“If Nifty is repaired incorrectly, there could be a short cover of more than 15,100 levels,” said Shakrite Chouhan of Kotak Securities.

The market closed on March 15 but began to experience a reasonable recovery from the low level of the day in the last two hours of trading. The exit of FII and DII, partial locks in some provinces and high WPI inflation are weighed down by investor sentiment.

The S&P BSE Sensex traded 397 points to close to 50,395.08, while the Nifty50 index lost 101.50 points to close the store by 14,929.50 levels and formed a bearish Hammer pattern on the daily charts.

Wide markets have also adjusted in line with priorities. The Nifty Midcap 100 index fell 0.68 percent while the Smallcap 100 index fell 0.79 percent.

“The market has regained its strength. The market is not yet ready to supply easily. The high level from 14,745 stands directly at 14,950 and Bank Nifty has improved by 800 points from below,” said Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak. Securities told Moneycontrol.

“If Nifty goes into the wrong correction, there could be a short cover of more than 15,100 levels and if so, and the chances of hitting 15,350-15,450 might be bright. It would be better if we keep some stock up to that point,” he said.

“If the market goes down again, it will be 14,800-147750 which will be the best support, add

Wide markets have also changed in line with priorities. The Nifty Midcap 100 index fell 0.68 percent while the Smallcap 100 index fell 0.79 percent.

Basic Support And Nifty Resistance Levels

According to pivot charts, the key Nifty support levels are set at 14,767.4, followed by 14,605.3. If the index goes up, the opposition levels to look at are 15,070 and 15,210.5.

Nifty Bank

The Nifty Bank index rejected 314.15 points to close at 35,182.55 on March 15. The pivot rate, which will serve as an important indicator support, is set at 34,560.73, followed by 33,938.87. In addition, key resistance levels were set at 35,674.33 and 36,166.06 levels.

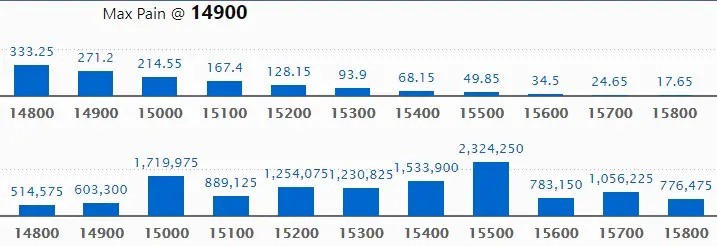

Call Option Data

The open interest rate of Mall Maximum for 23.24 lakh contracts was seen in the 15,500 strike, which will serve as an important resistance level in the March series.

This is followed by a 15,000 strike, with 17.19 lakh contracts, and a 15,400 strike, which collected 15.33 lakh contracts.

Phone calls were seen in the 14,900 strike, which added 2.28 lakh contracts, followed by a 15,100 strike that added 2.17 lakh contracts and a 15,700 strike that added 1.94 lakh contracts.

Phone losses were seen in the 15,800 strike, which terminated 1.22 lakh contracts, followed by a strike of 14,300 which terminated 53,550 contracts.

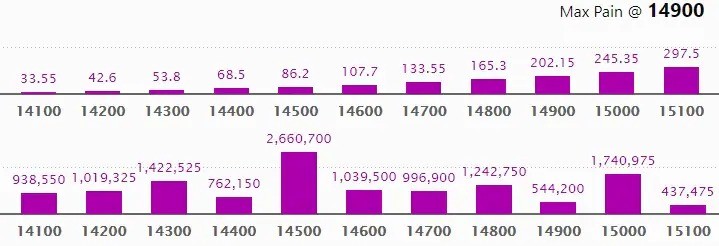

Enter Option Data

Maximum Put The open interest of 26.60 lakh contracts was seen in the 14,500 strike, which will serve as an important level of support for the March series.

This is followed by a strike of 15,000, with 17.40 lakh contracts, and 14,300 strikes, with a total of 14.22 lakh contracts.

Put writing appeared on a strike of 14,500, which added 1.63 lakh contracts, followed by a strike of 14,600, which added 1.43 lakh contracts and a 14,100 strike that added 1.27 lakh contracts.

Put unwinding was seen in the 15,000 strike, which destroyed 4.3 lakh contracts, followed by a strike of 14,800 that destroyed 1.15 lakh contracts.

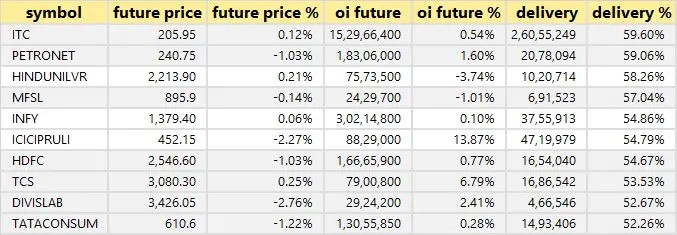

Shares Have A High Delivery Rate

A high percentage of submissions suggest that investors are showing interest in these stocks.

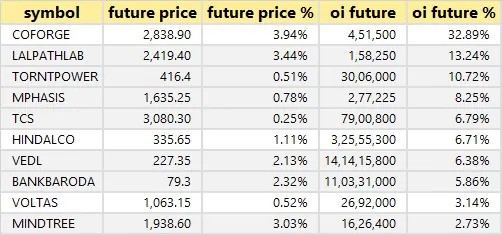

25 Shares Have Seen A Long Build

Depending on the percentage of open future interest, here are the top 10 stocks where long-term construction has been observed.

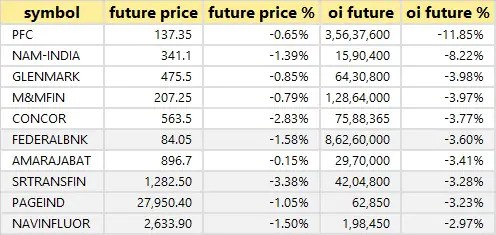

54 Stocks Saw A Long-Term Outflow

Depending on the future percentage of open interest, here are the top 10 stocks where long-term stocks have been found.

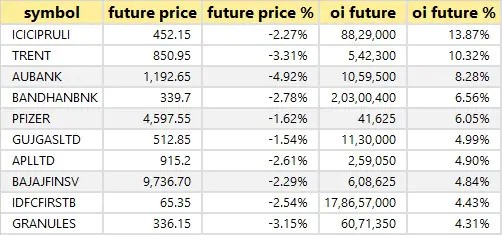

46 Shares Saw A Short Build

The increase in open interest rates, as well as the decline in prices, indicate the formation of shorter positions. Depending on the percentage of open future interest, here are the top 10 stocks where short construction has been observed.

33 Shares Saw A Short Cover

Open interest rates, as well as price increases, are particularly indicative of short coverage. Depending on the percentage of open future interest, here are the top 10 stocks where short coverage was observed.

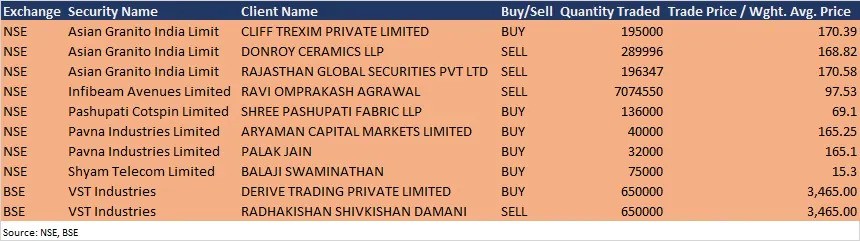

Bulk Deals

Analysts / Board Meetings

Kalpataru Power Transmission: Officials of the company will contact Quest Investment advisers on March 17 and travel to India Virtual Forum: Capex Drivers hosted by BofA Securities India on March 18.

Railtel Corporation Of India: A meeting of the company’s board of directors is scheduled for March 22 to review the combined and independent financial results for the quarter and nine months ending December 2020 and to announce the interim budget, if any.

Mahindra Logistics: Individual calls are scheduled for operation with Nippon AMC on March 16.

JSW Steel: Company officials will attend ‘Indian Virtual: Capex drivers’ conference organized by BofA Securities.

Infibeam Ways: Company officials will meet with many investors at an unconventional show on March 17-18.

VRL Logistics: Company officials will meet Singaporean investors around the world at a conference organized by Motilal Oswal Financial Services.

Som Distilleries & Breweries: The company’s top executives are scheduled to hold a conference to be held at Zoom Call, with analysts and investors on March 16th.

Dhanuka Agritech: Mahendra Kumar Dhanuka, Managing Director of Dhanuka Agritech will participate in the ‘Nakshatra-The Shining Star- Mid & Small-Cap’ conference on March 23 hosted by Centrum Capital.

Stocks In The News

Adani Ports and Special Economic Zones: The company will build a terminal container (WCT) in Colombo Port in Sri Lanka. It will work with the Sri Lankan agricultural organization John Keells Holdings PLC and the Sri Lanka Ports Authority (SLPA) as part of the delegation.

Shipping Corporation of India: Life Insurance Corporation of India has sold 2.01 per cent of the stock in the state-owned Shipping Corporation of India through open market transactions.

NIIT: INIIT (USA) Inc, the company’s US subsidiary, has signed a service agreement with a US financial services organization (existing client) to provide a variety of learning services.

HFCL: The company has signed a shareholding agreement with a shareholder agreement with Tamil Nadu based on the company solutions company Nimpaa Telecommunications and its proprietary shareholders. The company aims to acquire 50 percent of the share payable shares in Nimpaa, in one or more trains.

Mishra Dhatu Nigam: The board of directors has announced an interim allocation of Rs 1.20 per allocation of Rs 10 each for the 2020-21 financial year.

New Martin: Promoter Peterhouse Investments and other promoters have reduced the company’s figure to 3.90 percent from 3.98% through open market transactions.

FII And DII Data

Foreign institutional investors (FIIs) sold shares worth Rs 1,101.35 crore, while domestic institutional investors (DIIs) sold shares worth Rs 749.71 crore on the Indian financial market on March 15, according to short-term data available on the NSE.

Shares Are Under F&O Ban On The NSE

Two stocks – BHEL and Sun TV Network – are subject to the F&O ban on March 16. Security during the ban under the F&O segment includes companies where security exceeds 95 percent of the market position limit.