 5.84 lakh contracts, followed by a strike of 14,900 contracts with 2.17 lakh contracts and a 14,800 strike that terminated 1.54 lakh contracts.

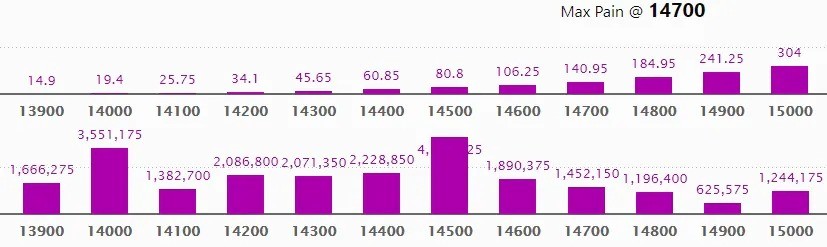

Put Option Data

Maximum Put The open interest of 41.27 lakh contracts was seen in the 14,500 strike, which will serve as an important level of support for the March series.

This is followed by a strike of 14,000, with 35.51 lakh contracts, and 14,400 strikes, with a total of 22.28 lakh contracts.

Put writing appeared on a strike of 14,400, which added 11.06 lakh contracts, followed by a strike of 14,500, which added 10.88 lakh contracts and a 14,000 strike that added 8.64 lakh contracts.

Put unwinding was seen in the 14,900 strikes, which destroyed 3.81 lakh contracts, followed by the 15,000 strike, which destroyed 3.01 lakh contracts and the 15,200 strike that destroyed 34,050 contracts.

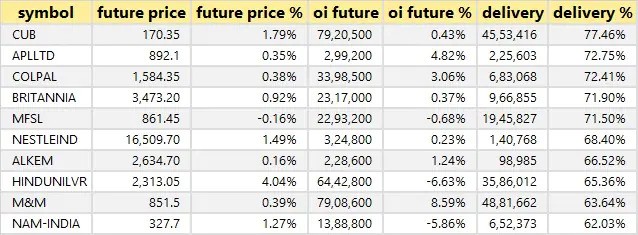

Shares Have A High Delivery Rate

A high percentage of submissions suggest that investors are showing interest in these stocks.

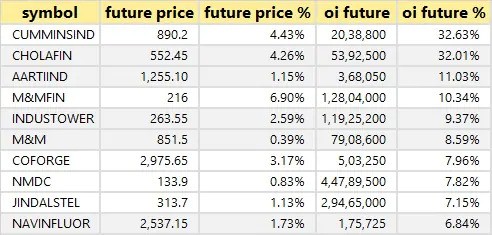

55 Shares Have Seen A Long Build

Depending on the percentage of open future interest, here are the top 10 stocks where long-term construction has been observed.

6 Stocks Saw A Long-Term Outflow

Depending on the future percentage of open interest, here are the top 6 stocks where long-term stocks have been found.

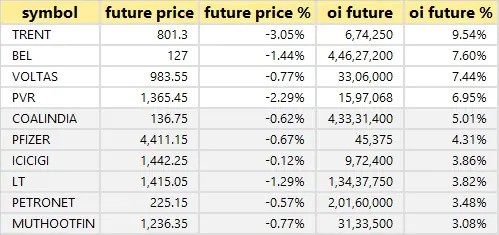

19 Shares Saw A Short Build

The increase in open interest rates, as well as the decline in prices, indicate the formation of shorter positions. Depending on the percentage of open future interest, here are the top 10 stocks where short construction has been observed.

79 Shares Saw A Short Cover

Open interest rates, as well as price increases, are particularly indicative of short coverage. Depending on the percentage of open future interest, here are the top 10 stocks where short coverage was observed.

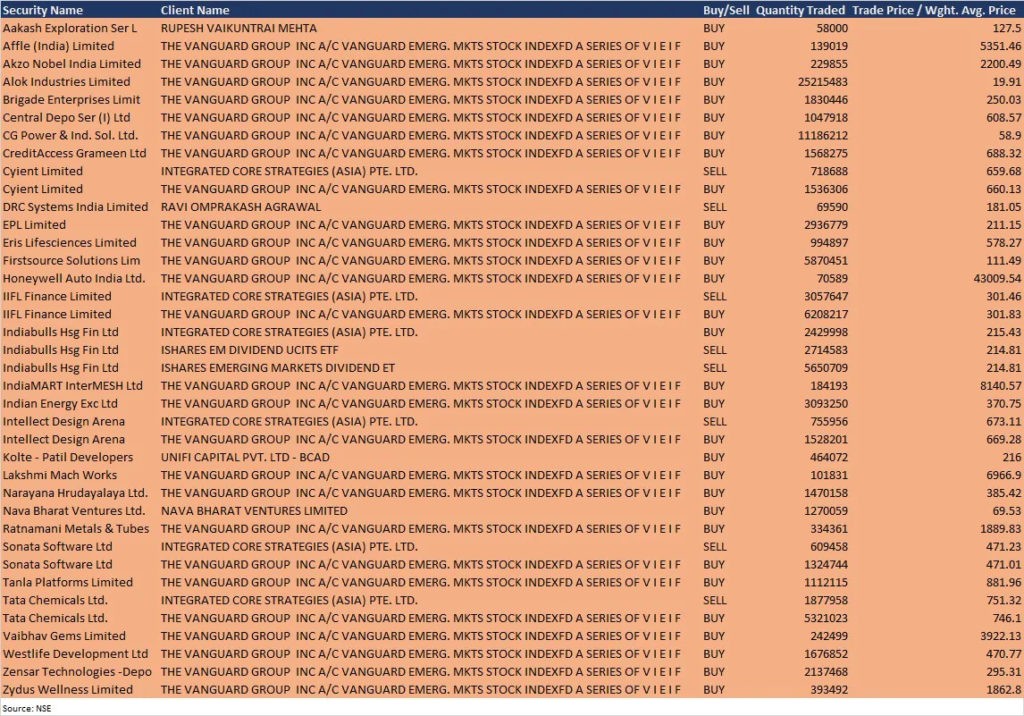

Bulk Deals

Analysts / Board Meetings

Marico: The company’s executives will meet with analysts and investors at a conference on March 22.

Indostar Capital Finance: The company will be attending a Nakashatra visual conference, The Shining Star Mid & Small-Cap organized by Centrum Broking on March 23.

City Union Bank: The bank will participate in a banking and financial conference hosted by Axis Capital on March 22.

Mindtree: Company officials will take part in the Motilal Oswal Investors’ Conference on March 22.

Star Cement: Company officials will attend meetings of investors and analysts on March 22 and 23 March by holding a video conference.

Prataap Snacks: Company officials will attend one-on-one web-based meetings organized by Centrum Broking in Nakshatra – Shining Star Mid & Smallcap Conference on March 23.

Godawari Power & Ispat: Director Dinesh Gandhi will take part in the Nakshatra-Shining Star-Mid & Smallcap Conference on March 24 using visual mode.

Prince Pipes and Fittings: The company participated in the 4th Ideation conference organized by Motilal Oswal on March 23.

Balrampur Chini Mills: Representatives of the company will be attending the Motilal Oswal 4th Ideation Conference on March 25.

Stocks In The News

Bharti Airtel: Bharti Airtel on March 19 entered into an agreement to acquire 17,43,560 (representing 7.48 per cent of the shares paid) in shares of Sandhya Hydro Power Project Balargha Private Limited, a special purpose vehicle (SPV).

Adani Green Energy: Adani Green Energy, one of India’s largest renewable energy companies, has signed a 100 per cent shareholding agreement in SPV with a 50 MW solar project based in SkyPower Global based in Toronto.

JSW Energy: JSW Energy said its subsidiary JSW Future Energy, formerly known as JSW Solar, received 450 MW of total air capacity from Solar Energy Corporation of India (SECI).

Bharat Dynamics: State defense company Bharat Dynamics has signed a contract to produce and supply the Milan-2T Anti-Tank Guided arrows. The contract price is Rs 1,188.12 crore.

Infibeam Strategies: Business Developers O3 Developers sold a 0.39 percent equity shareholding on Infibeam Avenues in open trading on March 17. Non-promoter Varini Patel reduced the company’s 32.50 cash shares on March 17.

PNC Infratech: CARE rates have given the credit rating to the banking institutions of the company, PNC Gomti Highways, as ‘A’. The rating agency provided a ‘stable’ view on banking institutions of Rs 559.30 crore.

FII And DII Data

Foreign institutional investors (FIIs) are buying shares worth Rs 1,418.43 crore, while domestic institutional investors (DIIs) are buying shares worth Rs 559.62 crore on the Indian financial market on March 19, according to short-term data available on the NSE.

Shares Are Under F&O Ban On The NSE

Vodafone Idea and SAIL are subject to the F&O ban on March 22. Security during the ban under the F&O component includes companies where security exceeds 95 percent of the market limit.